I’m not sure what it is about March – but in recent years it has often been a turning point for markets. March 2009 marked the bottom of the Global Financial Crisis (GFC). Late March 2020 was the turning point after the abrupt COVID-19 market sell-off. In mid-March last month, markets started to rebound sharply after a market rout driven by rising inflation, spiking interest rates, and the war in Ukraine.

While March being the turning point is simply a coincidence, what isn’t a coincidence is that the rebound in markets started when news headlines were bleak – and seemingly getting bleaker by the day! There were no ‘all clear’ signals, and sentiment was terrible.

In March 2009, US GDP had just contracted at its fastest rate in 26 years, markets were down over 50%, and The New York Times had just run an article comparing the GFC to the Great Depression. In March 2020, whole countries were shutting down their economies – and we were about to experience the biggest quarterly contraction in global GDP ever. And this March, the bad news continued to pile up: The war in Ukraine; high and rising inflation; increasing mortgage rates; and oil prices hitting consumers in the pocket. The chart below highlights that investor sentiment was as bleak in March as it was in the COVID sell-off.

Why do markets behave in this counter-intuitive way?

While it may seem counter-intuitive, it is not unusual for markets to rally when sentiment is poor. When investors are most fearful, it is often the case that markets have already fallen significantly and panicky investors have been flushed out. At these times fear is often peaking, and investors are capitulating. Markets are putting too much weight on the short-term negatives, without enough consideration of the counter-factual (i.e. World War III may not erupt, and oil prices may come back to ground someday).

After a sell-off, valuations start to look more attractive, markets find an equilibrium, and then start to rise again as opportunistic buyers step in. The rebound can be almost as sharp as the sell-off, as buyers step in to find bargains.

We have started to see this dynamic in the last few weeks, with bargain hunters stepping in to take advantage of attractive opportunities. We have been doing this in our portfolios, and pleasingly we are starting to see clients do this as well – by investing more money while prices are depressed.

A timely reminder not to try to time markets

Recent market movements provide a good reminder that market timing can be counter-productive. If you had sold when the war in Ukraine started, you may already be regretting that decision.

Investors are best to stick to a strategy through thick and thin, and let markets do the hard work for them. The best days in the share market typically come shortly after the worst days. If you sell when the markets hit the skids, you may well miss the rebound. Some investors feel that they can take control of the markets by selling out of them – but the reality is they simply lock in losses and make them permanent.

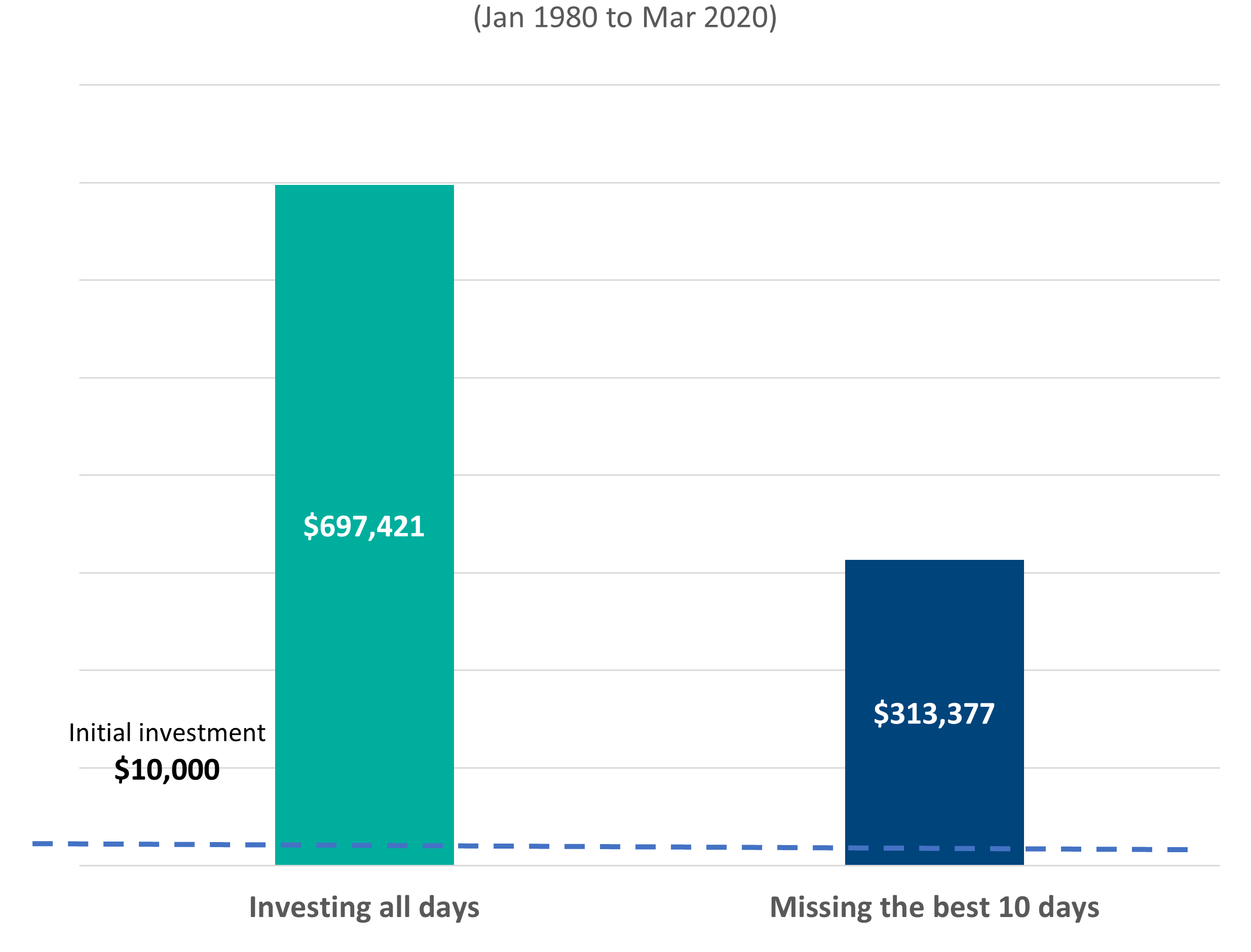

The chart below shows that if investors missed the best 10 days over the 40 years from 1980 to 2020, they would have missed out on over half of the potential market gains. Over this 40-year stretch, $10,000 invested in the S&P 500 would have grown in value to $697,421. If an investor missed the best 10 days, the portfolio would have only increased in value to $313,377. This highlights the wisdom in the old investing saying that “time in the market is more important than timing the market”.

The implications of this for the current environment are clear. Make sure you are in the right fund for your risk tolerance, develop a long-term investment plan with your adviser, and then make sure you stick with that plan through thick and thin.

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.