The New Zealand economy is slowing. While this is getting headlines, the reality is that our underlying economic performance has been poor for some time now. Poor economic fundamentals matter. A weak economic machine means more poverty, a sicker health system and education that does not deliver the results we all aspire to. We need greater policy clarity and a mind-set focussed on entrepreneurship, innovation and growth to turn around our fortunes. It is time for our economy to get off the couch and train like an athlete! We should expect more.

HSBC economist Paul Bloxham famously labelled the New Zealand economy a “rock star” in 2014. He was wrong. For too long New Zealand has relied on net migration, importing people, to grow.

This can be a great strategy if 1+1=3, if more people moving here stimulates growth that benefits everyone. This has not been the case.

Over the past five years, while the economy has grown overall, the income earned by each of us, GDP per capita, has been static. Even though a larger economy looks good on international economic performance league tables, income per head is what actually makes a difference to our lives.

No growth in income per head means our standard of living is not improving. In fact, arguably, our standard of living has been falling as roads get busier and services harder to access.

Now even the lustre of strong overall economic growth is fading. Recent data showed the overall economy grew at a paltry 0.5% in the June quarter. Forward-looking surveys like the ANZ confidence survey point to growth falling further, with the worst confidence reading in 11 years.

Rebuilding the machine

An economy is like a machine. There are inputs that feed in one end - labour, productive capital, technology and innovation - and outputs that come out the other end - the goods and services that we consume or export.

If all goes to plan those inputs get used in a more productive way over time. Productivity growth means we produce more output for each unit of input. It is by improving the productivity of the economic machine that we improve our standard of living.

While there are a few steps in this process, more productivity ultimately means better healthcare, better support for the vulnerable in our society and a country we can be even more proud of.

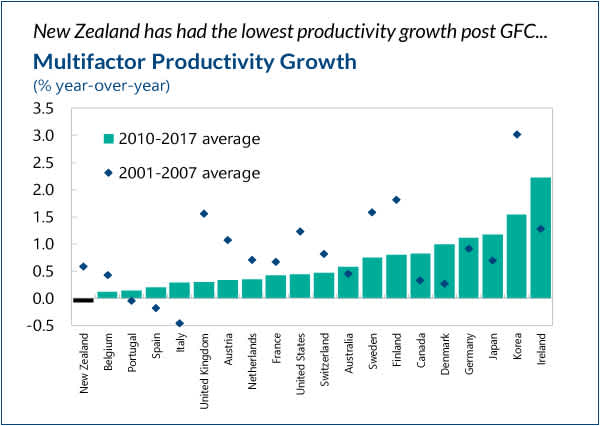

Unfortunately, New Zealand’s productivity data would suggest, as an economy, we are less rock star, less finely tuned All Black and more slightly sagging couch potato.

While we have been adding more labour inputs to our economic machine, investment in productive capital has gone nowhere in almost a decade. Partly as a result of this our productivity “growth” has been woeful.

The cures to correct productivity woes are hard. And a long way above my pay grade.

But policy choices that constrain business efficiency and confidence clearly don’t help.

Business needs certainty to invest. We need investment to drive the productivity growth that improves our lives.

Clear, consistent policy enables businesses to make sound long-term decisions. Policy uncertainty on the RMA, productive lands, water quality, ETS and bank regulation would appear to be constraining investment. Clarity will lead to more investment.

There is also a long-term mind set shift needed. This is where we can all make a difference. In my view, New Zealand needs to develop a culture of entrepreneurship, innovation and a focus on growth to create the country we want.

Step one in this is investing in ourselves; focussing on education and the skills needed to be successful in a modern world. Like training for the All Blacks, the prize is there, but we have to get off the couch.

Short term negative, long term hopeful

While I believe that slowing economic growth may act as the catalyst we need to address some of these issues the fixes will take time.

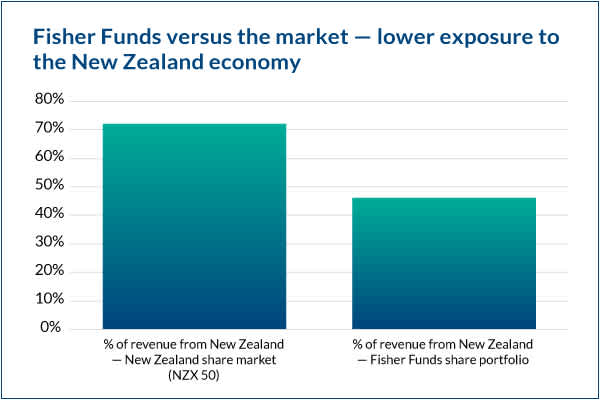

In the very near term, we are cautious and have less growth exposure to the New Zealand economy than is normal in our portfolios.

One implication of this is that we have more invested in New Zealand fixed income than is typical and we have invested in bonds with longer than average maturities. These will make outsized capital gains if interest rates continue to fall as we expect.

We have lower than normal exposure to the New Zealand share market. This reflects both the earnings outlook for some New Zealand companies but also the valuation of the New Zealand market that is off the scale compared to history.

Within our New Zealand share portfolio, we prefer companies with significant overseas businesses.

These companies have the characteristics we look for in an investment - strong brands with products that customer’s love, global growth aspirations selling into huge potential markets and leadership with clear vision and long term business strategies.

We believe a handpicked portfolio of companies like this, like A2 Milk, Mainfreight and Infratil will deliver very solid returns even if growth slows down in New Zealand.

In fact we would go one step further – it is exactly these kind of companies that represent the very best of what we can become, highly productive, innovative and Global leaders.