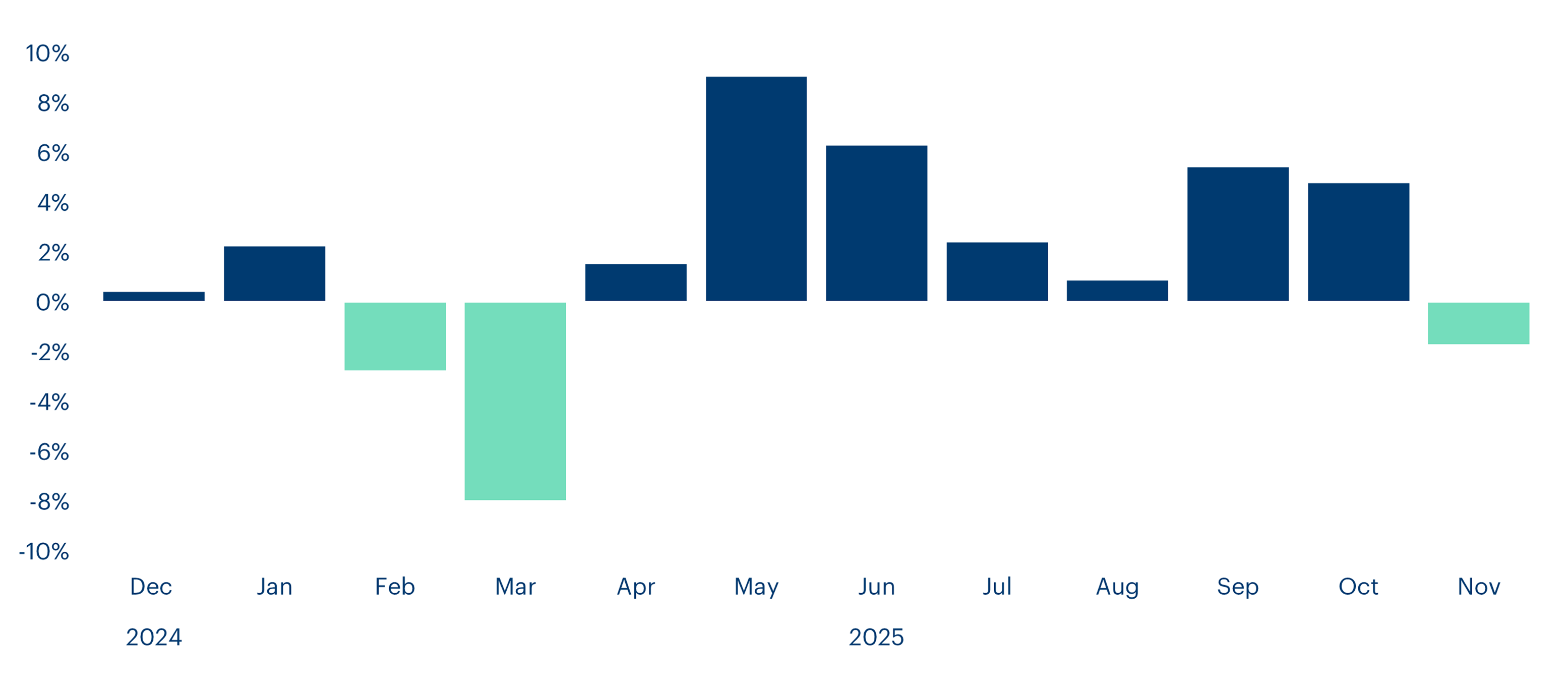

November was a tumultuous month for markets as doubts about lofty AI valuations collided with a data blackout from the U.S. government shutdown, leaving investors guessing about the Fed’s next move. Volatility spiked and former high-flyers were punished before soothing Fed commentary helped markets stabilise by month-end. Closer to home, the New Zealand economy finally showed early signs of life after more than two years in the doldrums.

