Market performance in the first quarter of 2025 has been vastly different from 2024, as investor optimism gave way to US-driven trade policy anxiety. The tariffs announced by Donald Trump on “Liberation Day” were more punitive than expected, and there will be flow on impacts for both economic growth and inflation. At the same time, the resulting market disruption is starting to create attractive opportunities for long term investors.

Trump bump becomes the Trump slump

After two consecutive years of +20% gains for US equity markets, it has been a tumultuous start to 2025. The Trump administration has imposed higher-than-expected tariffs on many of its trading partners, while also beginning to implement restrictive immigration policy and fiscal austerity through Elon Musk’s Department of Government Efficiency. The trade policy uncertainty has knocked consumer and business confidence – and left investors grappling with how this will impact the real economy.

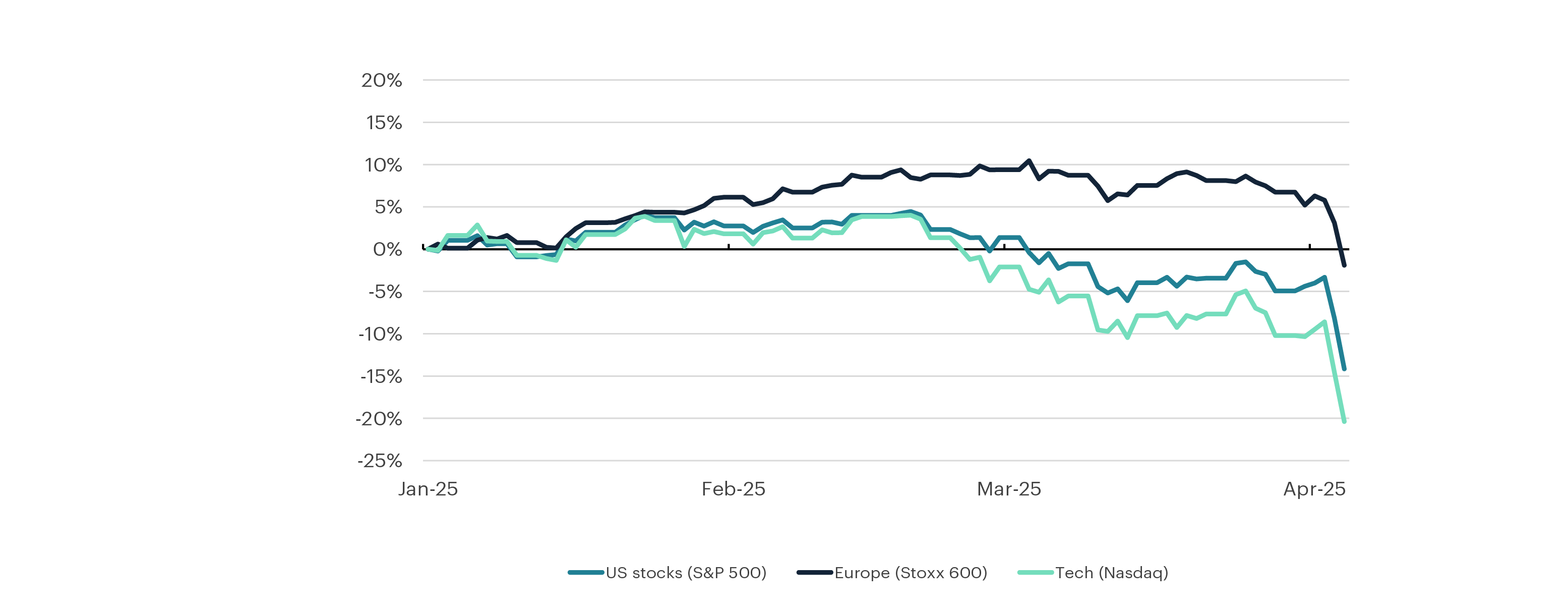

As a result, the initial post-election surge in US equities has sharply reversed, and the S&P 500 Index fell 4.6% in the first quarter. Outside of the US, other markets have fared significantly better, with Europe and Emerging Markets gaining 5.2% and 2.4% respectively in the first quarter.

Combined with the market impact of Trump’s April 2nd Liberation Day announcements, the S&P 500 has fallen 17.5% from its highs. The US small cap Russell 2000 Index and tech-heavy Nasdaq Composite have fallen 25.9% and 22.9% respectively.

