Markets rode a wave of optimism to start the year, with share markets back to all-time highs. The S&P 500 surpassed its previous peak from January 2022, fuelled by robust economic data from the US that lent support to the notion of an economic soft landing. What can we learn from the recent rebound in markets, and where to from here?

What a difference a year can make

One month into the year, with my feet firmly under the desk (in shoes!) and the kids back to school, the market atmosphere feels markedly different from this time last year. Reflecting back to this time last year, inflation was still soaring at around 7%, central banks were on a path of aggressive rate hikes, and just about every commentator was stirring fears of a looming recession.

Fast forward 12 months, and the mood has changed dramatically. Market sentiment is high, and shares are on the up. After a significant rally of 20.3% last year, they've continued their upward trajectory with an additional rise of 3.9% in January alone. The sharp rise in interest rates which caused fixed income asset prices to tumble throughout 2021 and 2022, has given way to a much brighter environment for bonds. Global bonds were up 6.6% last year, after one of the worst periods in their history, and are broadly flat so far this year.

Factors driving the rebound

Compared to this time last year, inflation has started moving in the right direction (currently 3.4% in the US) and is now much closer to ‘normal’ levels. Central banks, in response, are now discussing rate cuts, signaling a shift from their previously aggressive stance on rate hikes. This adjustment in monetary policy reflects a cautiously optimistic outlook on inflation control and economic stability. Moreover, the recession that many markets feared has so far been avoided in most regions, indicating resilience in global economies amidst challenging conditions.

Contributing to the market's recovery, big tech companies like Microsoft, Meta, and Alphabet have played a pivotal role, with their stock prices returning to peak levels. This resurgence is driven by a combination of factors, including robust earnings growth, cost-cutting initiatives, rapid growth in cloud computing demand, and some AI hype thrown in for good measure.

No bad news is good news

Sometimes, markets simply rebound when the worst fears don’t materialise. A year ago, many investors were bracing for persistent high inflation and an imminent recession. As these potential risks haven’t come to fruition, relief and optimism have replaced the previous year's apprehension – supporting the market recovery.

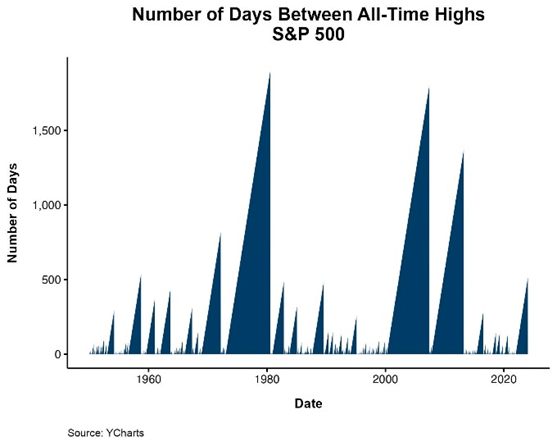

The chart below shows that this return to all-time highs has occurred at an average pace - it wasn’t as rapid as the rebound following the 2020 COVID-19 sell-off, which saw markets recover swiftly due to unprecedented global monetary and fiscal interventions. However, the recovery also didn’t take as long as the post-GFC rebound, which was a more prolonged process due to the deep-seated issues affecting financial systems and the broader economy at that time.

Where to from here?

Investors are undoubtedly more interested in where markets may go from here than what happened over the last year. But as we’ve seen in recent years, short-term market forecasts aren’t usually worth the paper they are written on. Instead of making forecasts, looking at historical market performance can be helpful for trying to understand the range of potential future outcomes.

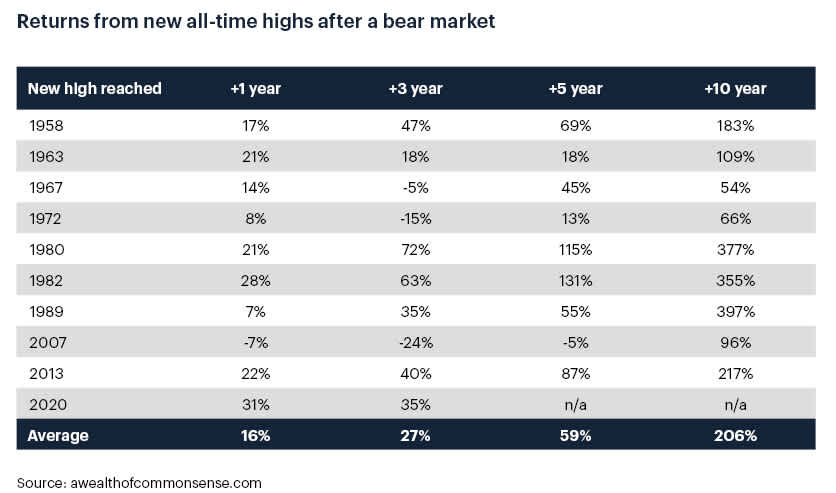

The table below looks at the performance of the S&P 500 index in the years following a recovery from a bear market. The trend observed since 1957 suggests that, typically, once a market rebound has established new highs, the momentum often continues to build over the years. On average, the subsequent one, three, five, and ten-year total returns after reaching new highs following a bear market have been substantial, with averages of +16%, +27%, +59%, and +206%, respectively. Markets didn’t perform positively in all cases - but they had a pretty good hit-rate.

This historical perspective can serve as a reminder for investors that while short-term fluctuations can be volatile and unpredictable, long-term growth trends have often been positive following such recoveries.

Need some help?

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.