The start of 2022 has been accompanied by a host of worries for investors and non-investors alike. Stock market volatility is at once a symptom and one cause of these worries. Fisher Funds’ active investment approach means that we proactively capitalise on the compelling investment opportunities unearthed by market volatility. We have recently added some new investments to our portfolios at prices we believe are very attractive. We profile one of these below - the software giant, Salesforce.

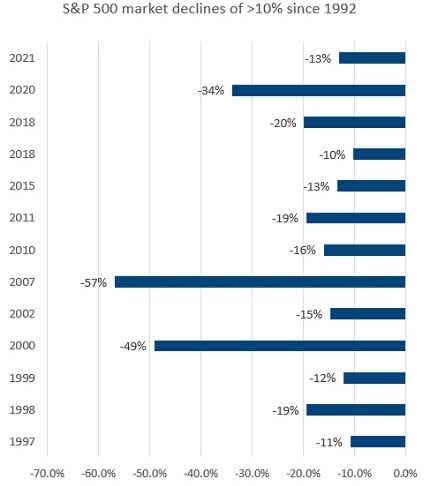

Market volatility is a feature, not a bug. New investors learn this in time, and even experienced investors need a reminder every so often. In the past 30 years, the US S&P 500 has delivered an annualised return of 10% whilst experiencing 13 falls of 10% or greater. At Fisher Funds, we do not attempt to predict the timing or duration of market volatility. Instead, we strive to be well-positioned to capitalise on the investment opportunities it unearths, whenever they may arise.

Preparation + opportunity = success (and returns)

At Fisher Funds, we aim to buy high quality businesses at reasonable prices to own for the long term. Our disciplined active approach to researching and identifying quality companies is key to ensuring that we are prepared for the investment opportunities presented when market volatility drives dislocation between stock prices and business fundamentals.

Not every quality company we identify becomes a portfolio holding straight away. A new addition must present a more compelling investment case than our existing portfolio companies – this means we are constantly improving the quality of our portfolio for the long term. Quality companies that are compelling, but less so than existing holdings, are added to our watchlist – the “fishing pond.” At first glance, this appears to be a lot of work without much to show (in terms of portfolio exits and additions), but the benefit of having previously done the work is a boon when the opportunity arises.

An example of preparation meeting opportunity was Hilton, a global hotel brand operating on an asset-light franchise model. We purchased Hilton in April 2020 in the depths of the COVID sell-off. We were able to move quickly because we had already done our research on the company, it was in our fishing pond, and we believed the market had overreacted selling down its stock on pandemic concerns. Hilton's stock price went on to more than double following our purchase, and we exited in February 2022 to redeploy capital to higher conviction opportunities in our portfolio.

Capitalising on opportunities presented by market fluctuations

Not every investment works out with such alacrity as Hilton did. According to Morningstar, COVID saw one of the most severe crashes, but also one of the fastest recoveries, in recent history. We cannot plan for such dynamics, only seize them as they come.

Now in March 2022, two years to the month after the COVID downturn, we are again seeing significant volatility – albeit driven by different factors including inflation, rising interest rates, and the war in Ukraine. Our playbook has not changed. We continue to work on identifying high quality businesses with sustainable competitive advantages, long growth runways, and committed management teams – characteristics that should allow them to perform well over the long term.

Since January 2022 we have taken the opportunity to add three new companies to our portfolio: Microsoft, Netflix (article here), and Salesforce. Markets have continued to fluctuate since our purchases; however, we have conviction in our investment approach and continue monitoring our portfolio companies closely to react to changes in business fundamentals.

New portfolio addition: Salesforce – the original software-as-a-service (SaaS) business

Renowned venture capitalist Marc Andreessen coined the term “software is eating the world” over a decade ago. Since the start of this decade, COVID lockdowns have driven more businesses to realise the necessity for an online presence ‘in the cloud.’ A McKinsey survey found that COVID has accelerated companies’ adoption of digital technologies by three to seven years. Salesforce is well-positioned to benefit from this strong tailwind of cloudification.

Salesforce is the original cloud SaaS company, offering customer relationship management (CRM) software on subscription since 1999. Today, it is the dominant provider of cloud-based CRM technology globally. According to research company IDC, Salesforce has 25% share of the cloud CRM market, while the next closest players have just 4-5% market share each. Its business-critical software offerings are used by 90% of Fortune 500 companies. Salesforce’s revenue growth strategy is to “land and expand”: land a new customer, and once they are using one or more of Salesforce’s products, expand that usage by upselling or cross-selling other offerings from Salesforce’s vast ecosystem.

Salesforce is also known for its acquisitions, a recent example being Slack (business communications). Salesforce’s vast ecosystem of products and large, valuable customer base has allowed it to grow both organic and acquired revenues at robust rates. We see Salesforce as a quality business that is well-positioned to gain market share in the fast-growing SaaS market.