The humble Flat White – invented here in New Zealand and now with the starring role in one of the most adventurous investment strategies of the modern era. Even if the Aussies did make it first, we make them better... We can use a simple coffee to highlight a multitude of investing principles and give a clear long-term vision to anchor our mindset through 2024 and beyond. Let me elaborate.

One of the hardest stages of investing is simply getting started. This can be for a multitude of reasons, with everything from complex industry jargon, negative headlines, or simply time, causing us to delay making a decision. Share market volatility can further reduce our enthusiasm, however historically these points in time can often be some of the most lucrative for those with a long-term view.

How a flat white can help you reach your investment goals

If, like many of us, you are struggling for that inspiration, or if you find it difficult to build a positive mindset around the longer-term benefits of investing, allow me to present 'The $200,000 Coffee Club'.

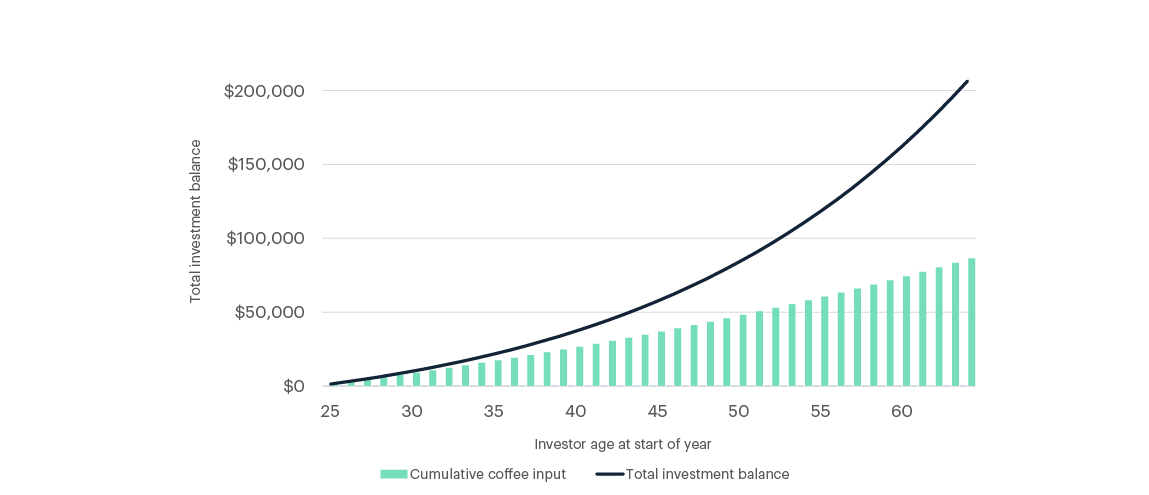

For this case study I’m going to use coffee as the basic building block for our investment. I’ll start with a simple $5.50 cost for a classic small flat white. Next, let’s make a sweeping assumption that you enjoy a coffee five days a week, bringing us to a total $1,430 per year for our coffee budget. Now what happens if we cut out our coffee altogether and instead invest this money into a Managed Fund at the end of each year? Next, let’s add in a starting age of 25 and project forward to age 65, with an inflation rate of 2% for the cost of our coffees each year (potentially a little conservative in the current environment).

The last variable is our investment strategy. Let’s say we invest in a diversified growth fund and assume the rate of investment returns will be 4.5% per year.

What develops is a textbook example of compound returns in action whilst also highlighting the key emotional stages many of us will go through as an investor. It also highlights why, for many of us, it’s easy to lose focus too early and miss out on the future benefits of being a truly long-term investor. Let’s do our best at peering through the crystal ball and look at the 40 years ahead of our 25 year old investor.

Start small …

Overall, it takes a little bit of time to get going – by the end of year 7 our investment balance will finally have crossed the $10,000 mark. This period is one of the longest and least rewarding stretches as an investor with just under 12.5% of our balance made up of investment earnings by this point.

Caffeine withdrawals aside, there will likely have been some sort of negative impact or life event by this stage to challenge our long-term mindset – COVID, inflation, a change of job, or even the discovery of UFOs.

By year 19 however, things are starting to get a bit more interesting – our annual returns are now matching our annual coffee input funds (around $2,000 by this stage, as a result of 2% inflation). And finally, as we hit age 65 (in year 40), our investment balance will be sitting at about $200,000. Of this, about 60% of the balance is made up of investment earnings – total flat whites sacrificed – over 10,000.

What happens if we start out with a small lump sum to get things moving a little quicker? $2,000 as a one-off deposit in year one, alongside our first batch of coffee funds, will boost our final balance by over $11,000.

KiwiSaver can enhance your coffee club investment

And what about KiwiSaver – how does this fit in with our new Coffee Club mindset? Let’s say- instead of investing in a Managed Fund we start contributing to KiwiSaver. Not only do we have our own coffee funds to invest, if we’re employed our employer is going to add in some flat whites too. Even better, the government is also going to throw in $521 of coffees each year just to really make this worthwhile. With KiwiSaver being built around a clear goal of retirement or first home withdrawal, this makes the long-term thinking that little bit easier and removes the tendency to dip into the funds or get side-tracked in those crucial first few years of the investment.

Ultimately, many of us who try and start an investment journey such as this will get distracted by shorter term volatility and life events along the way. We’ll switch from our growth fund just as the market hits a low and come back when things look good again – missing returns along the way. But by using a small lifestyle change such as this as the catalyst, we can add a whole new dynamic and psychological anchor to the investment which gives us a much stronger chance of staying the course.

How my personal coffee club is going

For me personally, I started my Coffee Club account on the 11th of March 2020, 6 days before my first daughter was born and right in the middle of a COVID media storm. I recognised that I would need to be more disciplined and with so much uncertainty at the time I decided it was the perfect opportunity to practice what we often read in the media around investing in times of uncertainty. As I approach the four-year anniversary, so far so good ... I haven’t made any withdrawals to date, and my coffee club balance is looking healthy.

Talk to us

If you’re interested in starting your own coffee club investment but don’t know where to start, our team can help. You can chat to us online, email us, or call us on 0508 347 437.