Stronger than expected economic data in the US during September resulted in long term interest rates moving sharply higher around the globe. While the spike in Government bond yields bodes well for future returns for fixed income investors, it dragged equity markets lower in September.

Global markets decline in September after a strong start to the year

After a strong start to the year, global share markets (measured by the MSCI World Index) fell 4.5% in September. The primary driver of this share market weakness was rising bond yields – with markets witnessing the sharpest rise in yields in over a year. As a proxy for global interest rates, the 10-year US government bond yield reached levels not seen since 2007, spiking from 4.1% to 4.8% over the last five weeks (and up from 0.5% three years ago).

The continued rapid rise in interest rates was somewhat unexpected, given that inflation appears to have peaked and is now heading back in the right direction. For example, US CPI inflation peaked at 9% last year, and has since fallen by two thirds to 3%. However, longer term interest rates are a function of economic growth as well as inflation, and economic data has recently come in better than expected. While a stronger than expected economy should be a good thing, higher interest rates mean that investors demand higher returns from all asset classes, dragging down share prices in the short term.

The decline in equity markets has also been driven by fears that central banks may over-react to this short-term economic data and underappreciate the pain currently being felt by the consumer. As we know from history, central bank interest rate hikes take several quarters (often up to 18 months) to have their full effect, as consumers re-fix mortgages and adjust their spending accordingly. Holding interest rates higher than needed throughout 2024 could ultimately lead to a recession. We are already seeing some of the effects of higher interest rates, with increasing loan arrears in many markets and well as lower housing turnover and a slight uptick in unemployment.

While there is increasing talk of an economic ‘soft landing’, we are not out of the woods and central banks will need to tread carefully for recession to be avoided.

Despite the recent softness in the past couple of months, global equity markets are still up 10% for the year.

Higher yields bring improved return prospects for fixed income investors

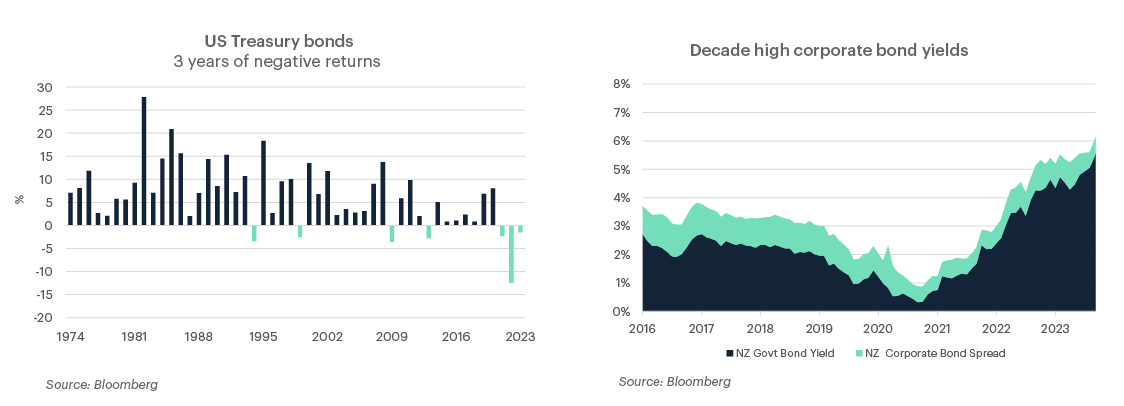

While global equity markets have rebounded this year, bond markets haven’t followed suit. The continued move higher in interest rates has resulted in fixed income benchmarks going backwards again this year. This is the first time in recorded history that we have had three years in a row of negative fixed income returns. While this journey has been rough for fixed income investors, the current yields on offer (combined with subsiding inflation) have set the scene for much better fixed income returns in the years ahead.

Although many bond indices are in the red for the year, our Income Fund has performed strongly and has delivered a 4.7% return for investors in the first nine months of the year. The fund currently has a running yield of over 7%, which we believe bodes well for future returns.

Equities have rallied, but valuations outside of tech look reasonable

While global equity market indices have been strong this year, this strength has been driven by a handful of large tech companies. In the US, just seven companies have driven the bulk of market gains this year (Apple, Microsoft, Alphabet, Meta, Amazon, Nvidia and Tesla). Excluding these companies, markets haven’t rallied significantly, and valuations look reasonable compared with their long-term averages. The chart below shows the price-to-earnings multiple of the ‘equal weight’ S&P 500 Index (which gives the big tech companies the same weight as all other stocks). On this basis, market valuations for the average listed company remain in-line with, or below, their long-term averages.

Outlook

2023 was always going to be a year of uncertainty in markets. Would inflation eventually subside, or remain stubbornly high? Would central bank interest rate hikes a cause a recession? Or would low unemployment and a healthy consumer cushion the economy and result in a soft landing?

So far this year the economy seems to be holding together better than expected, inflation is heading in the right direction, and markets have stabilised. While we aren’t out of the woods, the outlook has improved compared to this time last year. Interest rates are higher (which is good for savers), equity valuations still look reasonable, and as we search global markets we are still encouraged by the investment opportunities the team are able to find.

Talk to us

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.