The third quarter of 2024 marked a long-awaited turning point, as central banks shifted from a singular focus on inflation, to a more balanced approach of also looking to support employment and growth. Following on from August’s volatility, markets pushed to new highs in September when the US Federal Reserve (Fed) decisively cut interest rates and signalled more easing ahead.

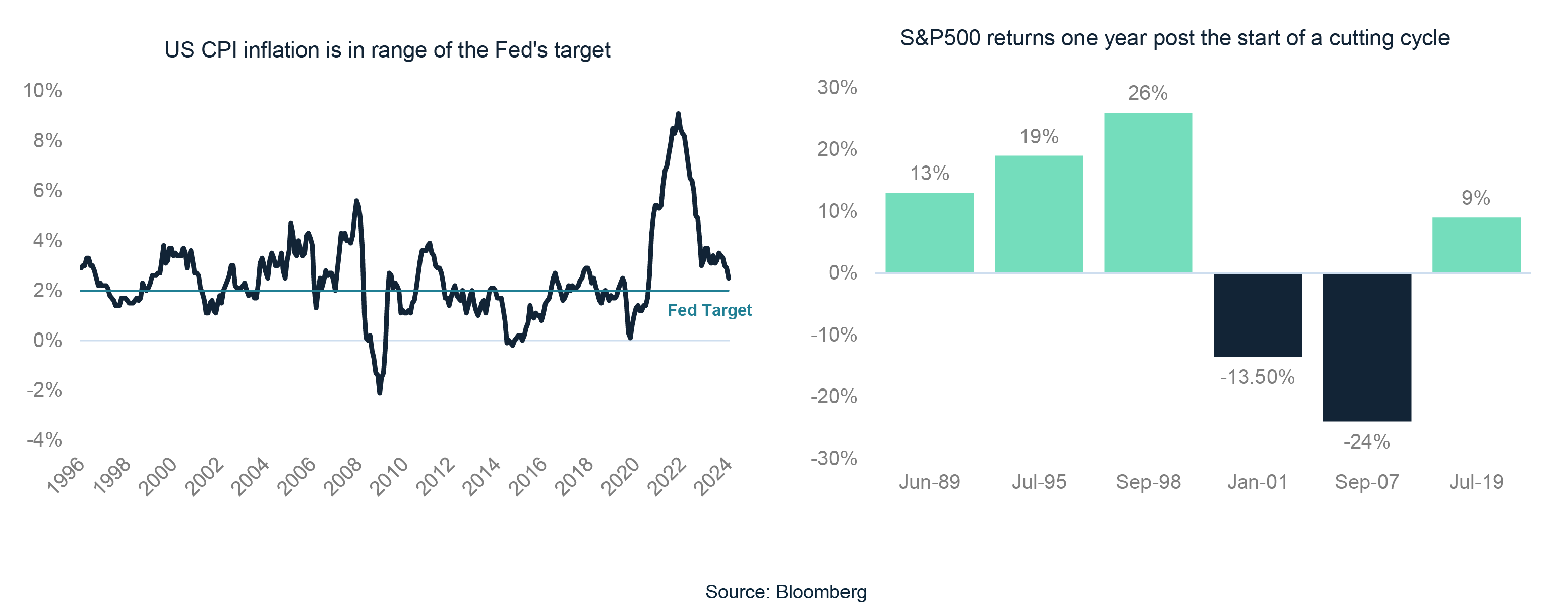

Changes in central bank policy were a big focus and driver of markets this month. Fed Chair Jerome Powell and RBNZ Governor Adrian Orr began the third quarter by signalling that further improvements in inflation data were needed before interest rate cuts could be considered. They got what they had been hoping for, as inflation continued to decline during the quarter and came within sight of both central banks' target ranges.

After two and a half years of interest rate hikes and restrictive monetary policy, both central banks initiated their long-awaited easing cycles. New Zealand’s prolonged economic slump, combined with inflation being back under control, led the RBNZ to deliver an earlier-than-expected 25 basis point cut in August. A few weeks later, in September, the Fed followed with a more aggressive 50 basis point cut. These moves were greeted not as one-off actions, but as a decisive shift to a phase of easing and an emphasis on preventing further increases in unemployment.

Markets tend to perform well the year following the start of a rate cutting cycle. However, this performance often hinges on whether a recession follows within the next 12 months. The context of the rate cuts is critical: Are we witnessing “celebratory” cuts, where the economy is on stable ground, and lower interest rates further support growth? Or are they “desperation” cuts, where central banks are scrambling to avert a recession, as we saw in 2001 and 2007?

