Global markets have gained significantly in 2024, extending last year’s gains and lifting many markets to record highs. While gains in the first quarter benefitted a range of countries and market sectors, the gains in the second quarter have been driven by a handful of tech companies (including market darling Nvidia). This divergence is starting to create both risks and opportunities for investors.

A rising tide

‘A rising tide lifts all boats’ is a saying regularly used in financial markets, and the rising tide has benefitted investors again this year. In the US, 2024 has had one of the strongest starts to a year on record – and the second-best start to an election year in 100 years. The US S&P 500 has gained 14.5% year to date, while the broader MSCI World Index has gained 10.8%.

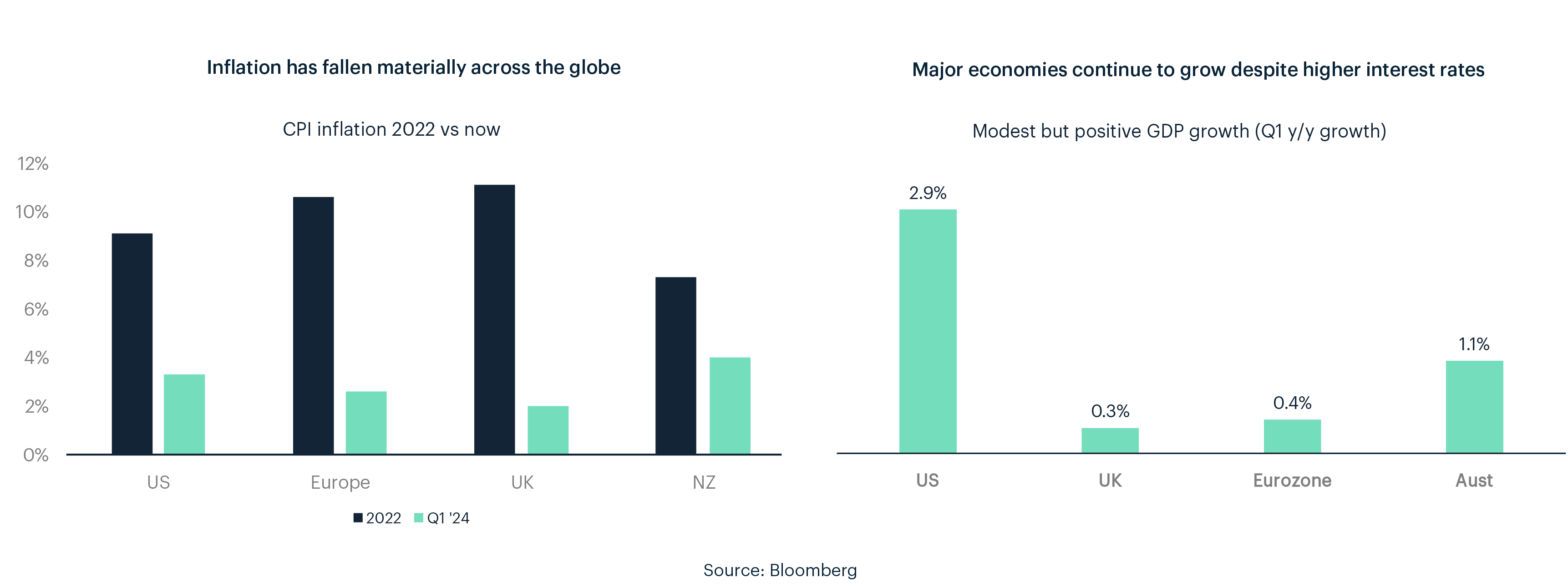

The surging tide has been driven by waning global inflation and a global economy that has continued to grow despite decade-high interest rates. Lending further support, easing inflationary pressures have seen selected central banks cut interest rates. The European Central Bank was the first major bank to cut rates – following the lead of its smaller peers in Canada, Sweden and Switzerland.

