We’ve all heard that starting to save or invest early is crucial, but have you ever wondered why that is? It makes sense that starting early gives you more time to contribute and grow your nest egg, but it also lets you harness the power of compounding returns to really accelerate your savings. While the value of investments does fluctuate, if you have a long-term timeframe, compounding returns can work in your favour, gradually building momentum and helping your investment grow over time.

So, what are they?

Compounding is a powerful concept in investing. It’s not just about earning returns on your original investment, it’s about the potential to earn returns on those returns too. So when your managed fund has a good year and your balance grows, that larger amount stays invested, giving your money the potential to earn even more over time.

Compounding takes time and patience, but once you understand its impact, the long-term benefits can speak louder than any short-term market noise.

Just keep in mind:

Any returns added to your investment are subject to the same market ups and downs as your original contributions. If the market dips, it affects both.

You don’t make or lose money until you withdraw your investment, so staying invested is key.

How it works

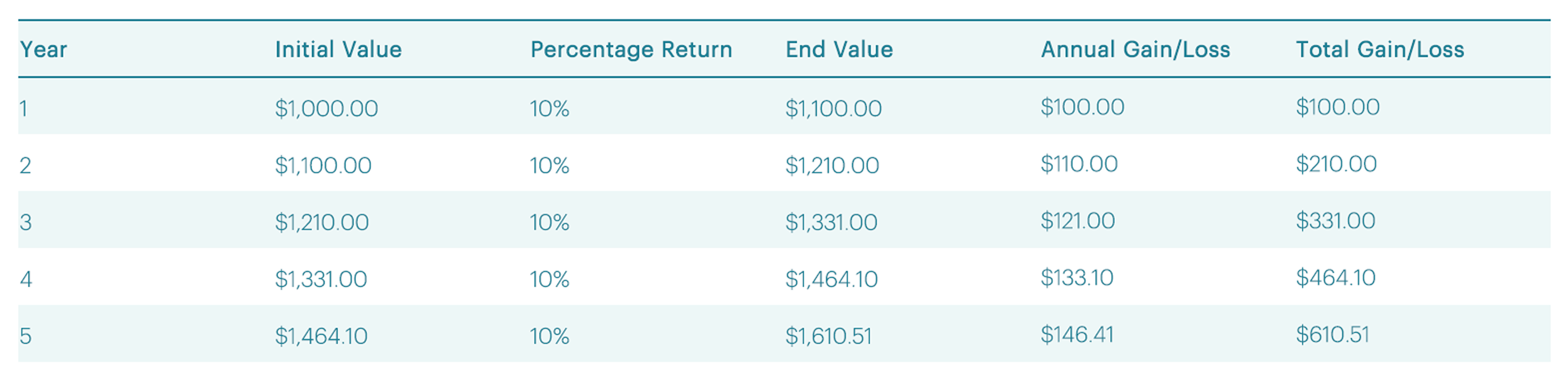

Let’s say you invest $1,000 with a return each year of 10% which reflects the average annual return of the Fisher Funds New Zealand Growth Fund over the 10 years to 31 March 2025. We have chosen this fund as it is a great example of how investing right here in Aotearoa can help Kiwis put their money to work.

Here’s how that investment could have grown over time through the power of compounding:

Each year, the dollar returns increase, not just because of the original investment, but because the gains themselves begin to earn returns. It’s a classic example of compounding in action.

The good with the bad – how it works with volatility

The key is staying invested for the long haul if you're aiming to benefit from the power of compound returns. Market downturns are part of the journey but over time, compounding can still deliver strong growth.

