Lately, we've had clients asking if the US share market’s best days might be behind it. Part of this questioning has been driven by concerns about potential election outcomes – but also by rising national debt and elevated share market valuations. While there are certainly risks to consider, it is also worth keeping in mind the benefits international diversification has provided for New Zealand investors over the years. Having exposure beyond our borders can add both growth and stability to portfolios – a principle we see as likely to hold true in the future.

Home country bias

Home country bias is the tendency for investors to favour investments from their own country. This is a common inclination worldwide and often driven by a sense of familiarity and comfort. For Kiwis, this often leads to portfolios that are heavily concentrated in New Zealand assets. However, this concentration carries risk, especially since the New Zealand share market makes up only about 0.1% of global equity markets.

Many of us already have our home, job, and perhaps a business in New Zealand, meaning that a large portion of our personal and financial lives is already tied to the performance of the local economy. Diversifying our investments internationally helps ensure we’re not "putting all our eggs in one basket."

Providing a boost when the domestic economy is weak

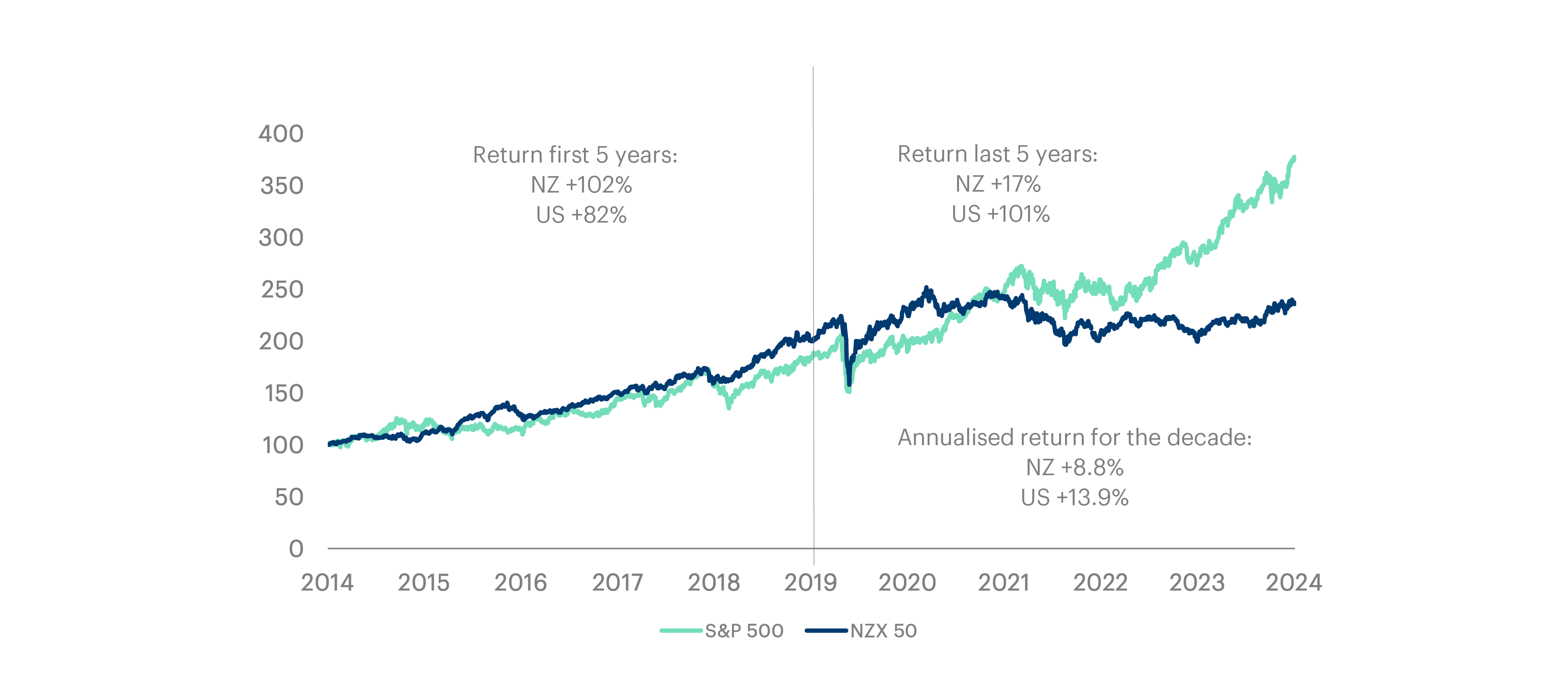

Over the past five years, New Zealand’s economy has faced significant challenges, and this has been reflected in the performance of our stock market. In contrast, the US market has delivered much stronger returns, underscoring how international diversification can help boost performance when the domestic market is weak.

The chart below shows the performance of the NZX 50 and S&P 500 over the past decade. While the first five years favoured the NZ market (gaining 102% vs 82% for the US market), the last five saw significant outperformance by the US. By diversifying across both markets, investors have had a more consistent ride.

