November delivered the strongest monthly gain this year for global share markets – with the MSCI World Index up 4.5%. November’s performance seems fitting in a year characterised by surprising market strength against a backdrop of political, geopolitical and economic uncertainty. For the year as a whole, markets have had a good run – with global markets up 20.2%, the US market up 26.5% and even our domestic market up 11.0%. As we look back at 2024, we reflect on some lessons for investors, and the outlook for 2025.

A year of surprising strength

Investors can reflect on a year of strong returns across global markets. It was a year marked by declining inflation, supportive central banks (eventually), and a soft landing for the global economy – all of which provided a favourable backdrop for markets. But this resilience wasn’t expected by many back in January.

At the start of 2024, many investors were bracing for a challenging year, weighed down by concerns over persistent inflation, the lingering impact of 2023’s monetary tightening, and the risk of a hard landing. Geopolitical tensions in the Middle East and uncertainty tied to the US presidential election added to the cautious sentiment.

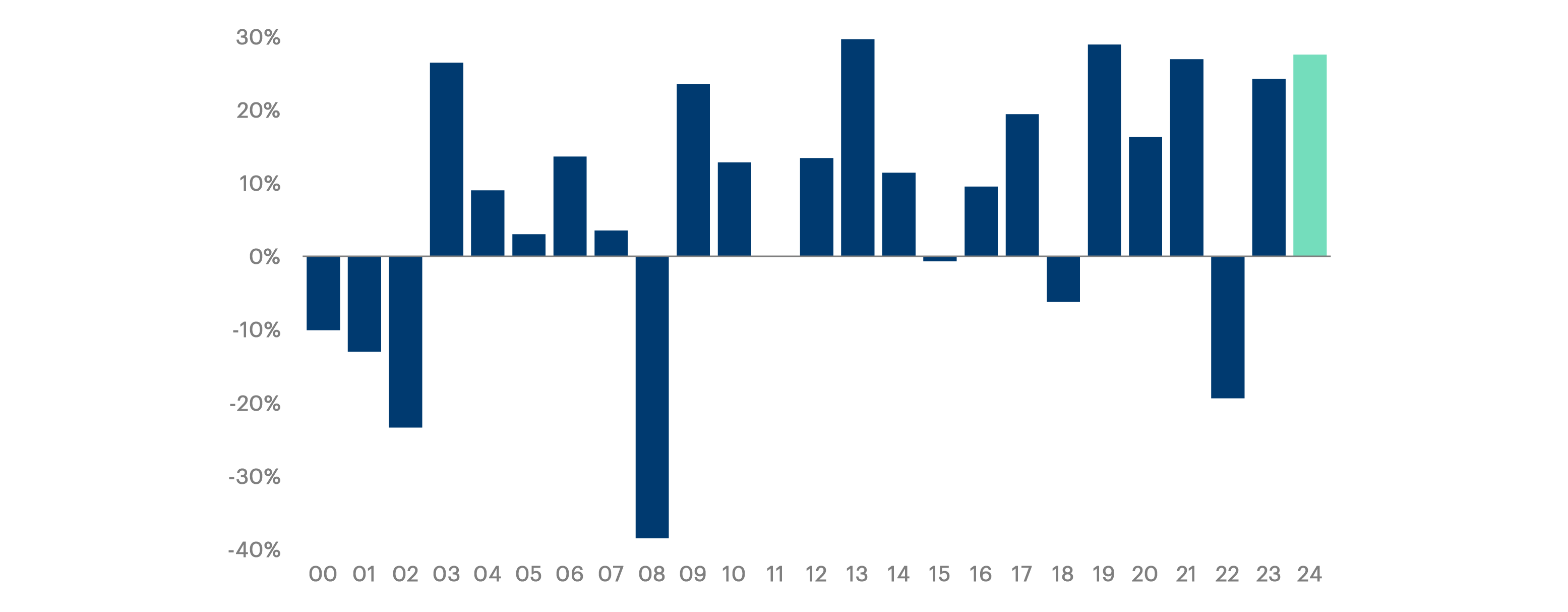

Fast forward to December, and 2024 has surpassed even the most optimistic predictions. The US market is poised to deliver annual gains exceeding 25%, positioning 2024 among the strongest yearly performances of this century. Notably, it would mark only the second time on record that this level has been achieved in back-to-back years (the last time was in 1954 & 1955).

