In Part 1 of this newsletter series we introduced Fisher Funds’ unique investing style and how it helps clients meet their financial goals. In the rest of this series we delve deeper into the specifics of our investment style and how we invest. We are continually seeking to identify a select group of businesses that have sustainable competitive advantages (moats); talented and incentivised management teams; and underappreciated growth runways. Today we examine the importance of a business having a wide economic moat.

Famed investor Warren Buffett once said that “time is the friend of a wonderful company, the enemy of the mediocre”. What he meant by a ‘wonderful company’ was one with a wide economic moat.

Competitive market dynamics dictate that most businesses fail to earn high returns on their capital for extended periods. This is because competitors will try to enter highly profitable markets, attack the incumbent’s position and attempt to take market share. We define a moat as a sustainable barrier that protects a business from the effects of competition – so that a company can avoid this fate.

Economic moats keep competition at bay

Wide economic moats are rare, but can take a range of different forms. In the case of Auckland International Airport, it is a natural monopoly, protected through both regulation and its investment in infrastructure over many years. The huge infrastructure investments required (airport, transport links, parking, freight facilities etc) and regulatory hurdles for building a new airport are probably insurmountable, which is why most cities chose to expand existing airports rather than build new ones. Barriers like these allow Auckland Airport to retain its position as New Zealand’s major international gateway, which makes it a major beneficiary of growing tourism industry.

A moat can also take the form of intellectual property. This is particularly relevant in the healthcare and technology sectors, where businesses can be protected by patents and the intellectual property created by their research teams. Many of the healthcare companies in our portfolios are good examples of this: Fisher & Paykel Healthcare in New Zealand, CSL in Australia, and Edwards Lifesciences and Abbott Laboratories in the US.

Another form of moat that benefits a number of our technology investments is called a network effect. A network effect exists when the value of a service or network increases with each additional user. Network effects often exist for the largest payments, ecommerce and social media platforms – with a good example being Facebook. In the case of Facebook, as more and more of your friends and family members joined in the mid-2000s you would have noticed the network becoming more valuable to you. If you weren’t already using Facebook at that point, you would have been more compelled to join. When you signed up and started sharing photos (hopefully not of your flat white!), joining groups, setting up events for family birthday parties and messaging your friends on the platform, then the platform also became more useful for your friends and family. Facebook’s network effect makes it very hard for potential competitors to create a competing social network. Why would you join a new social platform if your friends and family don’t use it?

PayPal’s widening moat

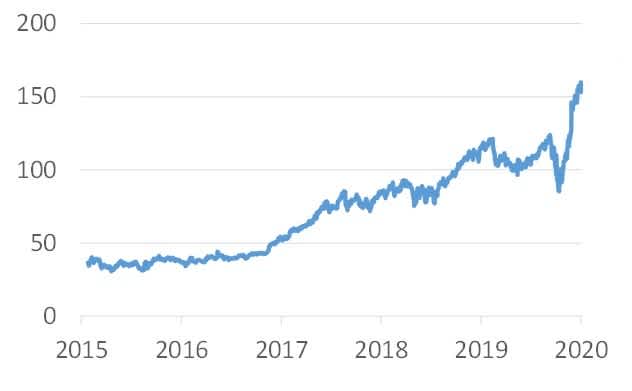

Network effects benefit a number of leading payments businesses, like our portfolio companies PayPal and MasterCard. When PayPal first listed on the stock market in 2015 we believed the strength of its moat wasn’t fully appreciated by investors and that the company was significantly undervalued

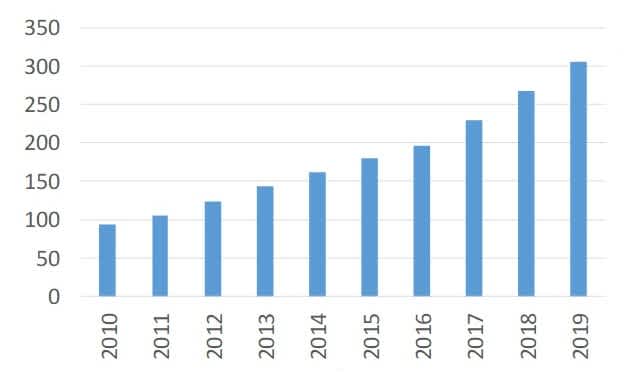

PayPal built its position in online payments in the early days of ecommerce when consumers were uncomfortable entering credit card details on retailers’ websites. PayPal stepped in as a trusted middleman. You only had to give your card details to PayPal, who would then take your payment for an online purchase and pay the merchant on a delayed basis - managing the risk of fraud and goods not actually arriving. This resulted in a lot of shopper demand for PayPal (they now have over 300 million users), and the evidence shows that shoppers are more likely to complete an online purchase if a merchant accepts PayPal. This creates a compelling value proposition for merchants who now feel compelled to offer PayPal (they have over 20 million merchants, including over 70 of the top 100 online retailers). More users lead to more merchants and vice versa, and the network effect becomes self-reinforcing.

When PayPal first listed on the stock market in 2015 the pending launch of ApplePay was getting a lot of press coverage. ApplePay was going to start stealing PayPal’s business. This turned out to be a great time to build a position in PayPal - as it ultimately became apparent how hard it is (even for Apple) to disrupt a company with a well-entrenched network effect. PayPal has continued to go on growing its customer base and payment volumes, and with that its profitability and share price.

Beware of narrowing moats

Moats don’t last forever. Investors must continually try to identify when a company’s competitive advantage is dwindling. When its moat is narrowing and the castle is about to be overrun by competitors. Missing these changes can be harmful to your financial health and Sky TV is a good example of this in the local market.

Sky TV used to have a wide moat given satellite was the only way to get a wide variety of quality TV content into your home. But fast broadband has almost made satellite TV redundant, and the ascendency of competitors like Netflix has seen a steady stream of customers dropping their Sky subscriptions. Despite this somewhat obvious development, Sky TV’s shares continued to be significantly overvalued in 2015 & 2016. This may have been partly due to shareholders not being willing to admit a mistake and take a loss on the investment, or because some dividend hungry investors decided they would take the risk and hang in there for what appeared to be an attractive (but illusionary) dividend yield. Sky TV’s share price has fallen over 90% in the last five years, and all due to their moat becoming obsolete due to new technology.

The point of these examples is to highlight the importance of economic moats, and why they are one of the three key characteristics we look for in a business.

Wide moats can help businesses thrive over the long term, while narrowing moats can be an investment red flag. Time really is the friend of a good company, but the enemy of the mediocre company.