The relationship between the United States and the rest of the World is at the core of Donald Trump’s political movement. While this was focussed more on immigration, walls and vague comments about Nafta Trump has pivoted this year to an explicit focus on the US’s economic relationship with its trading partners. This has caught the market’s attention and tremors in stock prices have been the result.

Ever since the establishment of the General Agreement on Tariffs and Trade (GATT) was established in 1947 the western world has embraced liberal trade policies. This has meant that countries focus productive resources on areas of comparative advantage and increase trade in goods and services to fill in the gaps. Trade has been generally beneficial, resulting in higher levels of economic growth and more competitively priced goods and services.

Companies have taken advantage of free trade to build complex global supply chains enabling significant production efficiencies. This has been hugely beneficial to the emerging economies enabling a period of rapid growth.

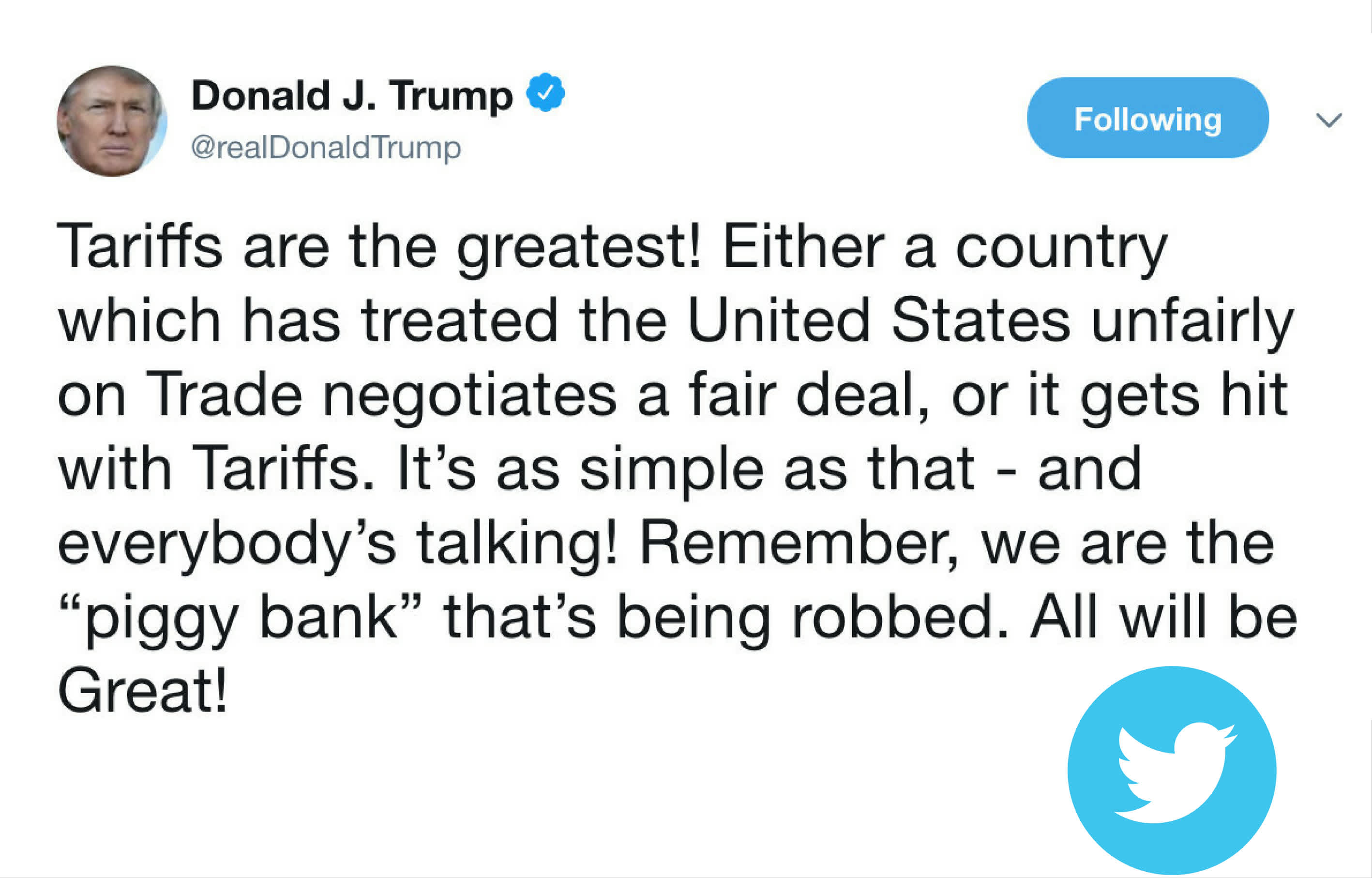

While trade has enriched most of us not everyone has been a winner. Similarly, not every country has strictly adhered to the free trade playbook. It is these two themes that Trump has tapped into in his twitter storms.

He is somewhat justified in his rants. The US imposes lower average import tariffs than China does. Similarly US tariffs are lower than those that apply in most of the European Union. Tariffs are only part of the story. China has played loose and fast with intellectual property rights and has constructed an array of non-tariff trade barriers making it challenging for US companies to do business there.

In April Trump added teeth to his twitter rants kicking off a trade war with China. The first announcement was a 25% tariff on US$50b of imports from China. These were imposed on the basis of protecting US intellectual property. China proportionately responded with its own round of tariffs on US imports.

In July a new tariff of 10% was introduced on a further $200b of Chinese products. President Trump, when he announced this, noted “these tariffs will go into effect if China refuses to change its practices, and also if it insists on going forward with the new tariffs that it has recently announced. If China increases its tariffs yet again, we will meet that action by pursuing additional tariffs on another $200 billion of goods.” All up then, Trump is considering imposing tariffs on $450b of Chinese imports. That is close to the total value of imports into the United States from China.