AI darlings face a reality check

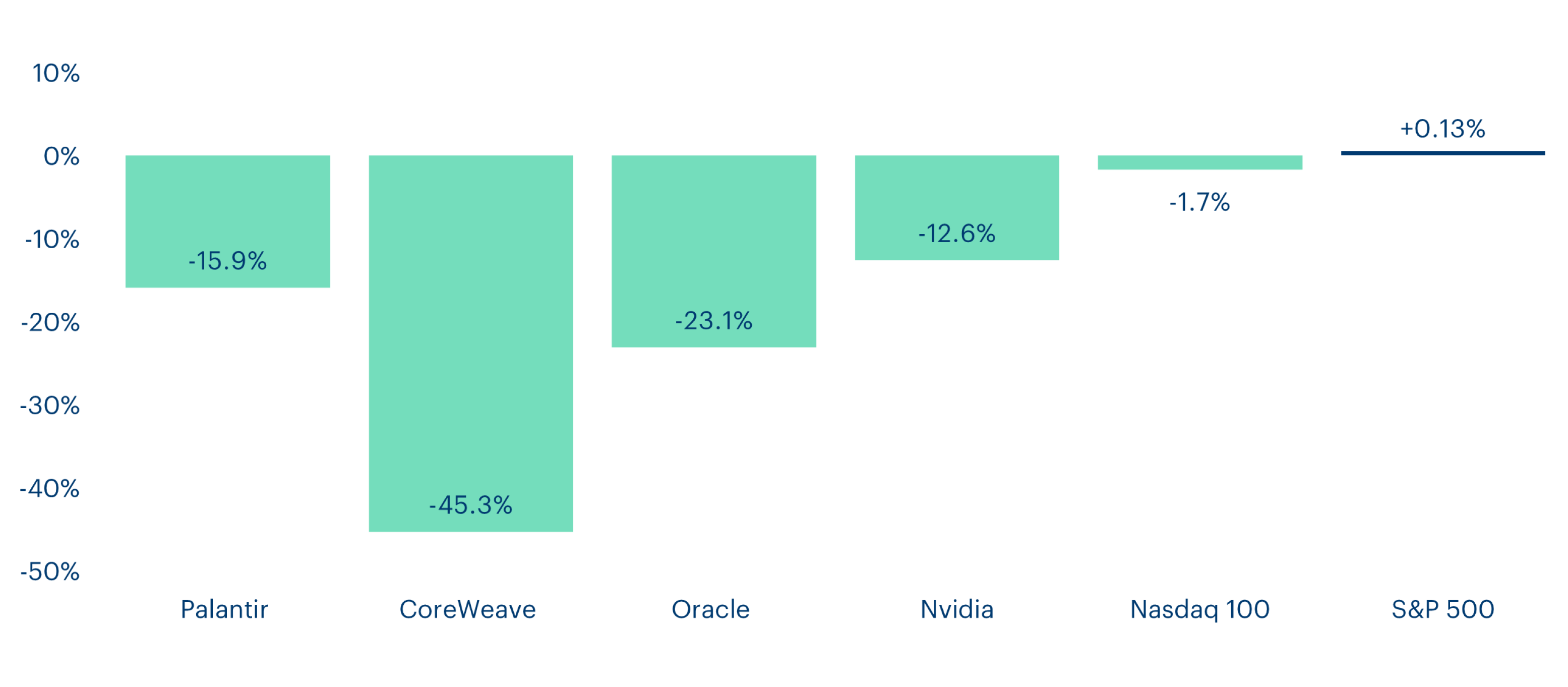

After three years where many AI-linked companies could seemingly do no wrong, November brought a clear change in tone – particularly for higher-risk AI plays such as Palantir or CoreWeave. Some of the market’s biggest winners saw sizeable falls on what, in earlier quarters, would have been shrugged off as minor blemishes, in a few cases even after beating earnings expectations. The tech-heavy Nasdaq 100 reflected that shift, heading for its first monthly decline since March. Nvidia’s earnings briefly steadied nerves, but the broader message was that the bar has risen, and AI-linked businesses must deliver on their promises – or see their share prices drop materially.

Investors are also starting to push back on the enormous capital expenditure required to build out AI data centres – and, increasingly, on the debt being raised to fund it. Companies like Oracle that are debt funding their AI data centre buildout have seen their share price fall over 23% in November.

The “risk-off” tone wasn’t confined to equities. Bitcoin fell around 17% in November and more than 27% from its early October peak, marking its worst month since 2022 as leveraged positions were unwound across the crypto complex.

Green shoots at home, but a long road back

New Zealand finally saw some positive surprises. Retail sales volumes rose 1.9% in the September quarter – more than three times the 0.6% economists had pencilled in and the strongest quarterly gain since 2021. Business confidence has also climbed to an 11-year high, a sign that firms are feeling less pessimistic about the year ahead.

New Zealand exporters also received an unexpected boost as the U.S. rolled back tariffs on roughly a quarter of our exports, including beef and kiwifruit, easing pressure on parts of the primary sector. Meanwhile, the Reserve Bank of New Zealand cut the Official Cash Rate again in November and signalled it is likely near the end of the easing cycle. In other words, the RBNZ seems to think we are close to the finish line and that the delayed impact of lower rates will finally start to feed through. They may be right, but it will still be a hard slog to get New Zealand back to an acceptable level of growth.

A bubble or not, there are opportunities for long-term investors

While November saw some of the hype fade in the most speculative parts of the market, the debate about whether this is an AI “bubble” has naturally intensified. On the surface it has many of the classic hallmarks – very high valuations and clear signs of speculation. But importantly, we are in an environment where investors do not need to rely on AI winners alone to generate returns.

The economic backdrop in the U.S. is broadly supportive of markets, the New Zealand economy is finally showing some modest signs of improvement, and central banks have been moving to more accommodative interest rate settings.

There are also other parts of the market that look undervalued. Higher quality ‘blue-chip’ stocks, and more defensive sectors like healthcare, which have lagged the broader market over the last few years, now look attractively priced and came back into favour last month as investors rotated away from the largest tech names.

By building diversified portfolios of high-quality businesses that now trade at reasonable valuations, we believe this approach will work out well for long-term focused investors.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your financial goals, get in touch with us – our team are always happy to help.