I’ve recently installed an app to track how much time I spend on my smartphone. The aim of this exercise was to show my colleagues that I don’t spend that much time looking at my mobile screen. The experiment failed miserably - it turns out I’m on my phone anywhere from one to two hours a day! At least I’m not alone. It turns out that the average person in the US is on their smartphone for over two hours a day, and using Facebook and Instagram for an hour a day combined. While this may not be great news for our employers, TV networks or even family members trying to get our attention – our mobile addiction is great for Facebook’s advertising revenue - and marketers savvy enough to use their ad platform.

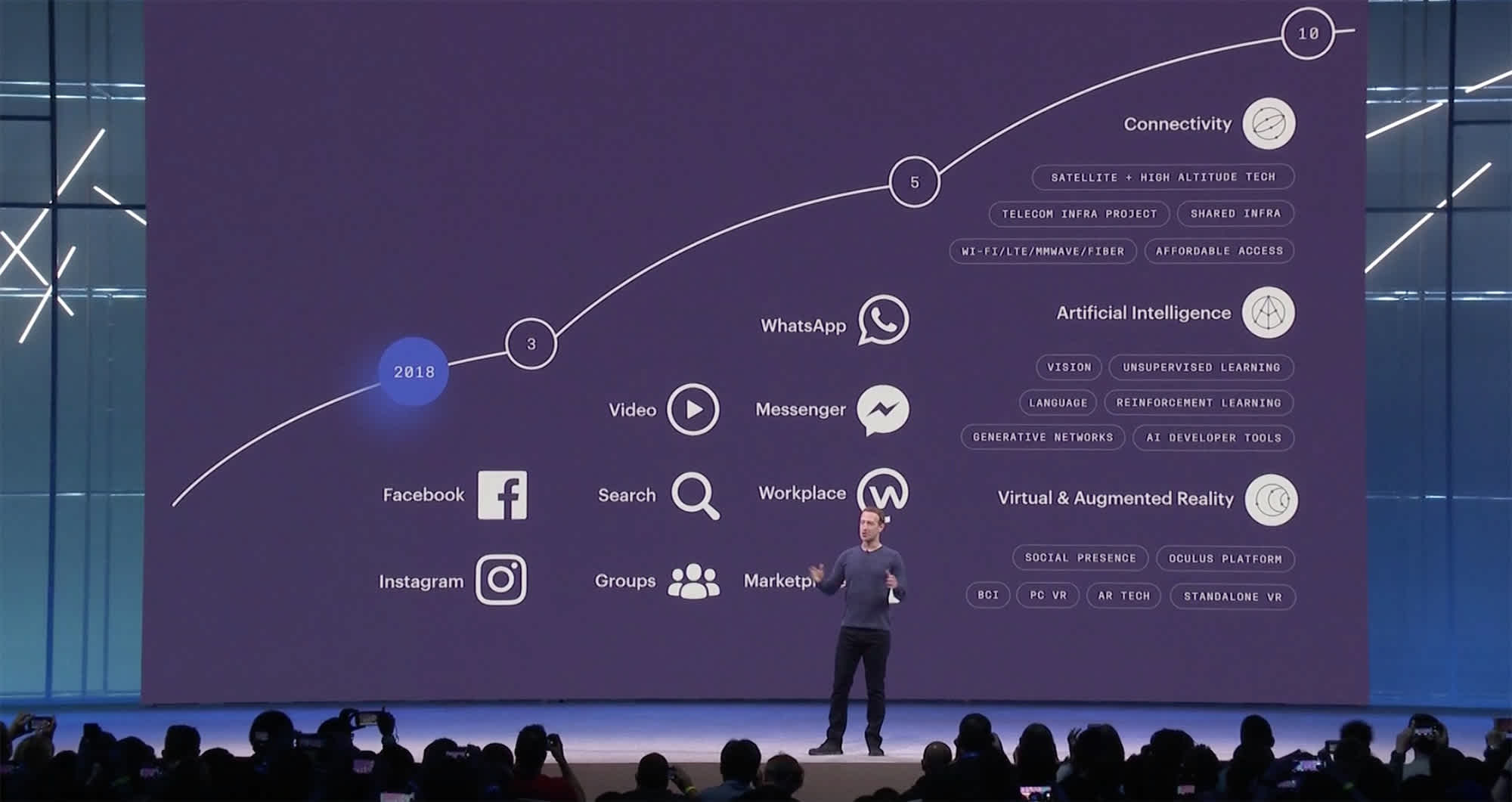

We’ve owned shares in Facebook for a number of years now. Facebook owns four of the world’s most dominant social networking and messaging platforms (Facebook, Instagram, Messenger and WhatsApp) and has an unparalleled ability to deliver an audience of over 2 billion users to advertisers. In a world where we are spending an increasing amount of time on social media and mobile devices, and less time watching TV, advertisers are having to upskill their marketing teams and learn to target potential customers through these digital platforms. Facebook’s treasure trove of data on users means that they not only know your age, gender and location, but they also know your hobbies, who you are friends with, and what you do and don’t like. This data means Facebook can offer advertisers a level of targeting like no one else, and when combined with Facebook’s huge reach and should allow them to capture a significant share of advertising spend as advertisers continue to move their focus online.

An investor’s dream is to find a great business, with a long runway for growth, at an attractive price. You very rarely get all three of these qualities at once, particularly in the current market environment.

Rebuilding trust and confidence

We believe the heightened investor scrutiny of Facebook following the Cambridge Analytica data breach and #deletefacebook campaign created such a buying opportunity for Facebook investors. While we don’t take the regulatory risks facing Facebook lightly, we believe management will do what is necessary to restore user trust. The scandal itself should have limited impact on the number of Facebook users as consumers’ mobile usage and social media addictions are now well entrenched. Facebook has become a primary way for people to communicate, follow developments with friends and family, and to build new relationships. It has also become a store of our memories and photographs, and most social media users are by now comfortable with the concept of being shown targeted advertisements in exchange for access to these social platforms. In our opinion, increased regulations in the sector that makes it harder to share user data (along the lines of GDPR in Europe) are likely to simply entrench the competitive advantage of companies like Facebook and Google that already have this data.

While it is still early days, Facebook’s recent results have shown a return to active user growth in its key US market, and the addition of 70 million monthly active users globally in the first quarter. #deletefacebook seems to be on the backburner for now.