After a turbulent April, markets showed remarkable strength in May and the MSCI World Index gained 5.7%. US equities (+6.2%) rebounded strongly as investors looked past tariff fears and focused instead on signs of underlying economic resilience – with the US labour market holding firm and corporate earnings surprising positively through reporting season. In our view, markets aren’t out of the woods however, with the temporary pause in the trade war needing a more permanent solution before the economic risks can be fully assessed.

The scariest part is the unknown

In early April, when the new tariffs were announced, markets reacted sharply. For a few days, it felt like we were watching the start of something more ominous — a throwback to trade wars past, or the beginnings of a tariff-driven bout of stagflation. At one point, US equities were down nearly 20% from their highs, and the VIX Index (a widely watched measure of market fear) spiked to levels last seen during the pandemic.

It was a classic case of “fear of the unknown.” Like the early scenes of a horror movie, the anticipation before seeing the monster is always the most terrifying. However, as more information came to light — tariff pauses, exemptions, and negotiation pathways — fear gave way to clearer-headed analysis of a likely middle-ground, and the market began to stabilise. In fact, within weeks, much of the drawdown had reversed.

Volatility is the price of admission

When markets fall quickly, it’s natural to feel unnerved, but history tells us these moments are more normal than they feel at the time.

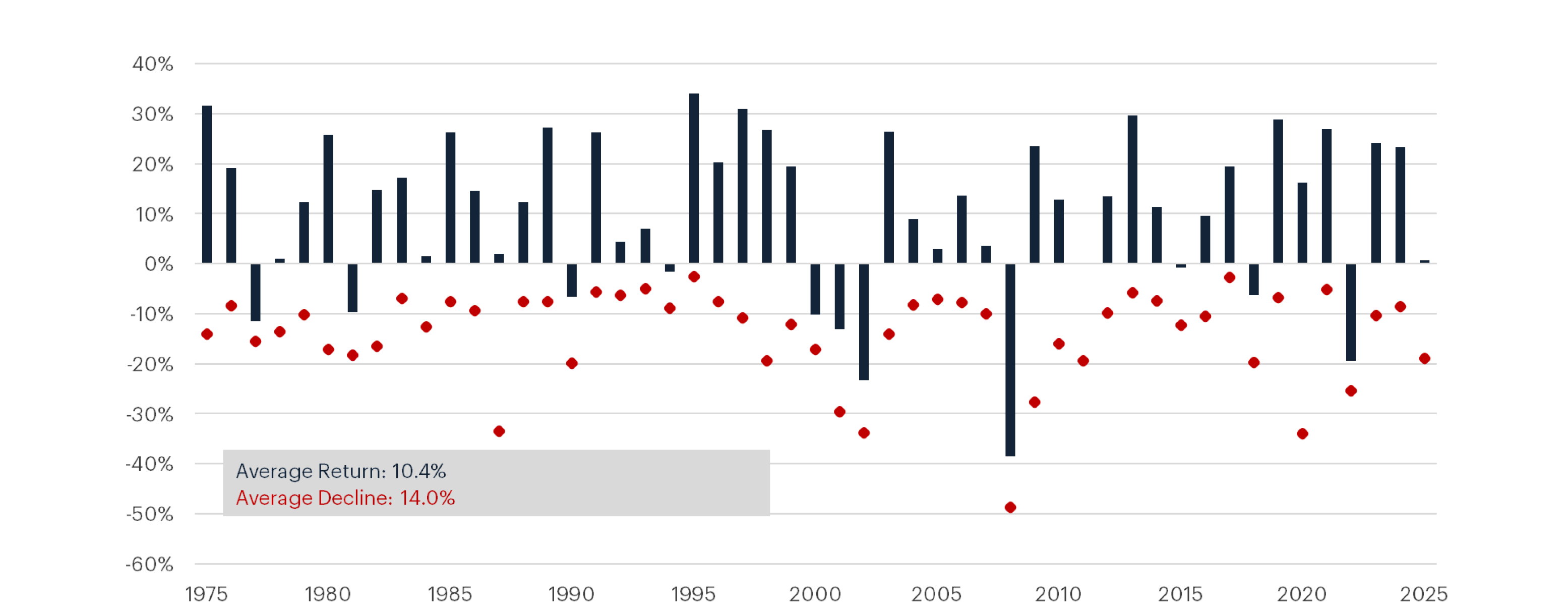

Over the last 50 years, the S&P 500 has returned an average of 10.4% per year — but it has rarely come easily. In almost every one of those years, investors endured sharp drawdowns, with the average intra-year decline of around 14%.

The chart below illustrates both the annual returns of the US share market (the blue bars), and the percentage drop from peak to trough at the worst point during each year (the red dots). Each red dot represents the lowest moment — the point of maximum pain, fear, or uncertainty each year. And yet in many of those years, returns still finished positive.

Take 1987, when stocks plunged over 20% in a single day, but the market still ended the year in positive territory. Or 2020, where a pandemic-triggered 33% collapse turned into a double-digit gain by December. Even this year, the near-20% decline in April is beginning to look like just another chapter in a typical market year.

The lesson? Volatility happens. In fact, it happens virtually every year. It’s not the exception — it’s the price of long-term returns.

What we did during the volatility

Periods like April are uncomfortable, but they also create opportunity. It’s important to stay anchored in your investment process and not react emotionally. Our investment process focuses on long-term drivers of return, not short-term noise, and is built for times like this. While it can be tempting to retreat during moments of uncertainty, we aim to stay disciplined and act decisively where we see value.

Across our portfolios, we made several key changes during April and May:

Leaned into volatility selectively — we added to high-quality businesses that were caught up in the broader sell-off. When markets sell first and ask questions later, it often creates a window to upgrade portfolio quality at better prices.

Added to fixed income at compelling yields — while equity headlines dominated, bond markets also repriced. We used the dislocation to add high-quality companies from our credit watchlist, companies with strong fundamentals that we’ve monitored for some time, but where valuations hadn’t previously stacked up. With yields reaching over 7% in some cases, the risk-reward balance finally tipped in our favour.

Trimmed risk where necessary — in a few cases, we reduced exposure to sectors or companies where the fundamental story had changed, where risks had risen but prices hadn’t yet reflected that shift in our view. Managing downside is as important as finding upside.

Looking ahead

While markets have largely recovered, risks remain. The tariff outlook is far from settled, and ongoing political headlines are likely to keep markets on edge. That means the potential for more volatility in the months ahead.

We don’t try to predict the next headline or time the next market wobble. Instead, we focus on what we can control: positioning portfolios for resilience, assessing risk quickly, and leaning in when opportunities arise.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.