The final stretch of 2023 painted a vibrant picture for investors, with equity markets soaring in November and December – and taking gains for the year to 23% for global equity markets. The remarkable turnaround from 2022 stems from cooling inflation and central banks signalling interest rate cuts may be on the cards for 2024.

Our funds also had a very strong year in 2023, with most of our funds materially outperforming their market benchmarks. As is often the case in markets, investors that were disciplined and stuck with their strategy were rewarded in 2023.

Our funds performed well in 2023

Our funds had a very strong year in 2023, with most of them delivering performance significantly higher than the broader market.

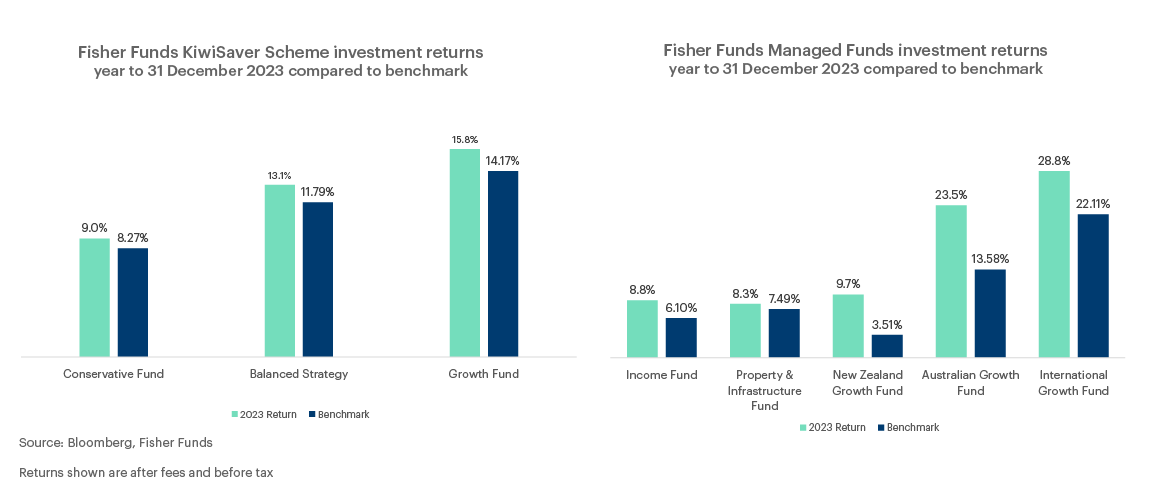

As can be seen below, our Fisher Funds KiwiSaver Scheme funds have outstripped the market, and in most instances our Managed Funds are materially ahead of their benchmarks.

Of particularly note is the strong performance in our New Zealand and Australian equity funds (despite lower returns in these markets) highlighting how active investment management can add value in years where market returns are low.

Our Income Fund also had a strong year despite the volatile backdrop for fixed income investments, delivering an 8.8% return for the year, which handily outstripped bond markets (+6.1%) and the returns available on term deposits.

Keep in mind some of our funds and strategies have an investment timeframe of longer than one year, and past performance doesn’t equal future performance. You can find more about our funds here.

Soft landing hopes boost sentiment

After a strong start to 2023, followed by a rocky September and October, markets rebounded spectacularly in the final months of the year. The MSCI World Index surged 15% in November and December alone, as did markets in the US (14%), New Zealand (10%), and Australia (13%). For the full year, global markets surged 23%.

Global bonds, which were still underwater for the year at the end of October, went on to surge 9% in the last two month of the year and ended up gaining 6% for the year (after two years of losses).

This bullish sentiment hinges on the narrative of an economic soft landing – a slowdown without a recession. Current data in the US seems to support this optimism. US inflation, once a fiery beast, had been tamed to 3.1% year-on-year by November, down from over 9% last year and inching towards the Fed's 2% target. Simultaneously, GDP grew at a robust 5.2% annualised rate in the third quarter – a long way from recession territory.

Central banks, once inflation hawks, seem to be changing their tune. The Fed's December statement suggested a shift towards balancing inflation control with employment preservation, hinting at potential rate cuts next year. This stands in stark contrast to their single-minded inflation focus earlier in 2023.

