August served as a reminder that investing isn’t always smooth sailing. Global markets dropped over 6.4% in the first three days of the month, only to fully recover by the end of August. It’s important to remember that volatility is a normal part of investing, and it's expected that we will experience a few down months each year, and the occasional more significant market correction. August’s rapid rebound however provided a crucial reminder of the importance of staying the course.

A month of two halves

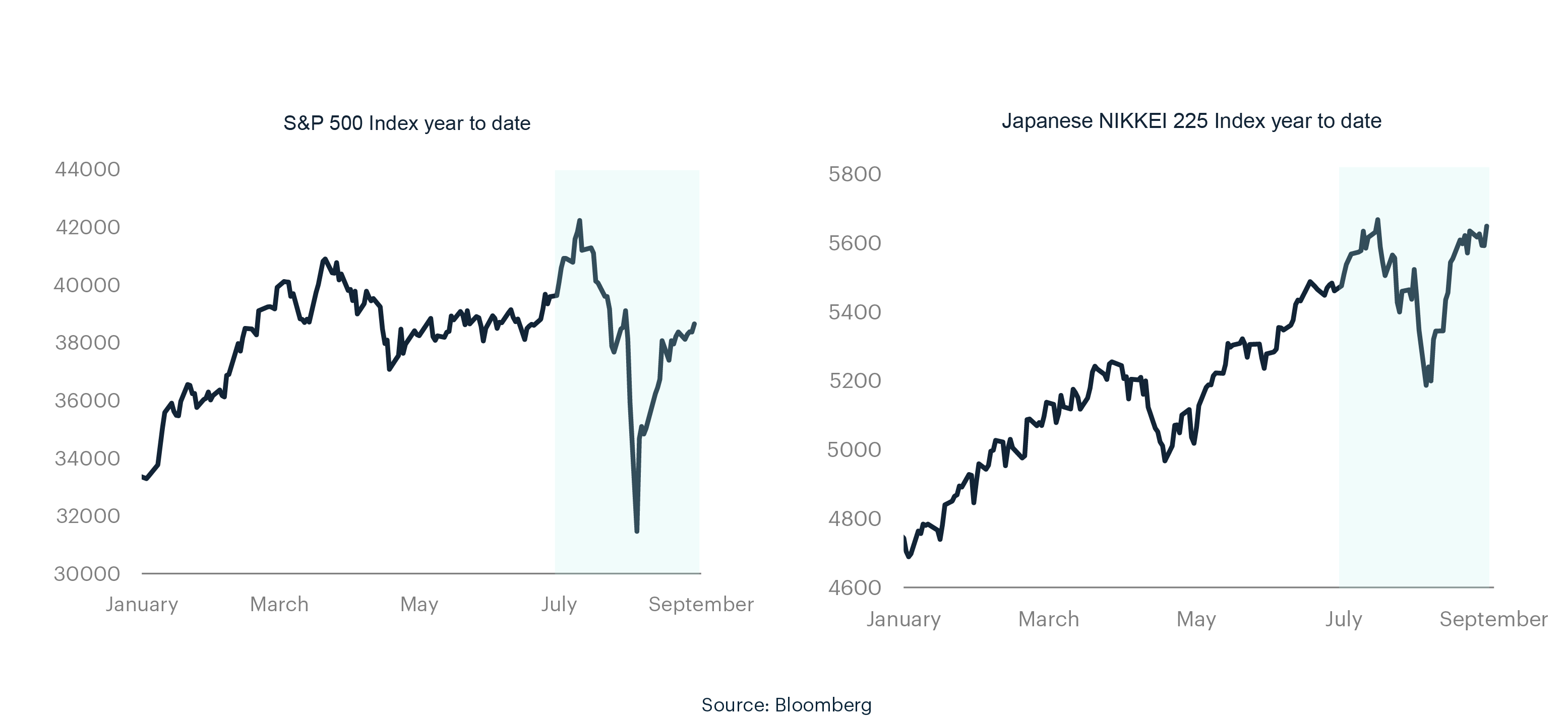

At the very start of the month, equity markets across the globe experienced a spike in volatility. The S&P 500 suffered its biggest drop in two years, falling 8.5% from its high in July, but managed to recover most of those losses by month-end. Japanese equities were hard-hit – plunging 25% from their highs, before rebounding 23%.

Two key factors drove this volatility. Firstly, disappointing US economic data, including an increase in the unemployment rate from 4.1% to 4.3%, and the addition of only 114,000 new US jobs in July, which was well below market expectations. Exacerbating the situation, the Bank of Japan hiked its target policy rate to 0.25% and hinted at the possibility of further rate increases, which pushed up the Yen. In response, speculators rapidly unwound their 'Yen carry trades' (borrowing Japan's cheap currency to invest in higher-yielding assets like those in the US) and sold Japanese stocks.

Ultimately, last month’s volatility stemmed from the concern that central banks may have gone too far in their quest to quell inflation. There were genuine fears that the US Federal Reserve (Fed) had lost its grip by not acknowledging the cracks in the labour market.

Why the rebound?