Not all smooth sailing

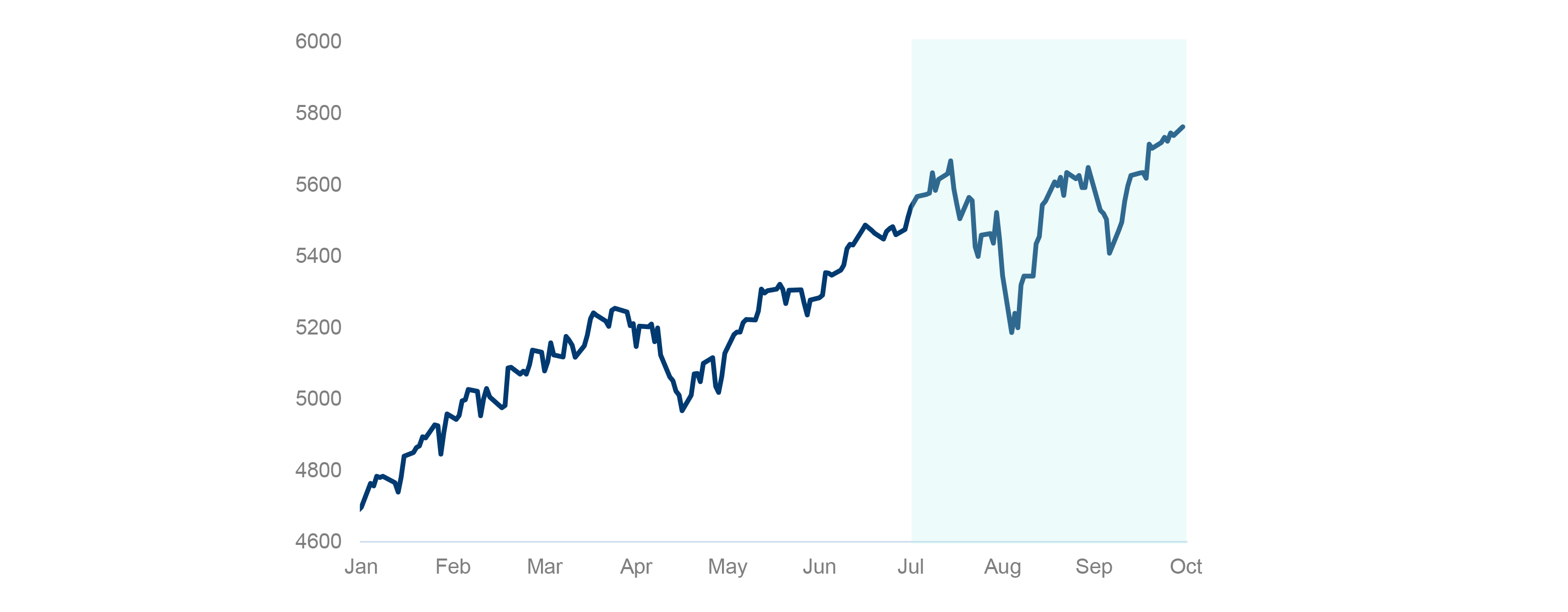

Despite markets reaching all-time highs by the end of September, the journey was far from linear. As shown in the chart below, the US market fell over 8% from mid-July to early-August.

Chief among the drivers of this volatility were fears of a slowing economy and whether the Fed was behind the curve addressing the cracks that were appearing. A surprise downturn in US employment data for July contributed to this sell-off – as did an interest rate hike by the Bank of Japan, which sent the Japanese share market sharply lower. Markets quickly rebounded, however, as central banks moved to ease monetary policy later in the quarter.

Spreading the love

The prospect of lower borrowing costs worked its magic for the market. Markets have surged to new highs since the Fed’s 0.50% September rate cut and signal that it is committed to lowering rates further.

