Many of us are all too familiar with the stresses of making our money last between paydays while we’re working, and yet when it comes to our retirement, it’s easy to forget that for many of us, retirement will last decades. We need to figure out how to make our nest egg go further. So how can we move towards this new chapter of our lives with confidence and make informed decisions about how to keep our money working even when we’re not? Is the answer a term deposit or keeping your money in KiwiSaver?

Currently there are about 842,000 Kiwis aged 65 or over and this figure is increasing by 80 people every day*. As a financial adviser, the question I am often asked is, “Should I withdraw my KiwiSaver now that I’ve turned 65 and invest in term deposits?”. The short answer for most clients is probably not, or at least not all of it. In fact, KiwiSaver can be a great way to continue growing your wealth in your retirement.

Retirement does not begin and end at 65 it starts at 65. A 65-year-old female in New Zealand today can expect to live to 88 years old**. You’ve worked hard to earn your money and your money needs to continue to work hard for you after you retire. As a financial adviser, it’s my job to help you make that money last as long as possible.

* Statistics New Zealand - One million people aged 65+ by 2028

** Statistics New Zealand - How long will I live calculator

What are the benefits of staying invested in KiwiSaver?

You can diversify – spread your risk by investing across different asset classes like shares and fixed interest

It’s a cost-effective way to invest - compared to other forms of investing

There’s a range of flexible investment options - our team can work with you to get the right investment strategy in place to suit your goals

You can access your money when you need it – once you’ve turned 65 your money isn’t locked in – you can make a withdrawal whenever you need it

You can continue to contribute to your KiwiSaver account after you’ve turned 65 – and if you’re still working although your employer isn’t obligated to contribute after 65, some will.

Your options when you turn 65

Once you’re able to access your KiwiSaver money, you don’t have to withdraw it all at once. You can:

Set up regular withdrawals such as fortnightly or monthly to top up your NZ Super

Make one off withdrawals when you need the money for significant expenses like a holiday or a new car.

What about share market volatility?

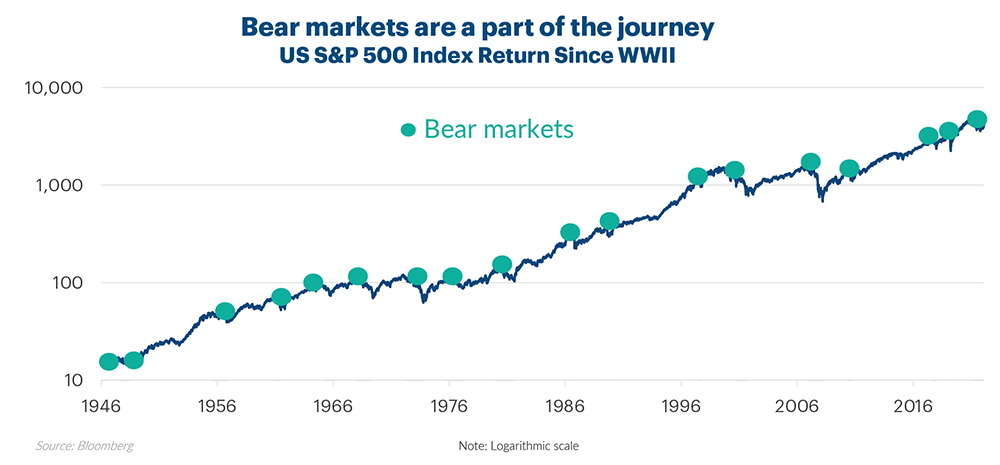

When talking with clients we often find people over the age of 65 want certainty and feel like they no longer have the stomach for market volatility. No matter what your age, it’s always important to make sure you’re in the right fund to match your investment goals. Market volatility is certainly a part of investing – since World War II, there have been 18 times the US S&P 500 index has been classified as a bear market (a fall of 20% or more from peak to trough). However, while the S&P 500 is still currently in a bear market, history has shown us that all these previous downturns have recovered. We are in a cyclical economy and for our seasoned investors with a longer investment timeframe, it’s the recovery from these downturns that has generated some good returns over the following years.

Is a term deposit a good option?

Some of you might be thinking, “Markets are volatile, interest rates are up, why not put my money into a term deposit at 5% for the next 5 years, then sit back and relax”. Here’s the thing, sure, deposits are a great low risk option, and their returns are looking pretty darn attractive right now, but that’s just it, they look good now. Two years ago, I was receiving calls from clients who were unhappy about the very low returns term deposits were offering. Interest rates this high won’t last forever, the same way this market volatility won’t.

The benefit of a term deposit is that it’s fixed, you know exactly what returns you’re going to receive after the investment has matured and you can decide how long your money will be locked away for. However, there can be a minimum investment amount you need to invest, and your returns might not keep up with the rate of inflation. Your money is locked away too – it can be difficult to access without a penalty if an emergency crops up.

That’s not to say term deposits are redundant, they can form a part of an investment strategy and may be a useful tool for investors that have a short investment timeframe. However, to help your money last throughout your retirement, it’s a good idea to be invested in some growth assets (like shares) which will usually provide higher returns over the longer term.

KiwiSaver can be better if you’re investing for the longer term

KiwiSaver offers diversified funds to suit a range of investors based on their age, stage of life, goals, and risk tolerance. Our KiwiSaver funds invest in a range of bonds, property, term deposits, cash, and shares from all over the globe.

Over the last two decades, investing in shares has outperformed term deposits significantly. The graph below shows a comparison of returns for different types of investments, with changes due to inflation removed. In 2002 if you had $100,000 and invested in a term deposit, by 2022 the inflation adjusted value of your investment would be $149,263. Not bad, but when you compare it to someone who put that same $100,000 into the New Zealand share market, 20 years later their investment has grown to be worth $363,113 (inflation adjusted). Disclaimer alert – KiwiSaver funds can come with a higher risk profile and past returns are no guarantee of future performance.

Investing in your retirement is likely to look a bit different compared to investing during your working life. Many of our clients benefit from a discussion with a financial adviser to unpack their situation and help them make an informed decision.

Talk to us

If you have any questions or want to learn more about investing through retirement, we have a team of friendly and experienced advisers that can help you customise your investment strategy to suit you. You can chat to us online, call us on 0508 347 437, or drop us an email.