Having recently turned 100, there is no sign of complacency at Hilton as the company positions itself to take market share.

Travel is a growing industry, supported by a rising middle class globally and a generation of consumers more willing to spend on experiences versus possessions. Hotelier, Hilton is likely to be a major beneficiary. Their brand will likely become increasingly appealing to independent hotel owners as Hilton wields economies of scale and lowers the cost of customer acquisition. The company has progressively moved from asset owner to a franchise model. This allows exploitation of a structural opportunity with very little capital investment.

The business

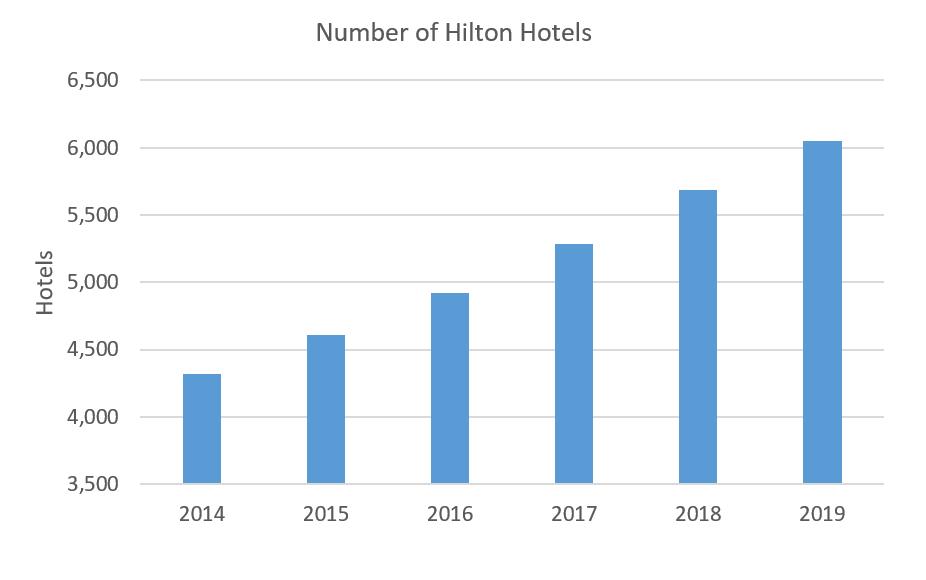

Under the Hilton umbrella are 6,000 hotels with a combined 950,000 rooms. Of which, Hilton only owns or leases 2% of properties. The rest are under 20-30 year franchise contracts. The company has a mid-single digit share of global hotel rooms, but a 20% share of the global hotel construction pipeline. This places Hilton in a good position to take market share. The company should grow rooms by 6-7% per year. Future growth is likely to come from the Asia Pacific, shifting mix slowly away from North America.

Asset light

Hilton has an attractive recurring-fee business model. Over the past several years, Hilton has sold off much of its owned and leased hotel portfolio, becoming predominantly asset-light. 98% of rooms now under franchise contracts.

This is an appealing model as franchise hotels have low fixed costs and capital requirements. Of the US$50 billion invested in Hilton’s construction pipeline, the company itself has only needed to invest US$200 million (0.4%). This drives increasing profit margins and returns on capital invested.

Hilton’s focus has been and continues to be on the mid-market. These hotels are popular with hotel owners as they are cheaper to develop, have fewer operational complications and simpler staffing models than the upscale subset. They offer the increasing group of price conscious, middle class travellers the space and layout they like.

Why the structural shift from independents

Hotel owners are a fragmented group including wealthy families, pension funds and real estate investment trusts. Increasingly these groups are looking towards brands rather than opening or remaining as an independent.

Hilton can lower the cost of customer acquisition. The company has 100mln loyalty members, which has been growing at 16% per year since 2012. Loyalty accounts book 60% of room nights directly as opposed to using an intermediary. This is increasing as Hilton offers more in the loyalty program (room choice, Wi-Fi, keyless entry, other avenues to redeem points like Amazon etc.).

As an independent, the cost of customer acquisition can be very expensive. A substantial number of bookings are likely to come through Booking.com or Expedia, which charge around 20% of the room rate. By joining Hilton, a property owner’s reliance on Booking.com etc. can drop from 50% to 10% of total rooms booked. Hilton also uses it negotiating power as the world’s second largest hotelier to reduce the fee paid by about half.

Hilton’s scale means the company can offer hotel owners first-rate IT systems (reservation tools, property management, customer relationship management etc.) and money saving through centralised procurement. Lastly, banks prefer financing a hotel development that will join a brand like Hilton. This serves to lower the cost of financing.

While we do not currently own Hilton, I hope that this article provides some insight into the companies on our ‘watch-list’. Hilton is benefitting from structural tailwinds, has a large growth opportunity and is taking market share. The business is capital light and has an experienced, well-respected management team with significant inside ownership.