Two-speed market

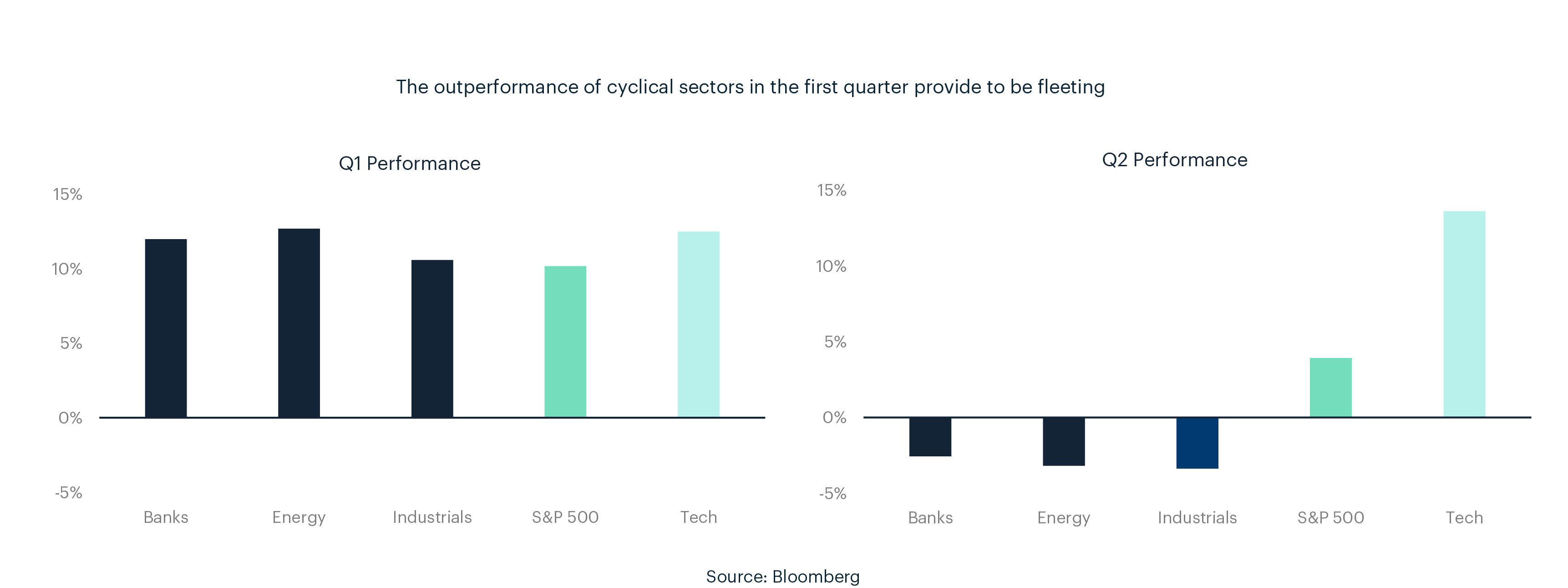

This economic resilience drove a rally in cyclical sectors (like banking and energy) in the first quarter, when they outperformed the wider share market. As shown below however, this trend reversed in the second quarter as incoming data suggested that interest rate cuts may finally be starting to bite. While the rising tide was lifting all boats at the start of the year, the dynamic has changed and there are now two very different parts of the stock market running at different speeds.