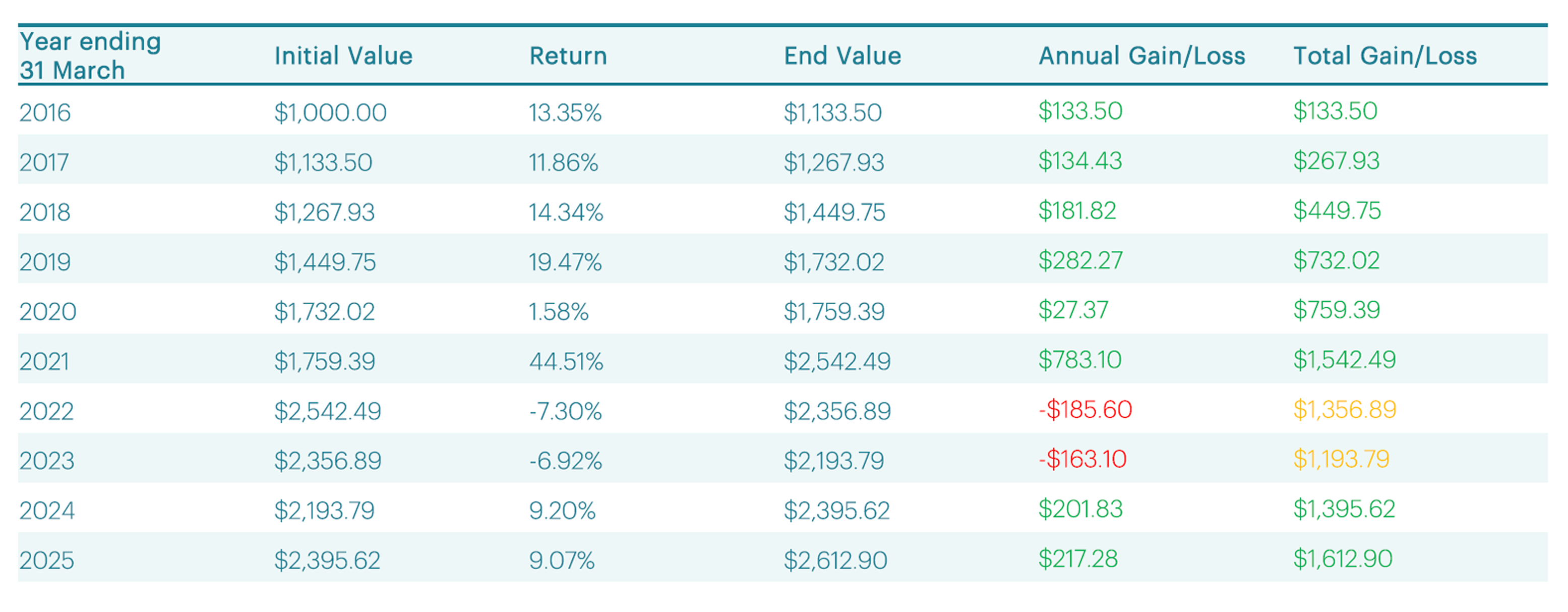

Let’s take that same investment of $1,000 and run the numbers using the actual annual returns of the Fisher Funds New Zealand Growth Fund over the decade to 31 March 2025. Even with a few rough years, the investment more than doubled in value.

At the end of the 10 years you have $1,356.89 more than what was originally invested, even though the portfolio lost about $185 in 2022 due to the fund having a negative return of -7.30%.

The numbers speak for themselves — even with a few bumps along the way, staying invested and starting early can make a huge difference. That $1,000 investment, despite market dips like in 2022, still grew significantly over 10 years. It’s a reminder that short-term volatility doesn’t erase long-term potential.

Patience pays off

Saving in a bank account can be great for some needs, but with little to no interest, your money just sits there. Inflation quietly eating away at its value.

Investing through managed funds puts your money to work. Over time, compounding returns have the potential to lead to exponential growth, especially if you stay invested and ride out market ups and downs.

Note: The returns in this article are after fees and after tax at the highest prescribed investor rate (PIR) of tax for an individual New Zealand resident. Your tax may be lower.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your goals, get in touch with us – our team are always happy to help.