The spike in term deposit rates has seen savers finally receive some compensation for parking money in the bank. While the headline deposit rates of over 5% may be enticing for savers, it is important to factor in inflation, and also balance the short-term security provided by term deposits against some of their pitfalls. Like a sugar rush, the initial reward from locking in a sweet short term deposit rate might not last.

A sense of security

Cash and term deposits can play an important role in investors' portfolios. They are a relatively safe investment, with a fixed rate of return – so you know what you will get paid each month in interest. This provides a sense of security.

However, there are no free lunches when it comes to investing – every type of investment has its pros and cons. The fixed return on a term deposit also comes with being locked in for a fixed period of time, reducing your ability to capitalise on other investment opportunities that present themselves. Term deposits also seldom outstrip inflation by much of a margin over time.

While the stability promised by term deposits is alluring, the sense of security can be a false one.

The only thing certain in life is death and taxes (and inflation)

The average one-year term deposit rate has jumped from c.0.9% to c.5.7% in New Zealand over the last two years. While the current headline rate may look attractive, investors may still be going backwards after accounting for tax and inflation.

For an investor with a 33% tax rate, a 5.7% term deposit rate will net them 3.8% after tax. With the most recent data showing that CPI inflation in New Zealand is running at 6.7%, investors are seeing their ‘real’ wealth decline by almost 3% per annum. Even if inflation does come down to 4.3% by March 2024 as the Reserve Bank of New Zealand projects, term depositors will still experience a negative real return.

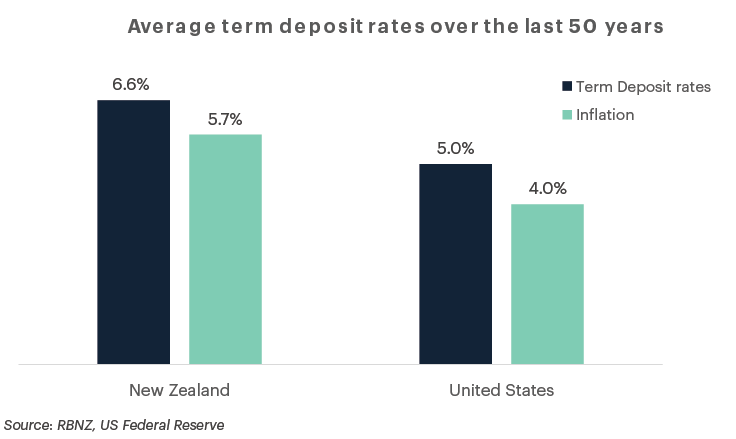

This isn’t just an unfortunate temporary phenomenon, it is by design. The fact that term deposits offer relatively stable and low risk returns, means that banks don’t need to offer much interest to attract depositors. Over the last 50 years in New Zealand term deposit rates have on average been c.0.9% higher than the rate of inflation – offering a small premium, but on an after-tax basis, most depositors were going backwards. The trend is the same globally, with US term deposits offering a c.1.0% premium over inflation over the last 50 years.

The price of safety is a declining portfolio value after inflation.

Short term gain, long term pain?

A hidden cost of only investing in low-risk investments like bank deposits and short-term government bonds is the upside that is forgone by not investing in growth assets like property and shares. For those still saving for retirement, this means not having their money working for them and ultimately a smaller nest egg come retirement. For those in retirement, relying solely on term deposits can increase the risk of running out of money later in retirement.

There are several different investment risks investors need to consider in retirement. The one that gets the most airtime is the volatility of a retiree’s portfolio. This day-to-day volatility is higher with growth assets like shares and property than with term deposits. The second risk that gets far less air-time – but is more important in my view – is running out of money in retirement. Or if not running out, having to significantly curtail your lifestyle because your portfolio wasn’t doing the heavy lifting for you. It’s important to invest throughout your retirement, and not just for it.

Investors need to balance up these two risks carefully. With increasing life expectancies and ever-increasing healthcare costs, the ‘longevity’ risk is looming larger and larger for many of us.

What is more comfortable in the short term, can be more harmful in the long term.

The sugar rush is wearing off

With the recent Reserve Bank of New Zealand announcement – essentially saying they believe the official cash rate has now peaked – the most likely direction for short term interest rates is down.

Term deposits were the safe haven to hide in last year, but 2023 is providing a reminder that investors shouldn’t chase last year’s winners.

With inflation starting to come down around the world, share markets have had a strong start to the year. Bank deposits may have returned c.2.5% so far this year, but global equity markets have gained c.15% in New Zealand dollar terms. This is a reminder that term deposits have a role in portfolios (as we saw last year), but they are not a complete solution for long-term orientated investors.

The term deposit sugar rush may be starting to wane.

Talk to us

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.