Even amidst periods of volatility, such as the August sell-off driven by concerns that central banks had overreached, market corrections proved to be temporary. Investors quickly regained confidence, encouraged by falling interest rates and reassured by companies' ability to deliver strong performance despite persistent macroeconomic uncertainties.

Key market developments in 2024

Some key developments underpinned the strong performance this year:

Declining inflation: Inflation fell significantly, approaching central bank targets after reaching multi-decade highs in previous years.

Central bank pivot: With inflation under control, central banks shifted their focus from fighting inflation to supporting economic growth, paving the way for further rate cuts.

Elusive soft landing: The much-anticipated recession never materialised. Instead, the US economy achieved a rare soft landing, marked by robust GDP growth, still historically low unemployment, and enduring consumer confidence.

Technological advancements in key sectors: Progress continued in sectors like artificial intelligence, healthcare, and even utilities getting a boost by increasing demand for electricity. These trends provided a strong catalyst for earnings growth in certain parts of the market.

Corporate strength: Corporate resilience stood out as most businesses successfully navigated higher costs, elevated interest rates, and consumer pressure – maintaining profitability despite these headwinds.

Three key lessons for investors from 2024

Keep politics out of investing

Political and geopolitical headlines dominated the news cycle this year, from Middle East tensions to the drama of European and US elections. Despite the noise, these events have had little lasting impact on markets. Investors who remained focused on fundamental factors and avoided being sidetracked by political distractions saw significant rewards.

The benefits of international diversification

With US markets stealing the spotlight and New Zealand under pressure for much of the year, 2024 was also a reminder of the benefits of international diversification. The New Zealand dollar’s tendency to weaken during periods of global uncertainty provided an added boost to returns on foreign assets when hedged back to NZD. Balancing domestic and global market exposure once again proved to be an effective strategy for reducing volatility and enhancing long-term return outcomes.

Innovation and earnings growth drive returns

The outperformance of US stocks this year reaffirmed that innovation and earnings growth, not geopolitical tensions or macroeconomic fears, are the true drivers of market performance. US technology companies, particularly those leading in AI, delivered exceptional results. Meanwhile, regions where earnings growth was more subdued, such as Europe, lagged behind. Corporate earnings expectations for companies in the US S&P 500 Index have increased more than 12% over the year, while companies in the European Stoxx 600 Index have only seen a 4% gain. The difference has in part been driven by the growth of large US tech giants like Microsoft, Amazon and Meta.

What lies ahead for 2025

The outlook for 2025 is shaping up to be more conventional, with conditions largely supportive of markets. Inflation is expected to remain subdued, enabling central banks to continue gradually easing interest rates, while unemployment will likely hover near historic lows. This balance of steady economic growth and restrained inflation provides a strong foundation for a constructive year in equity markets. Likewise, long term bond yields that are still near decade highs also providing a supportive backdrop for fixed income investors.

However, it’s important to approach the year with some measured caution as well. While current market momentum is promising, speculative assets, such as cryptocurrencies and other higher-risk investments, are showing signs of overvaluation. Additionally, the bar for meeting expectations is high, particularly in sectors like technology, raising questions about the sustainability of recent gains.

Company fundamentals will remain central to investment decisions in 2025. The focus will be on whether the AI boom can continue to produce tangible results, and whether other sectors, including smaller-cap companies, can continue to contribute to broader market strength.

As our team scour the globe for investments, we are still finding attractive long term investment opportunities – despite some growing areas of exuberance. As 2024 demonstrated, staying the course, diversifying beyond home borders, and focusing on long-term drivers of returns remain essential strategies.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.