The interest rates that borrowers pay on fixed mortgages are determined by the yields on long term government bonds that rise and fall with the market. While this matters a great deal for home buyers, the bond market also has a great deal of influence on government and politics.

The political power of the bond market

In 2022, UK Prime Minister Liz Truss learned this the hard way in her short stay at No 10 Downing Street. After 17 days in office, her government announced a mini budget that proposed to cut income taxes significantly. The resulting rise in bond yields led to a crisis in the pension industry which required emergency intervention by the Bank of England. Truss lasted only another four weeks in the role.

In 2013, Dallas Federal Reserve President Richard Fisher likened Wall Street to “feral hogs” because of the ability of markets to sniff out weaknesses in economic policy. Policies that might satisfy the general public, may not satisfy those with money at stake.

In 1994, James Carville, who was an adviser to President Bill Clinton at the time, mused that he would like to be reincarnated as the bond market because “You can intimidate everyone.” This was at a time when bond yields were rising fast and putting pressure on the new President, whose popularity at the 100th day of his presidency was the lowest of any president to that point. Clinton ultimately went on to produce budget surpluses during his final three years in office.

In the late 1980’s, former New Zealand Prime Minister David Lange described money market traders as “reef fish”, presumably due to their fickle nature (perhaps forgetting the vital role they play in a coral reef ecosystem). The markets were quick to sense any reform fatigue from the Fourth Labour Government.

Just recently in the USA, the prospect of heedless deficit spending following the Presidential election has led to the sharpest monthly rise in bond yields in the past two years as markets caught a whiff of much more federal borrowing under Trump’s leadership.

It’s not just government borrowing that matters

Government borrowing is just one factor. If there are other participants in your economy that do a lot of saving, then governments have less of a problem. Countries like Switzerland and Japan can fund their government shortfalls more easily because their household sector has ample savings and their export income comfortably exceeds their import costs. When both the government deficit and the current account deficit are high, it’s known as the “twin deficits” and countries in this situation (like the UK and USA) are more vulnerable.

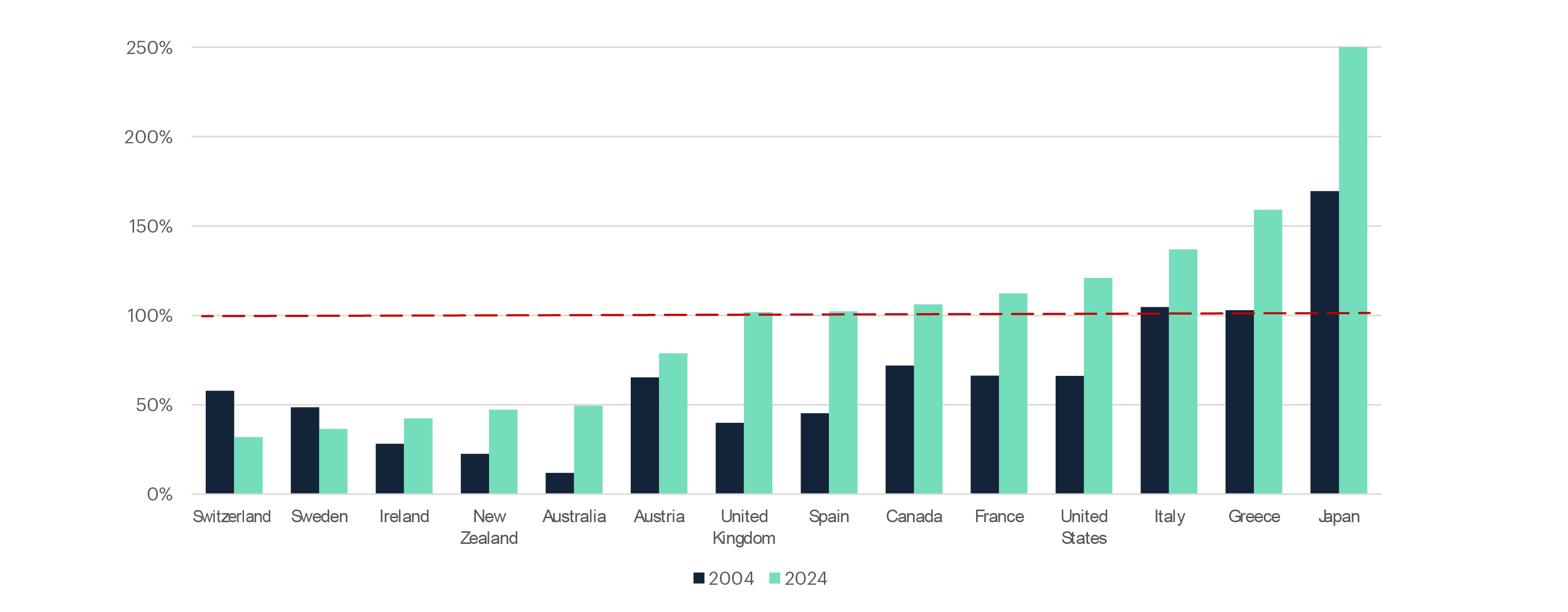

Debt crises have a habit of playing out gradually and then escalate suddenly. Economists call this a “non-linear response”. This is because when public debt is less than 100% of GDP the economy has a chance at growing its way out of the problem. This happens when GDP grows faster than the debt compounds (nominal GDP growth rates and long-term bond yields tend to have percentages that are broadly similar, so when debt equals GDP they will both growth in line with each other).

When debt is more than 100% of GDP it gets harder to grow your way out of the situation and the ratios are more likely to deteriorate faster and faster. To put some large numbers on it, the USA is currently about a 30 trillion dollar economy, with federal debt of 37 trillion dollars. Unless there is significant fiscal reform, the debt is likely to grow faster than the size of the economy in the years ahead until…something goes wrong.

Although it’s impossible to predict what will be the catalyst for a public debt crisis, the more debt grows relative to the economy the more difficult the resolution will be. In the meantime, politicians should heed the lessons of the Liz Truss government and make sure that they maintain the confidence of the bond market.

This article originally appeared in the NBR on 3 December 2024.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.