Currency diversification: A free boost for Kiwis

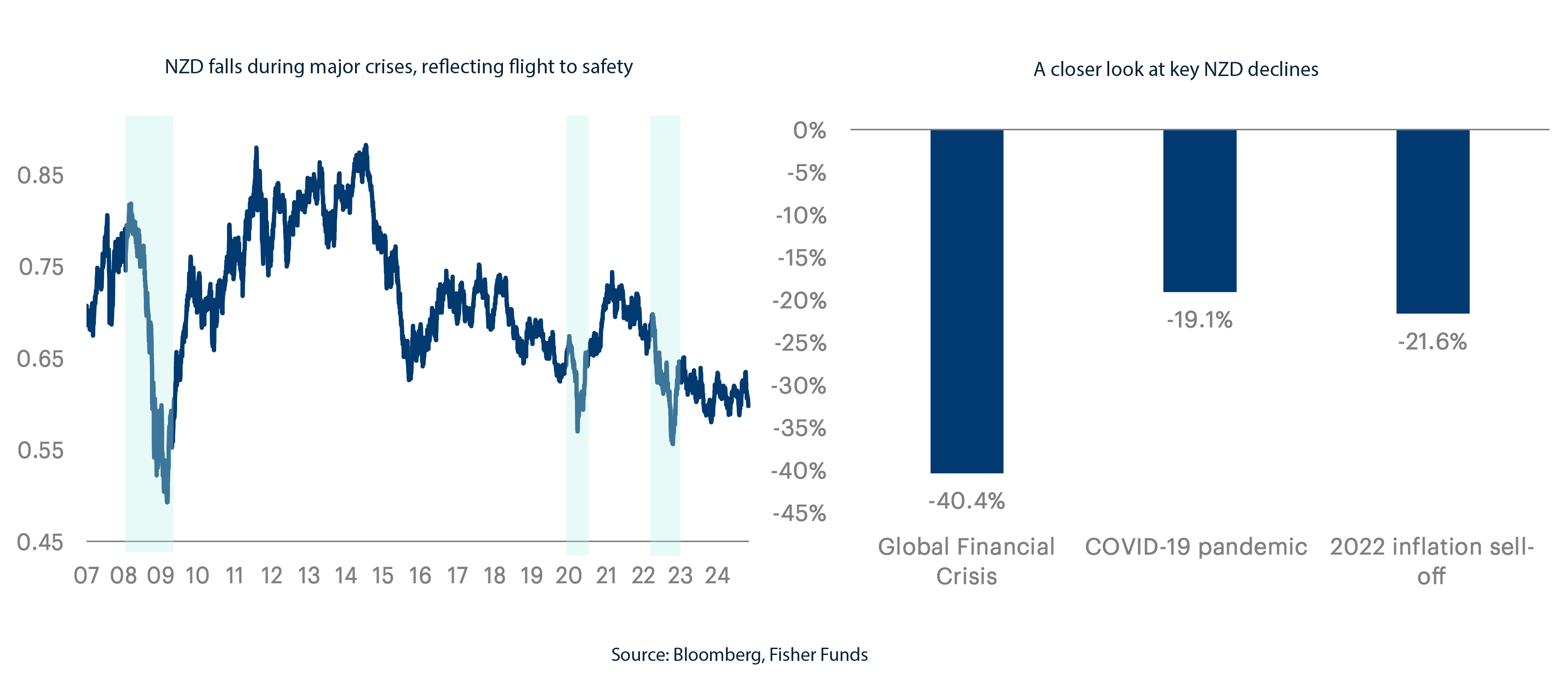

One of the reasons that international diversification is especially powerful for New Zealand investors is the behaviour of the New Zealand dollar in times of global market stress. Historically, the NZ dollar tends to fall during crises due to a "flight to safety." When markets are volatile, investors often pull money out of the currencies of smaller nations like New Zealand and shift into safe-haven currencies like the US dollar, Japanese Yen, and Swiss Franc.

When the NZ dollar falls, the value of foreign investments – typically denominated in stronger currencies like the US dollar – increases, helping to cushion portfolios during a downturn. For example, during the Global Financial Crisis (GFC), the NZ dollar dropped sharply as investors flocked to safe havens. This, for example, boosted the NZ dollar value of US assets for Kiwi investors.

The charts below show how the NZ dollar fell during three recent major market events: the GFC, the COVID-19 pandemic, and the 2022 inflation driven sell-off. Each event led to significant drops in the dollar, underscoring how currency effects can amplify the benefits of holding international assets during market stress.

Exposure to different currencies, economies, and stock markets that don’t move in sync means a diversified portfolio can be significantly less volatile than a portfolio of only New Zealand stocks.

This concept is often summed up by the phrase, “The only free lunch in investing is diversification.” By spreading investments across regions, you can achieve similar or even better returns with less risk.

Other benefits of international diversification

Beyond currency benefits, international diversification offers several other advantages for Kiwi investors:

Access to a wider range of industries: The New Zealand share market lacks scale in growth sectors like technology (eg. datacentres, software and digital advertising) and healthcare (medical devices and pharmaceuticals). Investing globally gives exposure to businesses simply not available on the NZX.

Diversification across business cycles: Different regions go through economic cycles at different times. Diversifying internationally reduces the risk of being tied to any single cycle, leading to more stable returns.

Broader economic exposure: Different countries have unique economic strengths. The US, for instance, leads in technology, while emerging markets excel in manufacturing and commodities, allowing a global portfolio to capture these diverse growth drivers.

Greater liquidity: Major international markets, such as the US, are far larger and more liquid than the NZX, making it easier to buy and sell shares, which is especially important in times of market upheaval.

Investing internationally isn’t just about chasing returns – it’s also about reducing risk and building resilience. Even if returns were identical across New Zealand and international markets, there’s value in diversifying. This approach keeps you from relying solely on one market’s performance, helping to smooth out the ups and downs over time.

We’re often asked, “Which market is best to invest in?” The good news is you don’t have to choose.

Talk to us

If you’d like to learn more our diversified investment options, get in touch with our team – we’re happy to help.