The start to 2022 has been tough for investors. Having passed the halfway point of the year, you will have seen numerous articles pointing out how 2022 has been one of the worst starts to a year in decades. We have officially entered a “bear market”. Global share markets dropped 21%* in the first half of the year, typically resilient government bonds have fallen 15%^, domestic house prices are falling, and talk of a potential recession has ramped up. This is now one of the worst ever starts to a year for equity markets, and the worst start ever for bond markets.

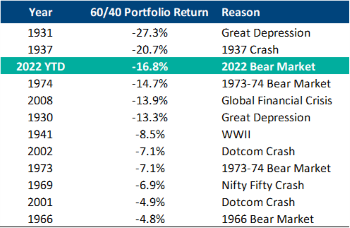

With equity and bond markets falling in tandem, there has been nowhere to hide. For a balanced portfolio investor in the US (selected due to more historical data) this is shaping up to be the third worst year on record.

A vastly different investment environment

The economic landscape has changed drastically over the last twelve months. This time last year New Zealand’s inflation rate was running at 3.3%, the Reserve Bank of New Zealand hadn’t started hiking interest rates, and global central banks were still talking about inflation being transitory.

Fast forward to today, and inflation is running at 6.9% (the highest rate in 40 years), we have a war raging in Ukraine, and central banks around the globe are hiking interest rates aggressively to head off inflation. The rapid rate hikes, and the prospect of skyrocketing mortgage costs has also spurred recession concerns.

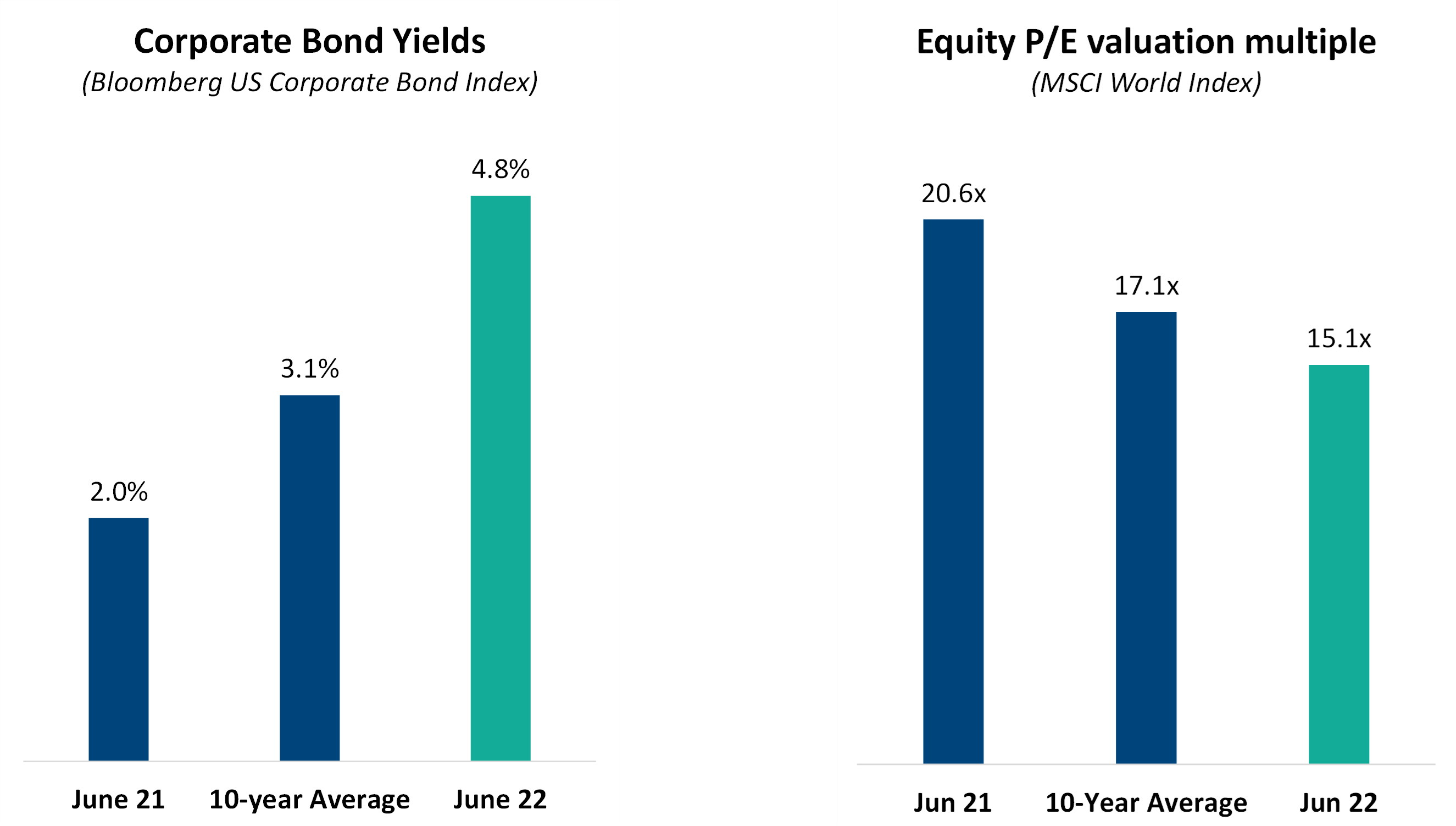

With financial markets having swung aggressively to reflect this changing economic backdrop, the investment outlook is also very different than it was a year ago. Interest rates have more than doubled over the last year. As an example, the running yield on our Income Fund has gone from approximately 2.5% a year ago, to 6.5% today. We have gone from a world where bond yields were unlikely to outstrip inflation, to one where investors can now expect to earn a significant premium over medium-term inflation.

Equity valuations have also come down materially. Twelve months ago, global equity market valuations were trading well above long term averages. Today they trade at a discount. We believe there are some great businesses that will deliver attractive long-term returns from today’s depressed valuation levels.

While the recent journey has been painful, the destination is shaping up to be much more attractive.

Source: Bloomberg

Tail risks exist, but some of them are already priced

While there are still a lot of risks out there, recent market declines mean some of these are already reflected in market prices. The 12 US recessions since World War II resulted in a median decline of 24% for the S&P 500. If we have a mild recession in 2022 or 2023, then there may only be another 10-15% downside. On the other hand, if we avoid a recession and inflation slows, markets are likely to be materially higher in a year’s time.

In the 12 months after entering a bear market in the US, the S&P 500 has delivered a median positive return of 24% (and markets have gone up two-thirds of the time). There is no guarantee that this will happen this time, but history suggests the odds are in investors’ favour.

With lower starting valuations, the investment opportunity set is looking more attractive

As we have seen on numerous occasions in the past, we believe investors that hold tight through the current turbulence will ultimately be rewarded. The flip side of falling share prices and rising interest rates is higher expected returns.

We like the investment opportunity set we are currently faced with. We are using current volatility to gradually reposition client portfolios and capitalise on the attractive investments our team are finding. There is no guarantee this will result in gains over the next three or six months. But over the long-term we are confident that our portfolios will deliver good outcomes for clients.

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.

*MSCI World Index

^Bloomberg Global Aggregate Treasuries Index