The right investment strategy will depend on a range of factors – many personal to you and your financial objectives. There are, however, some principles that can help guide you in making this important decision. We explore these below.

Consider what you want to achieve and when

Setting a goal is the first step in building any successful plan. Investing is no different, you can’t expect to decide the right investment strategy without first knowing what you’re trying to achieve.

Your financial goal can be anything. But the most common one we hear from our clients is to maximize the size of their nest egg at retirement. Other popular, shorter term, goals include saving for a first home or a special occasion.

People who write down their goal are 42% more likely to achieve them*

Once you have your goal, write it down. Studies show you are far more likely to achieve it that way. This is particularly important in investing, because a written goal can be a great reference point for when markets get tough and you invariably begin to question your investment strategy.

Our investment team practice this very same discipline. The goal behind every investment we make on your behalf forms part of our investment thesis, which is written down in painstaking detail.

A goal without a plan is just a dream

Your investment strategy is personal to you. Because of this, it will need to evolve as your personal circumstances change. But to get you started, our Investor Profile Questionnaire can help with finding the right strategy for your current situation.

There are two key factors which determine your ideal strategy; your investment time horizon and your ability to tolerate undesirable outcomes.

Step 1: Set your investment timeframe

The timeframe you have for achieving your goal will make certain assets more appropriate than others. A clear understanding of how long you plan to be invested can also help provide valuable context when turbulent markets make you question your investment staying power.

For example, if you are saving for a short-term goal, growth assets such as shares, will be much less appropriate as their value can fall suddenly, just when you need your money. However, if you are saving for a longer term goal, then you have time to ride out the ups and downs of investment markets – allowing you to take on more investment risk in pursuit of better returns.

Step 2: Get to know your own tolerance for risk

The pain of losing is psychologically twice as powerful as the pleasure from gain. It is for that reason, many of us find ourselves on the conservative side of the risk tolerance scale. The most important thing to consider here is how able you are, in both a financial and mental sense, to cope with investment volatility.

Factors that can influence your risk tolerance include your age, your ability to recover from losses and your health. Again, our Questionnaire is a helpful resource here as it will provide you with a useful insight into where you sit on the risk tolerance scale also.

Step 3: Building a match fit investment strategy

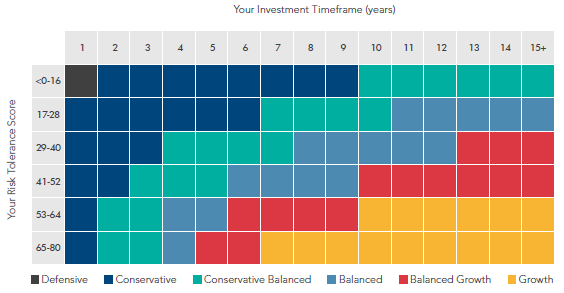

As we’ve discussed, your ideal investment strategy combines an appreciation of your risk tolerance and investment timeframe. The below excerpt from our Questionnaire illustrates how these two aspects come together to help guide you to the right strategy for your current situation.

Your investment strategy is your plan for achieving your financial goal. It is important you regularly revisit this plan to ensure you remain on target. We believe an annual check-up is about right.

If you haven’t talked to us about your financial goal, we would love to hear from you. There is more than what is in this article to discuss. Alternatively, if it has been a while since you last revisited your strategy now is the time to get in touch.

* denotes research undertaken by Dr. Gail Matthews, psychology professor at Dominion University in California