The way in which your Kiwisaver provider invests your hard-earned savings will have a significant bearing on your long-term financial security. At Fisher Funds we approach investment in a relatively unique way and believe this will lead to better long-term outcomes for our clients.

As New Zealanders’ Kiwisaver balances grow, it is becoming increasingly important that savers take an interest in how Kiwisaver providers are managing their money. You may be young and just starting to save for your retirement. Perhaps you are trying to balance paying down a mortgage with saving for retirement and putting money aside for your children’s education. Or maybe you’ve already hit 65 and want to make sure your nest egg goes the distance. Whatever the goal, it is important you are getting good advice and your money is working for you.

In this newsletter series we provide a refresher on how the team at Fisher Funds invests your savings, and why we think this will generate superior long-term returns.

A bit of history and why our investment process is so important

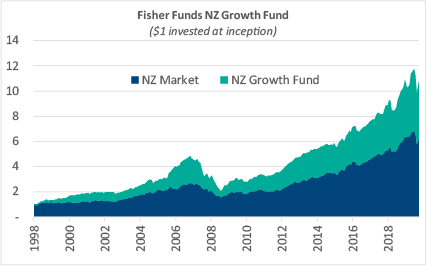

Over the last 21 years our New Zealand Growth Fund (the first fund set up when Fisher Funds was founded) has delivered an annual return of over 11% per annum after fees. Clients that have been invested since the beginning would have seen a $10,000 investment grow to almost $110,000 today. This compares with less than $65,000 if it had been invested passively in an index replicating the NZX 50 Index.

While 21 years is a long time in financial markets, the pillars of our investment approach haven’t changed. If anything our experiences over the last two decades (including the global financial crisis and the recent coronavirus pandemic) have strengthened our conviction in our investment process.

Our active approach to investment

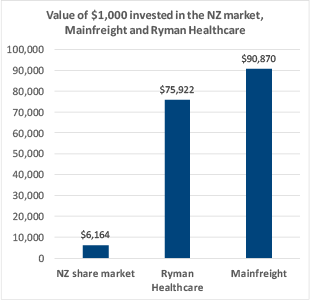

At the core of our investment approach is a belief that markets are not always efficient and many investors underappreciate the potential for certain businesses to create significant shareholder value over the long-term. It is not uncommon for a large proportion of share market gains to be driven by a small group of companies. For example, half of all gains in the US S&P 500 Index since 2007 have been driven by just 20 companies.

In New Zealand a handful of phenomenal local businesses like Ryman Healthcare and Mainfreight contributed significantly to the outperformance of our NZ Growth Fund over the last 21 years. Assuming dividends were reinvested, $1,000 invested in Ryman Healthcare 21 years ago would be worth $75,000 today (yes, you read that right – 75x your initial investment). And if you had held on to Mainfreight over the same period you would have turned $1,000 into $90,000.

While most investments will never work out as well as this, our investment process is designed to try and identify high quality compounders like these and hold onto them for the long term. All of this is much easier said than done!

The three pillars of our investment philosophy

There are three key attributes common to many value creating businesses, which have been continually reinforced by lessons our team has learned over the last two decades.

Wide economic moats | Talented and aligned management | Underappreciated earnings growth |

|---|---|---|

Competition means most businesses fail to earn high returns on capital for extended periods. However, companies with durable competitive advantages (“moats”) can avoid this fate, maintain profitability and take market share. Moats significantly reduce business risk. | Exceptional people build and maintain exceptional companies. We are looking for management teams that have significant skin in the game, a clear strategic vision, and a history of making decisions that prioritise long-term value creation over short-term gains. | For truly long term investors, the bulk of investment returns will come from the compound earnings growth a business delivers. We are looking for businesses that have the ability to reinvest capital and drive growth in their businesses for many years to come. |

Most of our research is focused on trying to identify business that have wide economic moats; aligned and long-term focused management teams; and underappreciated earnings growth runways. Finding all three of these attributes in one company is rare, and the vast majority of businesses we look at don’t make the grade.

Mastercard and Visa’s network effects provide wide economic moats that have stopped new entrants from competing in the highly profitable payments industry – delivering great rewards to their shareholders. The long term focus by Jeff Bezos at Amazon and willingness to forgo short term profitability to build a global ecommerce powerhouse has created enormous value for shareholders. In the case of Mainfreight the market has continually underestimated the length of the company’s growth runway, and the role the firm’s culture has played in allowing it to continually out-compete peers and take market share.

In our next three newsletters we will delve into each of these factors in much more detail with examples from our portfolios – to explain why these factors are so important and how they have helped us beat the market over the years.

A growing percentage of the Kiwisaver market is managed either passively or in a way that largely mimics the market (we call this behaviour “index-hugging”). Index-huggers simply try to deliver average outcomes and hold on to their Kiwisaver clients through banking relationships or expensive marketing campaigns. We take a very different approach. We believe that having one of the largest investment teams and actively managing all of our funds in-house will allow us to deliver better results for clients in the years ahead – as it has over Fisher Funds’ 21 year history.