Trade policy has hit sentiment, and is now starting to impact the real economy

In the lead-up to the April 2nd tariff announcements, various indicators of business and consumer sentiment started to deteriorate. Trump’s stop-start policymaking also started to have an effect on behaviour, with consumers pulling back on large purchases, management teams putting M&A activity on ice, and businesses delaying new investment projects.

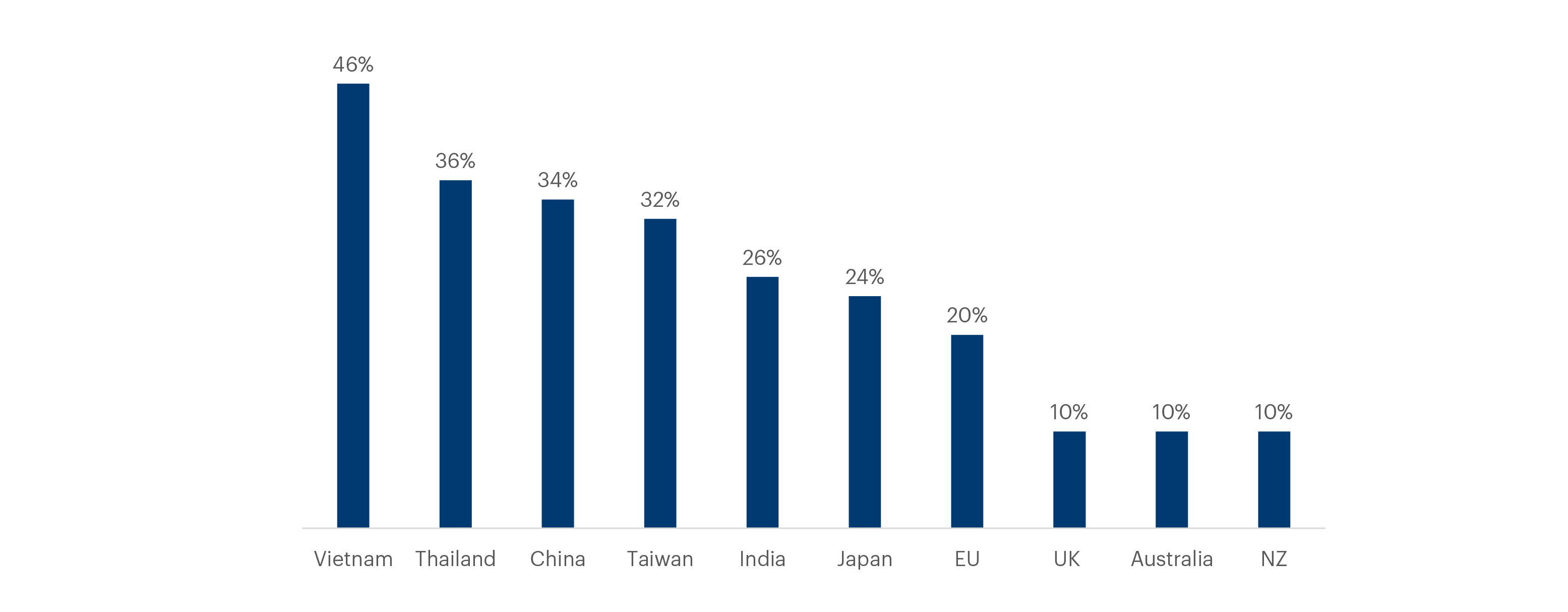

With the April 2nd announcement we now have some clarity – but at higher tariff rates than the market had expected (a further 34% tariff for China, 26% for India, 24% for Japan, and 30%+ for a number of South East Asian economies). This announcement resulted in a 4.8% one-day drop in the S&P 500 Index as investors tried to digest the potential impacts this would have on inflation and growth.

The hard economic data hasn’t been impacted by tariff uncertainty yet as unemployment is low and US growth has been resilient. However, initial assessments suggest that these new tariffs could lift US inflation by around 1.5% and reduce economic growth by 1.0-1.5% in 2025. While these impacts may seem small, particularly compared to what we saw post-Covid, they could increase if other countries retaliate. That said, there is more water to go under the bridge, and co-operation by other countries could also see tariff rates and the economic impact reduced.