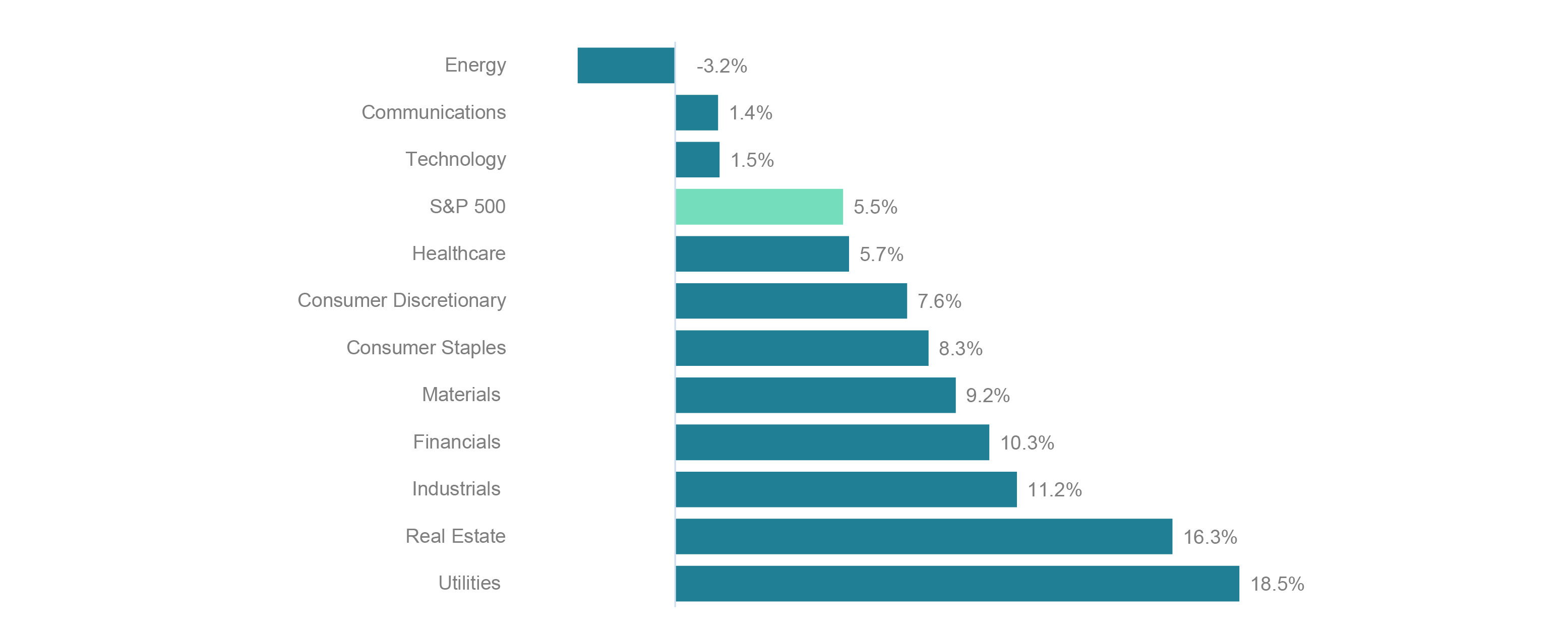

The Fed’s assertive stance has also resulted in a long-awaited shift in market leadership, spreading performance beyond the large tech names that had dominated for so long. Within the “Magnificent Seven” tech stocks, notable leaders like Nvidia, Microsoft, Amazon, and Google ended the third quarter lower than where they began. This is a positive development for the broader market, as it signals a broadening in the economic recovery and reduces the vulnerability to sharp market corrections if this narrow group of market leaders falter.

In the third quarter, eight of the S&P 500’s eleven sectors outpaced the broader index, a sharp contrast to the first half of the year, when only technology and communications managed to outperform. Cyclical sectors like Utilities and Real Estate - both highly sensitive to interest rates – emerged as the top performers.

On the home stretch for 2024

This quarter marked the long-awaited turning point, as central banks shifted from a singular focus on inflation, to a more balanced approach supporting growth. While the Fed seems close to achieving its elusive soft landing, recent market volatility has reminded investors that the march higher in markets is never a straight line.

As we look ahead, the remainder of the year may well bring more turbulence as the market tries to discern whether interest rate cuts are coming fast enough to prevent further economic harm. Event risks, including the US presidential election and escalating tensions in the Middle East also create heightened uncertainty.

What’s encouraging however, is that company fundamentals remain robust, with earnings growth hitting its highest level in three years and broadening across sectors - not just in the tech heavyweights that supported markets earlier in the year. This combination of strong fundamentals, falling interest rates, and positive economic growth provides a solid foundation for markets as we head toward the end of the year.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.