A reminder to beware of market predictions

The surge in markets in 2023 came despite a chorus of predictions from market strategists that 2023 would be a tough year for investors. In late-2022 economists saw a recession as a near-certainty, with 70% of them predicting a US recession in 2023. That recession never materialised, and the most recent US GDP data shows that economic growth actually accelerated in recent quarters.

When Russia invaded Ukraine in February 2022, analysts predicted much higher oil prices should the war continue. Almost two years later, the war continues and Russia has significantly reduced its energy exports to Europe, but oil and gas prices are below pre-war levels by 20% and 44% respectively.

After an eventful few years which included the COVID pandemic, a sharp global recession, a post-pandemic market rebound, inflation spiralling and a bear market, investors hardly needed another example of how unpredictable markets can be – and that buying and holding rather than trying to time the market has been proven to be the best approach. 2023 was a great example of what famous investor Peter Lynch meant when he said that “far more money has been lost trying to predict recessions, than has been lost in recessions themselves”.

Uncertainties remain, but we remain optimistic about the medium and long-term outlook

While the current landscape looks favourable, a dose of caution is always warranted. Like a slow-acting medicine, the effect of interest rate hikes takes time to fully manifest. And while a soft economic landing now seems more likely, further economic fallout from this tightening cycle is still a possibility. Weaker consumer spending in many countries underscores this risk. And while the US may be travelling well, closer to home we have witnessed declining house prices, weak consumer confidence and falling retail sales – all feeding through to a sluggish domestic economy and share market (the NZX50 was only up 3% in 2023, lagging global markets by 20%).

However, economic uncertainty can have a silver lining – more reasonable market valuation levels. When everything is going swimmingly, market valuations tend to be lofty. Right now, bond yields and asset prices appear palatable. Notably, real US 10-year Treasury Inflation-Protected Securities (TIPs) currently yield 1.8%, near their highest levels since 2008, indicating positive real returns for the first time since 2019. Likewise, equity valuations in many geographies (eg. the US, Europe and UK) are in-line with or below long-term averages.

Beyond the fog: A long-term view

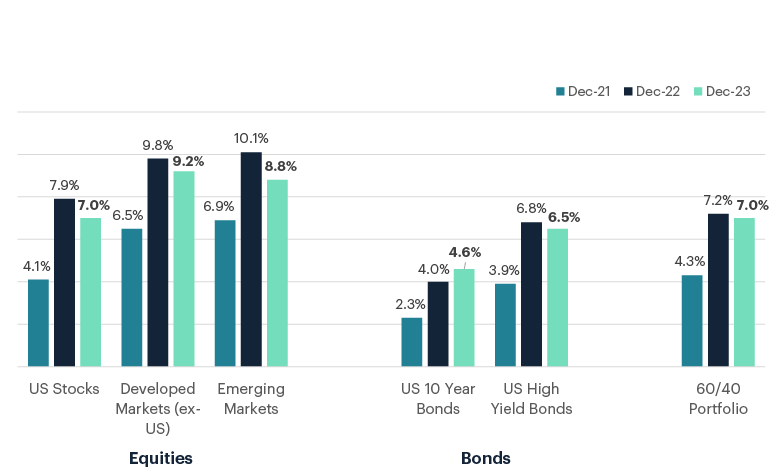

While short-term forecasts are fickle and unreliable, long-term asset class predictions provide greater accuracy. Economic growth, corporate earnings, and dividend payouts play a bigger role in long-term returns than short-term market sentiment.

JP Morgan's annual 10-year asset class return forecasts (published at the end of each year) paint a hopeful picture. Although slightly muted compared to the December 2022 predictions, the current environment of higher interest rates and lower valuations translates to materially better expected returns than two years ago, and roughly in line with historical averages. This reinforces reasons to be optimistic for investors with a medium- to long-term view.

With term deposit rates seeming to be peaking and finally heading south, now is also the time to ensure you have the right balance in your portfolio.

Need some help?

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.