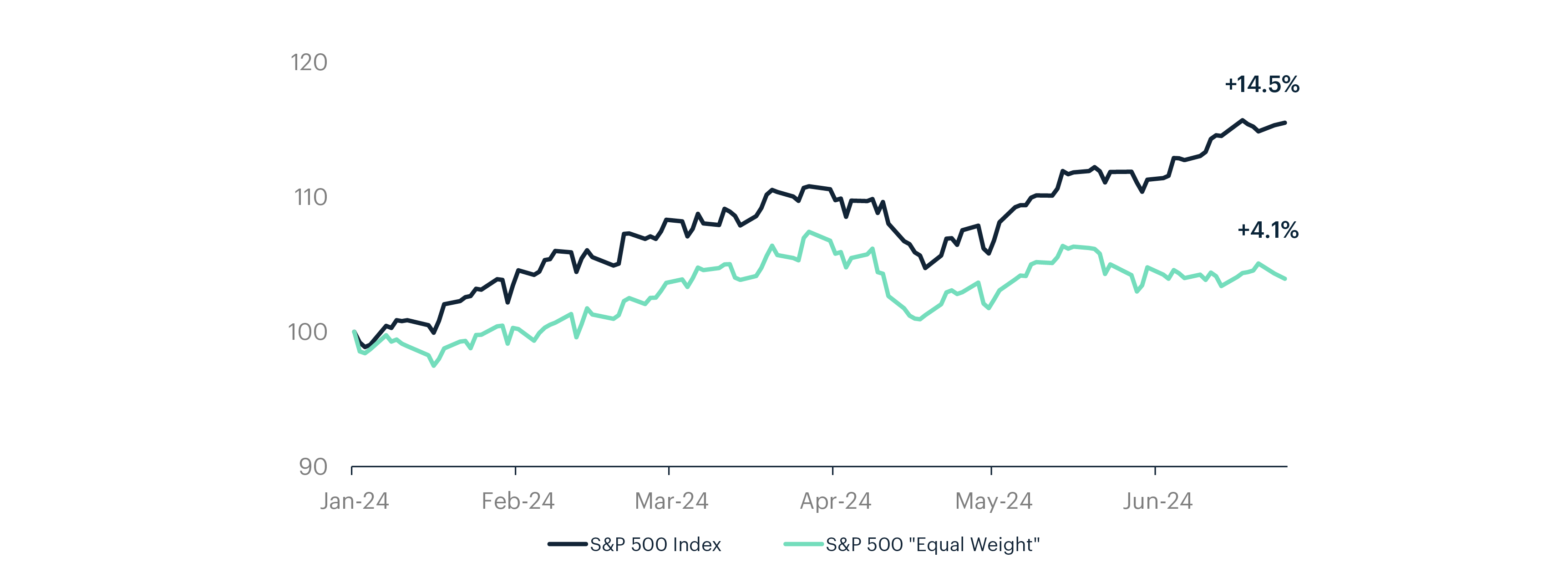

The US share market provides a great illustration of this two-speed dynamic. While the US S&P 500 is up 14.5% this year, over 60% of this gain has been driven by just six big tech stocks (Nvidia, Amazon, Microsoft, Meta, Alphabet and Apple). These stocks, which include AI-chip-maker, Nvidia (+149% this year), have all benefitted from the current market frenzy around Artificial Intelligence (AI).

The chart below shows that if we ignore the size of these big tech stocks (which together make up over 25% of the index) and assume that all stocks in the S&P 500 Index have the same weight, the index is only up 4.1% year-to-date (and it fell 3.1% in the second quarter). Viewed this way, there are clear haves and have nots in the corporate sector.

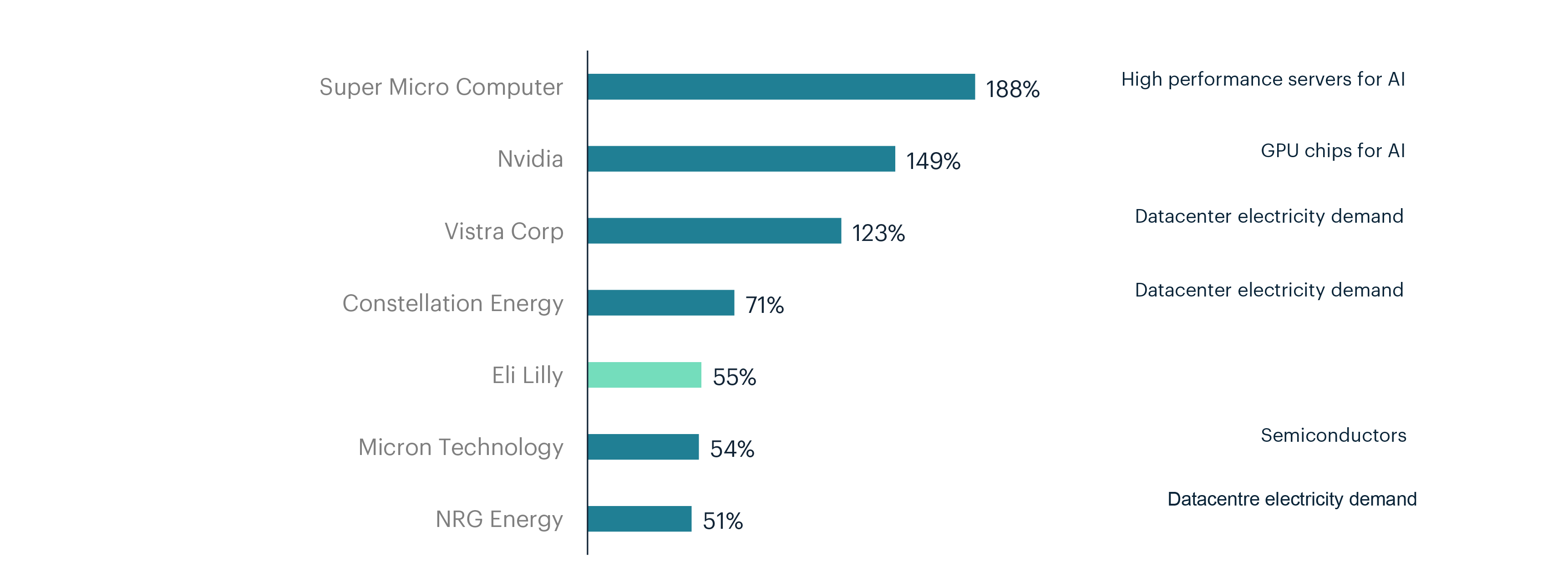

Companies with structural growth linked to AI, including silicon chip manufacturers, datacentres and electricity generators are prominent among the top gainers in markets this year. Of the seven largest gainers in the S&P 500 this year, six have benefitted from AI-related themes – either through the production of silicon chips, servers, or through the provision of clean and reliable power (e.g. nuclear) for the booming build-out of datacentres.

