An often-cited statistic suggests it takes 21 days to form a new habit. With much of the world recently in lockdown for weeks if not months, this poses a question of what new consumer behaviours have become permanent.

How changing consumer behaviour will affect businesses post Covid-19

As we think through how Coronavirus-driven changes may affect businesses, there has been a general theme. It is more important than ever that business meet the customer where they are.

The pull forward of online shopping adoption will have an impact on both big and small businesses as well as other industries such as marketing and payments that encircle the consumer.

Commerce shifts online

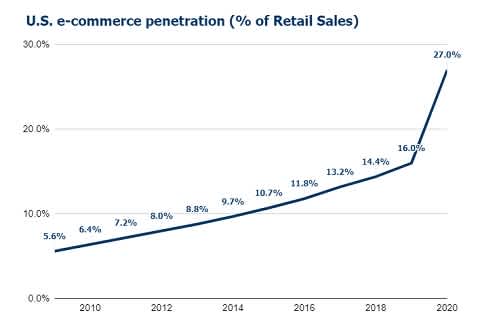

E-commerce penetration in the US leapt 11% in the eight weeks ending in April, the same increase as during the previous 10-years, highlighting just how rapid the shift has been.

The accelerated shift to digital sales will create winners and losers as the customer moves from the high street to online.

The obvious beneficiaries are those companies with a strong online presence already. As most would expect Amazon’s sales boomed during March and April.

Less obvious beneficiaries are retailers like Walmart and Target in the US with the size and scale to invest in infrastructure needed for e-commerce who already have a strong customer base.

Losers will be middle of the road physical retailers with a weak customer proposition. Their demise is going to hasten.

The stores that will succeed will be those who offer an experience not easily replicated online like US hardware retailer Floor and Décor, or stores that provide both value and convenience to customers, like TJX and Dollar General.

Small and medium sized businesses will need to adapt

As the customer shifts online, what does this mean for small and medium sized businesses (SMBs), which contribute a significant portion of any country’s gross domestic product and employment?

They will need to adapt. For those that do, we think there is significant opportunity.

By selling through online channels, SMBs can dramatically increase their customer reach from a relatively small geographic area around their stores, to the wider globe. It means investments into storefronts, customer discovery and customer traffic will likely need to be redirected to online platforms who already have a customer base.

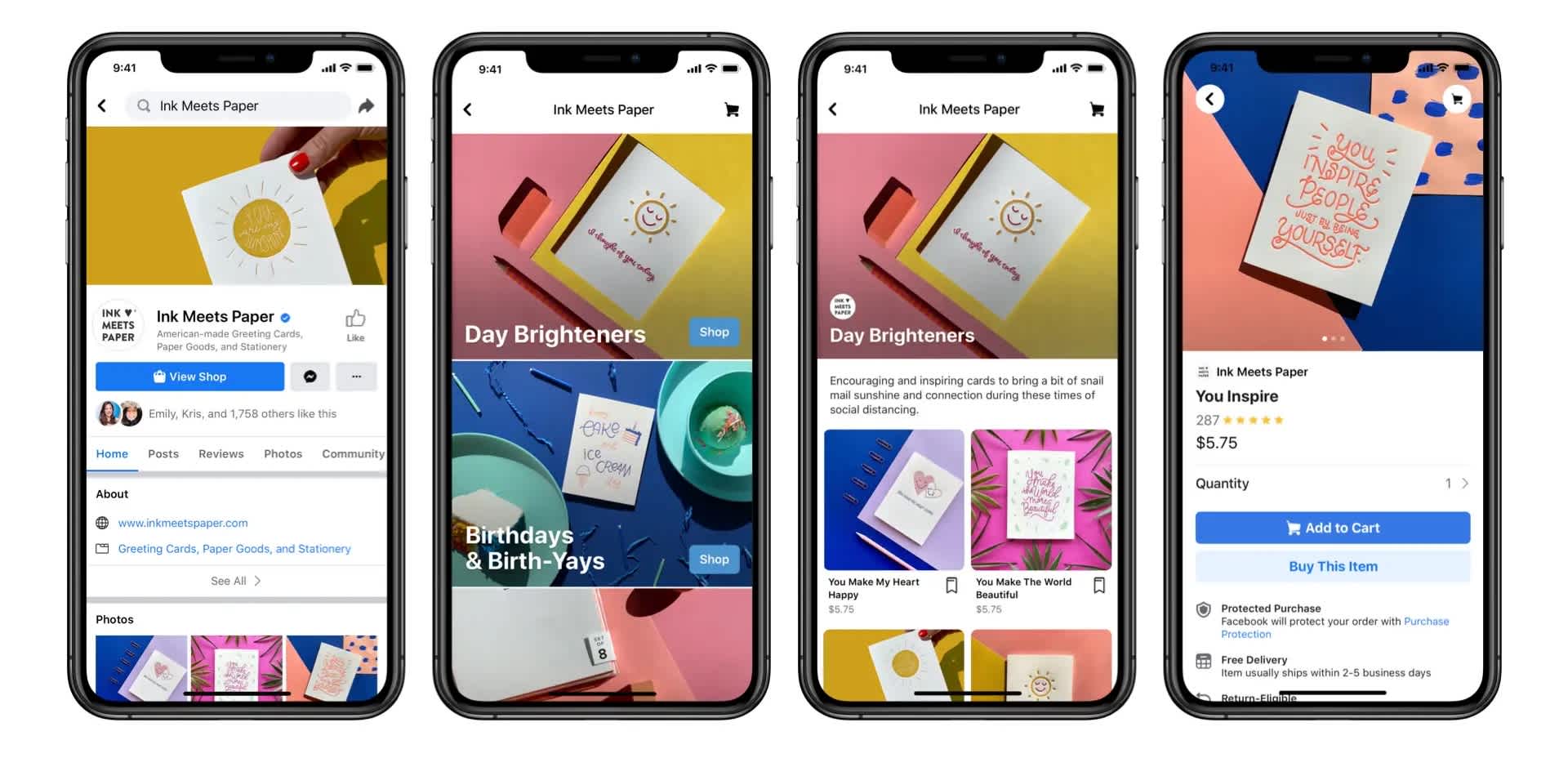

Facebook is one such platform. The company has recently pushed further into e-commerce. Through Facebook Shop, SMBs can create storefronts across its platforms (Facebook and Instagram), opening up the potential to sell their goods and services without friction to Facebook’s 3 billion users.

Shopify and Wix, companies we follow but do not own, allow SMBs to move online at little cost. Both companies enable SMBs to create a website and use their solutions to sell, ship, and manage products and services.

Beneficiaries in the adjacencies of digital advertising and payments

For industries like payments and marketing, there will likely be an acceleration of trends already in place. Covid-19 could be the tipping point for cash with some retailers in the US now only accepting cards. MasterCard recently said contactless forms of payment, such as Apple Pay, increased by 40% in recent weeks.

Companies will have to re-allocate marketing budgets to meet the customer where they are. This will push ad dollars online from offline, benefitting the likes of Google, Facebook, Alibaba and Tencent.

While the Coronavirus will reverse some trends, it will also accelerate trends that were already in place. To align with our investment horizon, our focus will be on the trends that will play out over 5+ years rather than trends that might just have an impact this year.