After the turbulent start to the month, central banks became more supportive, and markets have now rebounded close to their highs. At the most recent Fed meeting, Chairman Jerome Powell significantly changed his tone, explicitly stating that “the time has come for policy to adjust” – and it is now widely expected that the Fed will cut rates at their upcoming September meeting.

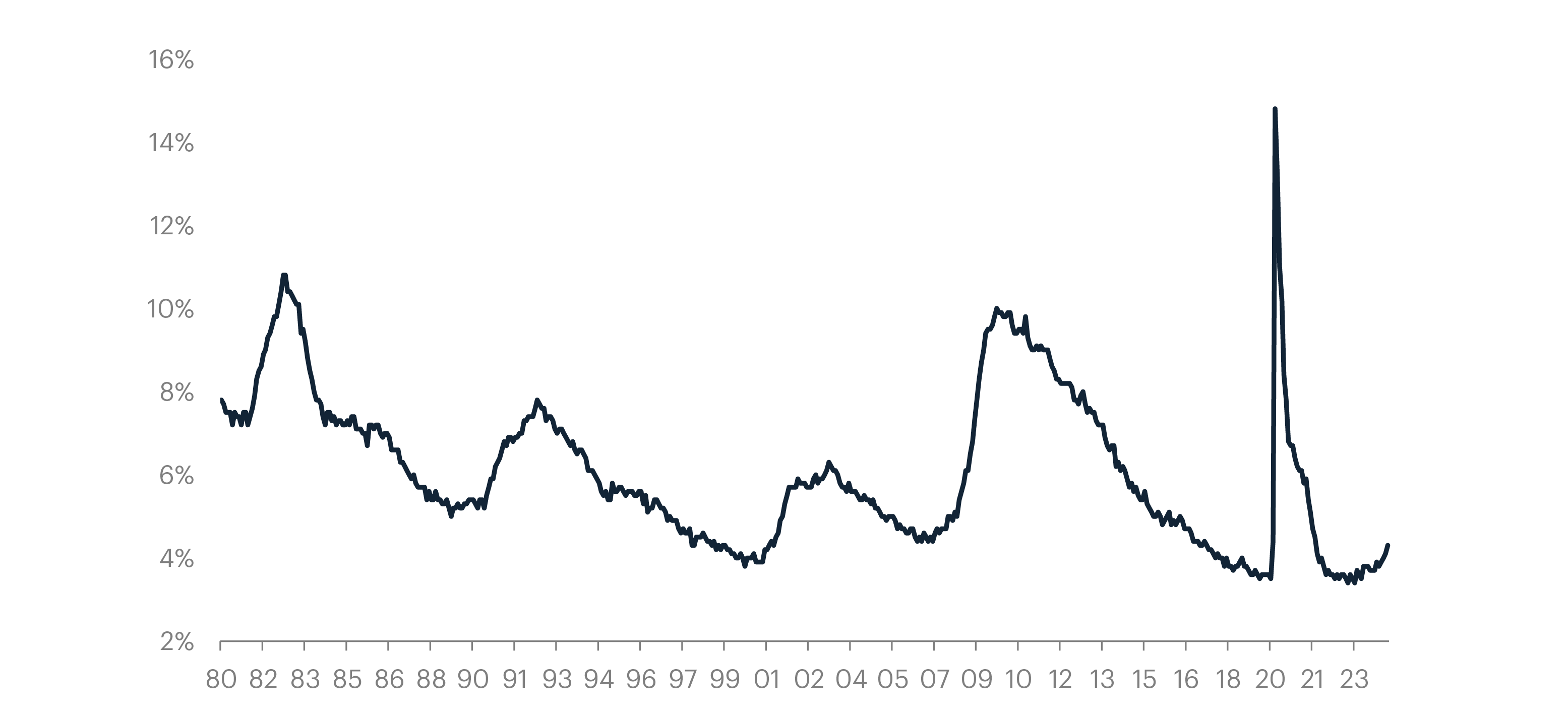

While high interest rates initially appeared to be slowing the US economy, a closer look at labour market data reveals that the situation is not as dire as it first appeared. The increase in unemployment has been driven primarily by a rise in the labour participation rate rather than widespread job losses – and job growth remains positive. Moreover, while increasing, an unemployment rate of 4.3% is still extremely low by historical standards.

The RBNZ also joins the party

The Reserve Bank of New Zealand (RBNZ) also finally turned a corner, cutting the Official Cash Rate in August. While uncertainty remains about the New Zealand economy and whether the RBNZ has gone too far, much of the bad news was already priced into the NZ share market – with cyclical shares having taken a battering over the last two years. As a result, the announcement of the rate cut (and the likelihood of more to follow) sparked a relief rally at home. Over the last two months the NZX 50 Index has now gained over 6%.

A reminder that markets don’t always move in a straight line

These short-term market fluctuations should be seen as bumps on the road to achieving your investment goals. Historically, equity market investors should expect around three declines of 5%+ in the global share market every year, along with one drop of 10%+ annually (on average). With events like the upcoming US presidential election in November, there may well be more sources of volatility before the year ends.

Don’t flinch – selling or changing your investment strategy out of panic in early August would have meant missing out on the rapid recovery that followed. While we can never be certain about the direction of markets in the short term, long-term investors should view market volatility as an opportunity.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.