The excitement around these themes has benefited investors materially over the last 18 months – but the question is now if these parts of the market are overhyped.

The US market has also been running at a different speed to other markets

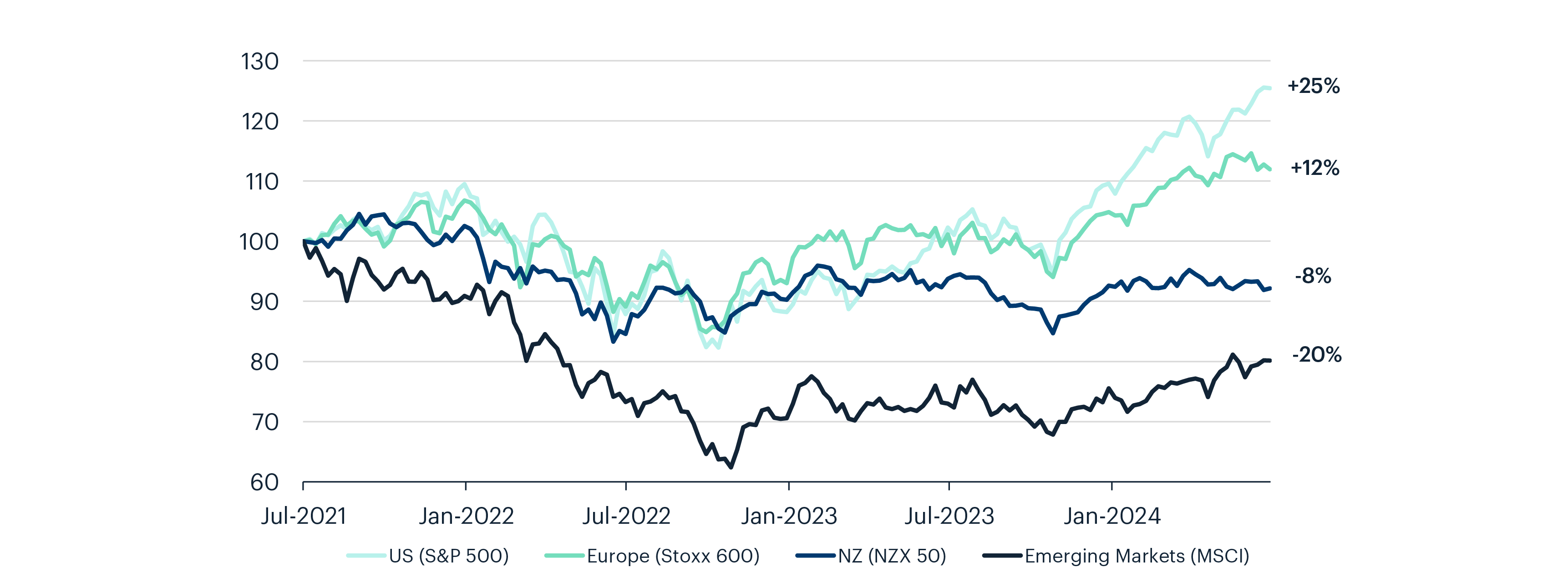

It isn’t just certain sectors operating at different speeds, the same can be said for markets. The US market has been powering ahead, while other markets (including emerging markets and our own) have been treading water.

This divergence in performance across markets is leading to an increasing valuation discrepancy. The US market is again trading at elevated valuation levels compared to history, while in the UK and Europe valuations look more reasonable. The New Zealand share market is one of the few that has yet to recover to its 2020 highs, and while the economy is still under significant pressure, selected companies are starting to look oversold.

Where to next?

A prolonged divergence in performance across different markets and sectors can create both risks and opportunities. Companies and markets that outperform for long periods often become over-hyped, and those that under-perform can become unfairly beaten down.

At times of market divergence like these it is important to be selective. While there are a handful of large US companies that seem to be hitting record highs daily, there are plenty more businesses that haven’t yet rebounded from the 2022 sell-off and are trading on relatively attractive valuation multiples. Many of these are also high-quality businesses with years of growth ahead – they just happen to be in less trendy parts of the market.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.