Investing is a bit like farming – in both cases, there is a lot you can’t control. Attempting to influence things outside one’s control is a bad idea. A better approach is to have processes in place to help deal with the task at hand.

Radio New Zealand’s Country Life programme is a great listen. Each week the show takes you to a different part of the country where people are working the land to achieve their goals. No doubt the farmers would like more of a say in tomorrow’s weather, just as investors would like to reign in the storms that upset financial markets.

We can’t control financial weather so we focus on careful analysis

Over the years, our fixed income team has developed an investment process that blends macro and micro analysis. This process enables us to investigate a wide range of fixed income investment opportunities.

Macro analysis is framed by the four stages of the economic cycle: downturn, repair, recovery, and expansion. Micro analysis is made up of four building blocks: business examination, financial assessment, capital structure review, and valuation appraisal.

Our robust investment process was important last month when, despite the lockdown – something we can’t control – we had to analyse a diverse range of new bond issues in New Zealand’s capital markets.

We made several investments during this flurry of activity. Let’s look at some of the bonds that made it through our process.

Oceania Healthcare – an experienced developer of retirement villages

The company issued a $100m seven-year fixed-rate bond to help fund its pipeline of independent living units and care suites. We bought the bond as the company has consistently demonstrated a commitment to quality clinical care and is set to benefit from growth tailwinds that reflect the country’s ageing population.

Oceania is an experienced developer of aged care and retirement-village assets. Recent developments have been completed on time and on budget, and we expect this to continue.

ANZ – a market leader with scale advantages

ANZ Bank New Zealand Limited offered $600m fixed-rate subordinated notes and we invested in this deal. Market position is an important aspect of our business examination building block , and ANZ is New Zealand’s largest full-service bank. This market position gives the group scale advantages.

We also think recent regulatory changes introduced by the Reserve Bank of New Zealand have been positive for debt investors as local banks are required to progressively increase equity levels in the years ahead. This equity provides a cushion against unexpected shocks and downside protection for creditors.

We think ANZ has the business and balance sheet profile to sustain its market leading position going forwards.

TR Group – a successful New Zealand business returns to the market

We were pleased to see the company return to the bond market in September. The group issued a $100m fixed-rate secured bond to support the expansion of its truck and trailer fleet. The team at TR Group are passionate about trucks and the company has a proven ability to win repeat business by supplying customers with the right heavy vehicle, in the right condition.

The management team is also adding electric (see picture) and hydrogen trucks to the fleet – a great initiative that aligns with the company’s motto ‘Always growing, learning, and improving’. We look forward to the next chapter of TR Group’s story.

UDC Finance Limited – the first bond in the company’s 80-year history

The company issued its first ever bond, a $400m asset-backed security. UDC’s principal activities involve providing finance to New Zealand companies and motor vehicle loans to individuals.

Loans backed by assets – new or used cars, and light or heavy commercial vehicles – were pledged as security to support the bond. Importantly, UDC retained the most junior-ranking stake in the pool of loans or the stake with the highest risk. This means UDC has, as the saying goes, ‘skin in the game’.

Our team has spent considerable time researching asset-backed securities in recent years. And we were impressed by UDC’s track record and effective portfolio monitoring and governance procedures.

New Zealand government bonds with 2051 maturity date

Our macro-analysis framework came to the fore when the government knocked on the market’s door for funds to support its fiscal position. Via the New Zealand Debt Management office, the government issued $3.0bn of bonds with a maturity date of 15 May 2051 – the longest-dated government bonds ever issued in New Zealand.

We invested in this bond because we think New Zealand is moving out of the recovery phase and into the expansion phase of the economic cycle – even factoring in the current lockdown slump. This is important because the expansion phase often corresponds with peak growth, inflation optimism, and rising bond yields.

We tend to reduce bond holdings during the recovery phase, and increase holdings in the expansion phases as bond yields rise, or begin to offer higher levels of income.

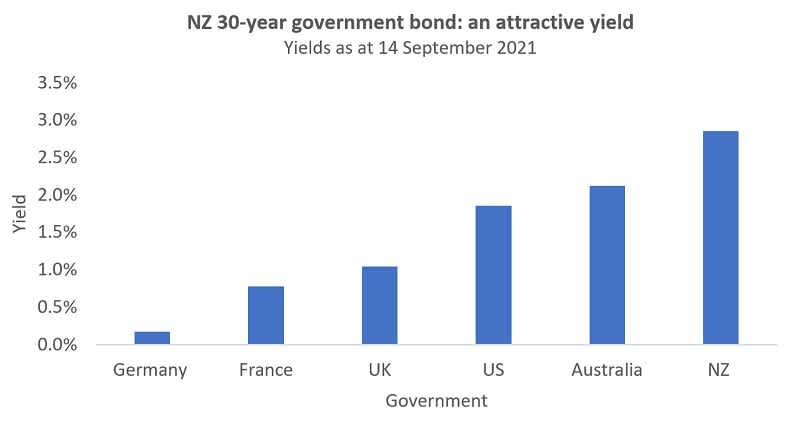

And the yield on offer was attractive relative to other developed countries (see graph).

Process can’t control weather but it helps manage it

All in all, a bond-market September to remember! Plus a reminder that good process helps investors come through all kinds of weather events.

We applied our process, focused on what we could control, and kept our eyes on the long term – much like the farmers who feature on Country Life.

Our focus on rigorous analysis and solid process will help us deliver greater lifetime savings for our clients.