Predicting how trade battles play out is very challenging. The players have different objectives, none of which are clear, and the complex politics add a further layer of uncertainty. Trump can’t back down now without a tangible victory and similarly President Xi of China can hardly roll over and let the US publically embarrass China. The stakes are high and the rhetoric adds fuel to a dangerous fire.

It is these high stakes that make predicting the impact of this trade bout difficult. Looking back at past trade wars would suggest that if things don’t get worse from here the impact to global growth is likely to be minor and easily absorbed by markets. Goldman Sachs, the global investment bank, estimates an “increase in the average tariff rate similar to our expectation for the current episode usually lowers output by 0.2%. The trade balance typically improves — as trading partners usually only retaliate partially — but the effect is small.”

So if this plays out in line with history we don’t have a lot to worry about. Of course the words “in line with history” and “Donald Trump” are not normally uttered in the same sentence. There is still a risk that this war gets out of control with a much greater impact on global growth and asset prices.

While we are not explicitly positioned for this outcome our portfolios have a cautious tone. We have a lower exposure to global shares than is normal. We expect inflation to rise - rising tariffs add to this risk - so have less invested in long-term fixed income investments than we would normally have. We have more cash than usual which provides both protection and liquidity if markets do come under pressure.

What’s not talked about as much in the media is the effect on individual companies. Companies have got used to liberal trade policy. Supply chains are global and inventory levels of unsold intermediate and finished goods are typically low.

Take Apple for example. iPhones are assembled in China by Foxconn with sub-assemblies from throughout Asia all delivered just in time for a phone to be built and shipped to customers. Tariffs and more onerous non-tariff barriers will be a real problem for this business model. Apple is not alone in facing this risk. A trade war is likely to add cost to the supply chains reducing corporate profitability. We have little exposure to manufacturing but it’s a dynamic we are watching closely.

All up there is some logic to this trade war. A reduction in intellectual property theft and a lowering of non-trade barriers would be good for the United States and good for the global economy. I for one do not expect China to so meekly roll over and suspect that tariffs around the current levels will be with us for a while.