A quick search on Google Trends reveals that the number of people searching the term ‘recession’ has skyrocketed this year. The most recent spike in May is closely aligned to comments by US Federal Reserve Chair Jerome Powell that were more hawkish than expected. After raising the Federal Funds rate by 50bps in May, his comments suggested that interest rates would continue to rise rapidly - almost irrespective of the damage they could do to the economy. More recently the Reserve Bank of New Zealand lifted rates by 0.5% and projected future rate hikes that were faster than expected. While central banks have talked about trying to reduce inflation without harming the economy (a “soft landing”), they are also showing less regard for the economy and stock market than in prior market corrections.

We believe central banks are directionally right to unwind the overly relaxed monetary policy experiment they have been running in recent years. But they also need to be aware that interest rates may be the wrong tool for today’s inflation – which is caused as much by a supply problem as it is by elevated demand.

A soft landing

An old market joke is that “economists have successfully predicted nine of the past five recessions”. This is important to consider amidst the current market pessimism – because a recession is only one of a range of potential scenarios.

An equally plausible scenario is that higher interest rates start to slow the economy at the same time as unwinding supply chain constraints reduce inflationary pressures. Recent announcements by large US retailers Walmart and Target indicated that rather than being short of stock due to supply chain issues, they have too much stock and are having to discount merchandise to clear it. After surging in 2020 and 2021, used car prices have also started to decline in the US. As a result, central banks may start to see inflation pressures ease, even before the impact of recent interest rate increases bite. In this scenario, as the year progresses, central banks may not feel the need for such aggressive hike rates.

Teetering on the edge of the third bear market in 20 years, markets already reflect risk of recession

Markets are always trying to price and place probabilities on various risks – just as betting odds on sports games reflect the chance of a team winning and will fluctuate as a game progresses. With a major swing in sentiment and a c.20% fall in many major share market indices so far this year, prices already reflect a significant probability of recession.

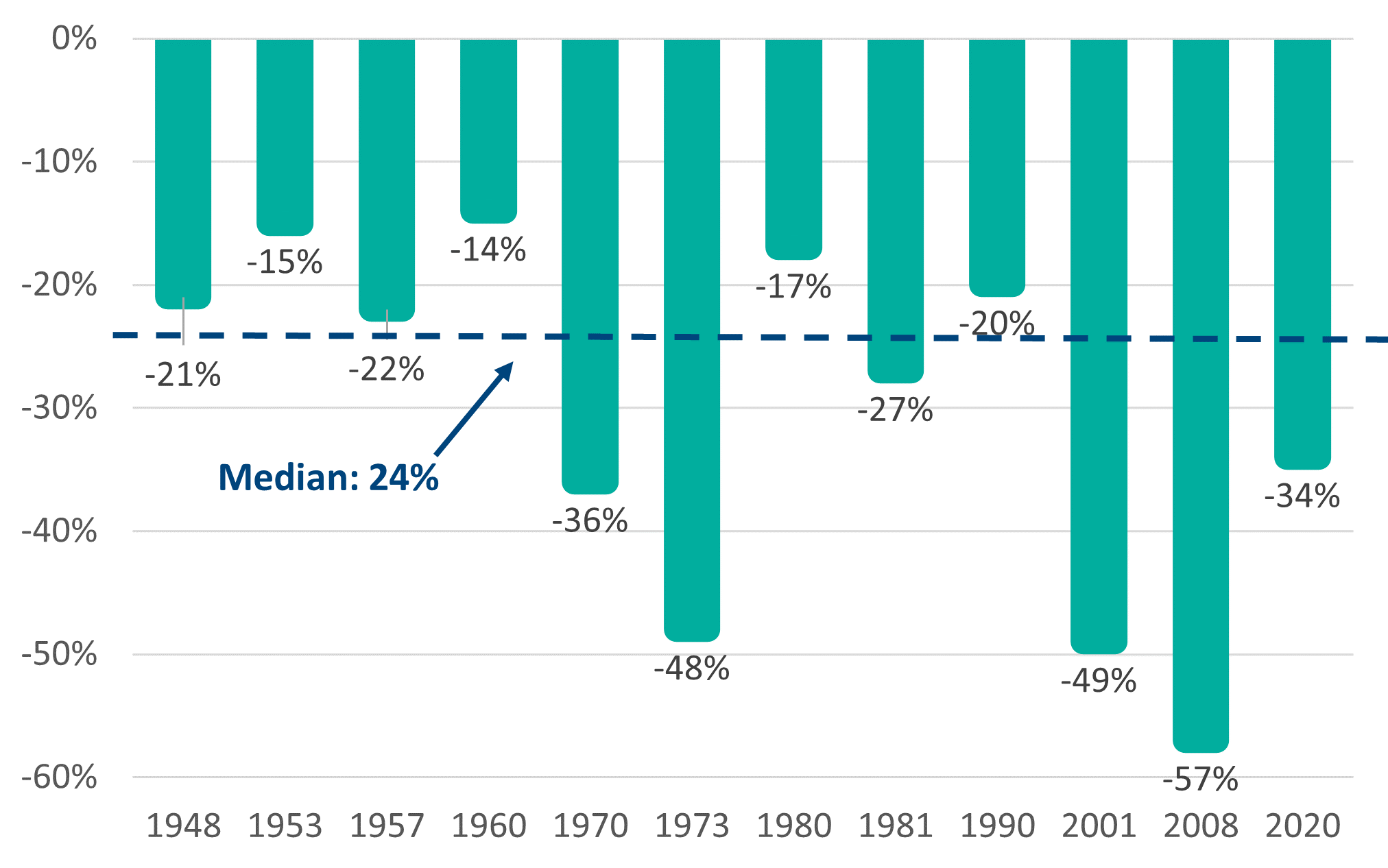

As can be seen from the chart below, in the 12 recessions since World War II, the S&P 500 Index has contracted from peak to trough by an average of 24%. A decline of this magnitude from the recent S&P 500 peak of approximately 4800 would bring the S&P 500 to 3650 (just 10% below current levels). If a recession does occur there may be a bit more downside, but investors must also factor in the scenario of no recession and a significant rally in markets as well.

The risk of market timing

The tendency of financial markets to quickly price in bad news creates complexity for investors that try to time the share market. To profit from market timing with the current market backdrop you need to be confident that a recession will occur and that markets will fall materially more in that scenario. Neither of those points are a given. If markets do fall further, then you need to astutely pick the bottom and buy back in before markets recover. This is easier said than done, as we saw in the Covid sell-off in 2020. After an abrupt six week sell-off, markets rebounded extremely rapidly - long before cases started to peak or a vaccine had been developed. Most investors that sold during the dramatic price declines are unlikely to have bought back in at lower prices. In fact, they probably bought back in at much higher prices – turning what could have been short term losses into permanent ones.

Missing rebounds after a market sell-off can have a significant impact on an investor’s long-term returns. According to Fidelity, if you missed the 10 best days in the US share market in the 40 years between 1980 and 2020, you would have given up half of all share market gains.

This just highlights the wisdom in the quote from investing great, Peter Lynch, who said that “far more money has been lost by investors trying to anticipate corrections, than has been lost in corrections themselves”.

None of this is to say that a recession won’t occur. But the risk of recession and the occasional bout of market volatility is what allows for higher long-term returns for shares compared to bonds and bank deposits. The current economic uncertainty is what has led to lower prices – and all else equal that means future returns look better now than they did a few months ago. To reap the rewards, however, investors need to tolerate some short-term volatility.

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.