Opportunities to emerge from the sell-off

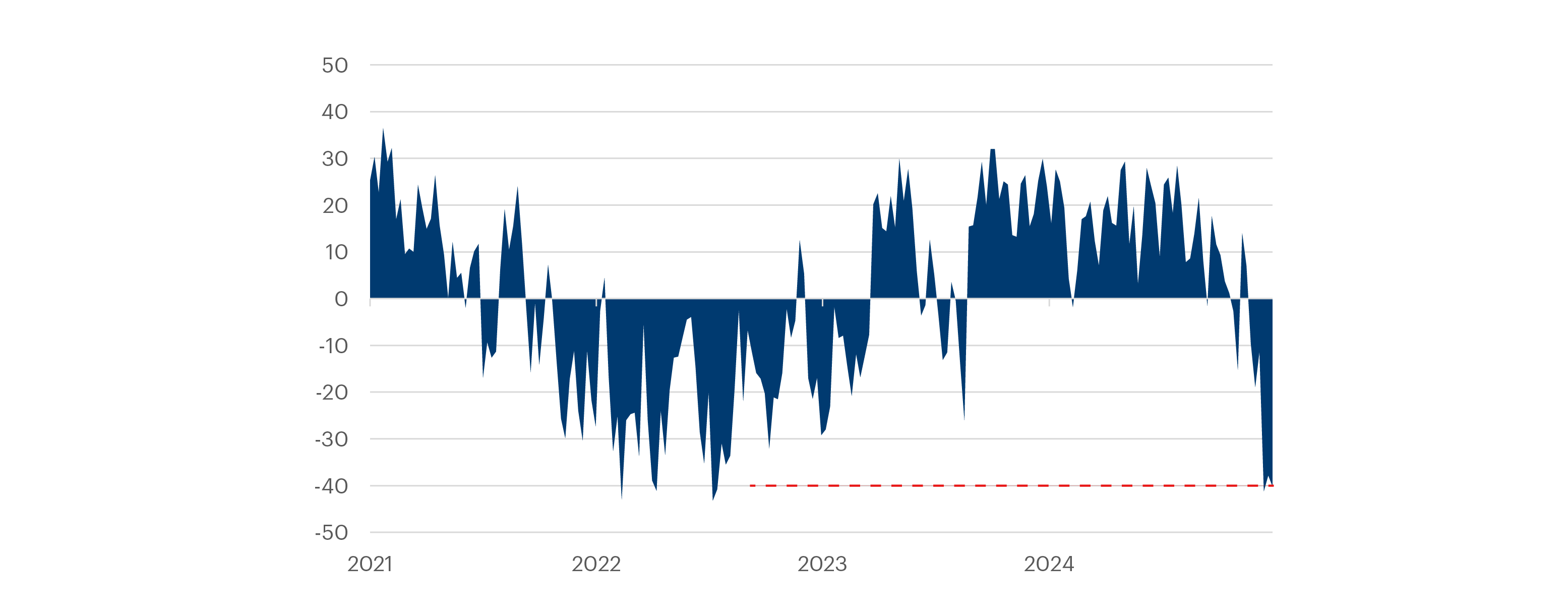

When things are moving quickly and uncertainty is high, markets can over-react to short term news. Indiscriminate selling can often create buying opportunities. As the chart below shows, US retail investor sentiment is already sharply negative, with bearishness approaching levels seen during the 2022 inflation spike. This suggests that there is already an element of panic in market prices.

Widespread tariffs will have consequences for growth, inflation and many global companies. It will also take time for businesses to adjust their supply chains and pricing in response. On the other hand, as we have seen from history, high-quality businesses will typically find a way to adapt to external events like tariffs, inflation shocks and pandemics.

Recent share price movements may be justified in certain parts of the market, but in some cases we believe the market is over-reacting. While the US market is down around 12% from its high, there are selected high quality businesses that have seen their share prices fall 25–30% or more.

If in doubt, zoom out

It is easy to focus on the risk du jour, but these risks never stay front and centre forever. The 2022 inflation spike seemed dramatic at the time, as did the global economy grinding to a halt during COVID lockdowns. Both events are now well and truly in the rearview mirror and markets have continued to move higher.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.