November was a rewarding month for investors in most asset classes, with global share markets jumping 9% and global bonds gaining 5%. Investor optimism returned as data indicated that inflation seems to be under control in many economies, and central banks hinted they may be done hiking interest rates. As year-end approaches, it’s a good time to reflect on the year in markets and consider what 2024 may bring.

A strong November rebound for share markets

After a weaker period for markets in September and October, global share markets leapt in November and closed the month near their high point for the year. The MSCI World Index gained 9.2%, recording its biggest monthly surge in three years. The US market gained 8.9%, while closer to home the New Zealand and Australian markets gained 5.3% and 4.5% respectively. Global bond markets, which had until November been under water for the year, gained 5.0% for the month. It was also a strong month for our KiwiSaver and Managed Fund portfolios.

Investors have gained confidence in recent weeks as inflation and economic growth data (particularly in the US) suggests that central banks may be able to pull off a soft landing – or a cooling of the economy and inflation that doesn’t tip us into a recession. Data released in November showed that US consumer prices overall were flat in the prior month and rose just 3.2% from a year earlier. Inflation is getting closer to the US Federal Reserve’s 2% target and is down two-thirds from its peak of 9.1% in June 2022. At the same time as inflation has slowed, recent US GDP data showed that the economy grew at a 5.2% annualised rate last quarter. Commentary from central bankers around the world now also supports the narrative that interest rates have peaked, and that rate cuts are potentially on the agenda for 2024.

While the US economy is showing resilience, the New Zealand economy has more question marks. Unemployment, while still low, has ticked up from 3.4% to 3.9% this year, consumer confidence is near all-time lows, and retail sales have declined 3.4% over the last year. Higher interest rates are impacting New Zealand households, as are lower house prices (down 9% compared with last year). The weaker domestic backdrop is one reason the New Zealand share market (-1% in the year to 30 November) hasn’t rebounded like many global markets this year. 2023 was another good reminder of the importance of client portfolios being internationally diversified.

Market backdrop supportive, but beware of short-term predictions

This time last year investors were pessimistic about the ability of central banks to rein in inflation, and there was a widespread view that many economies would fall into recession in 2023. But the worst fears rarely play out in markets, and in hindsight late 2022 was a great time to be investing, with global share markets up c.18% since the start of this year.

That said, interest rate increases take several quarters (often up to 18 months) to have their full effect, which means there is still likely to be more economic fallout from this interest rate hiking cycle. While the chances of an economic soft landing have increased, there are still risks that could derail the economy and markets.

While the economic backdrop is uncertain, asset valuations and yields appear reasonable, and help compensate for this uncertainty.

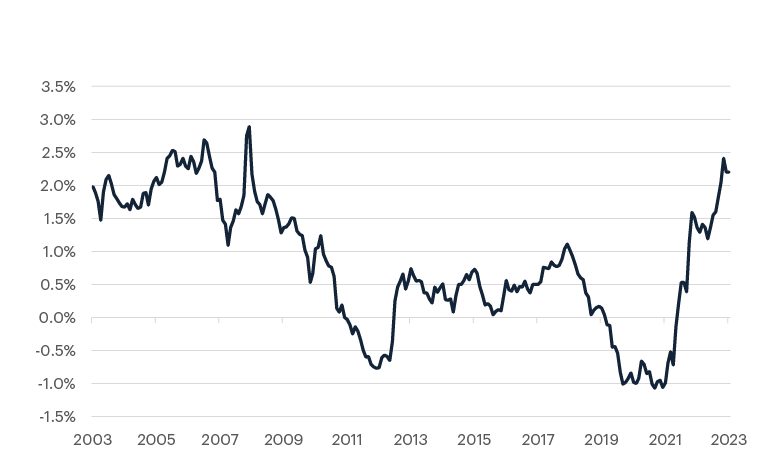

Long term interest rates ended November higher than they started the year, boding well for future returns for bond investors. With inflation subsiding, bond investors now have the prospect of positive real returns (ie. after inflation) for the first time since the start of the COVID pandemic. As the chart shows, the real yield on US 10-year Treasury Inflation-Protected Securities (TIPs) climbed above 2% recently – the highest level in 15 years.

While equity markets have moved higher in 2023, this is largely due to a handful of large-cap growth stocks (Apple, Microsoft, Alphabet, Meta, Amazon, Nvidia and Tesla). Excluding these companies, the US market would have gained only c.2% this year. Corporate earnings have also been resilient in 2023, meaning that market valuations excluding these seven growth companies are in-line with or below long-term averages.

None of this is a prediction of how markets may perform in the short-term. It is just to say that the economic backdrop is more supportive than it was a year ago, and that market valuation levels look reasonable relative to their history.

Optimism about the longer-term outlook

While short term market predictions are notoriously unreliable, longer term asset class forecasts tend to be far more reliable. Returns over longer periods are driven more by the growth in the economy, corporate earnings and the dividends companies pay. Short term sentiment-driven changes in valuation multiples have less of an impact.

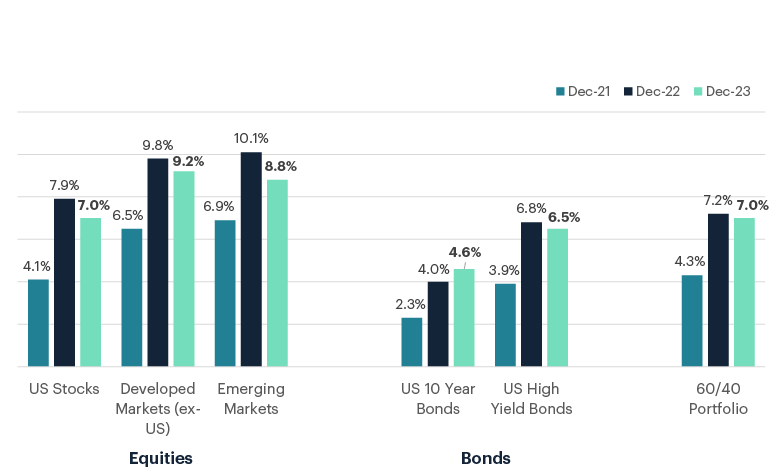

In December each year JP Morgan publishes detailed forecasts of expected asset class returns over the following 10 years. This year’s report shows that while expected long-term returns have come down slightly from last year’s predictions, the current environment of higher interest rates and lower valuation multiples sees them forecasting materially better returns than they did two years ago (and returns broadly in-line with the long-term history).

This is another reason we remain optimistic about the outlook for long-term investors.

Talk to us

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.