Market history shows us the largest companies in the S&P 500 rarely remain the same from one decade to the next.

The Magnificent Seven (Mag 7) stocks, which include Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia, and Tesla, were aptly named after the iconic 1960s western film starring Steve McQueen and Yul Brynner, featuring seven skilled gunslingers. Perhaps we just need to swap out the six-shooters for economic moats (the competitive advantage these companies hold).

In the film, only three of the seven survive the climactic gun battle to ride off into the sunset. Will the Mag 7 stocks face a similar fate?

Investing in the largest company

According to Michael Mauboussin, from 1950 to 2024, just 18 companies have held a top three spot in market capitalisation at the end of each year. The most frequent appearances are from ExxonMobil, AT&T, IBM, General Electric, and Microsoft. The average number of appearances is thirteen years, while the median is just five.

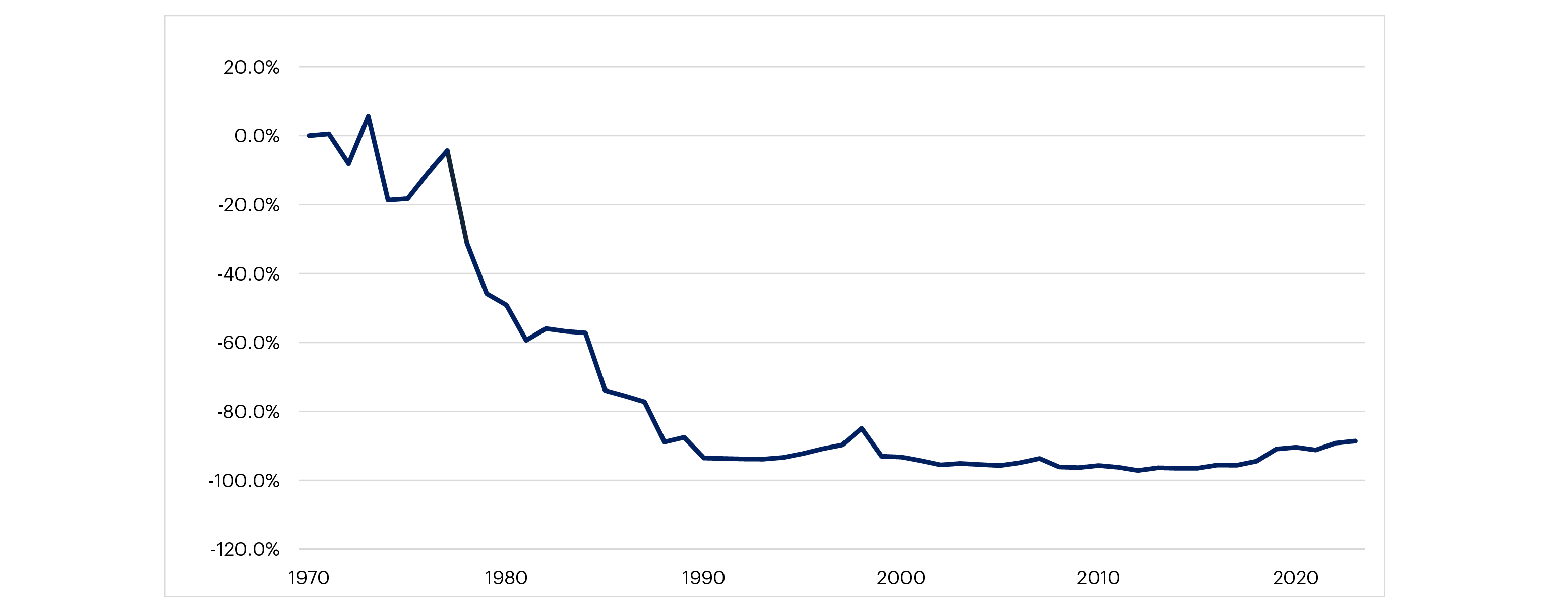

In fact, Michael Mauboussin’s research (replicated in the graph below) shows that if you invested $100 in the largest company by market capitalisation every year from 1950, your $100 investment would have underperformed the S&P 500 index by a staggering 89%.

But the last 10 years have been very different, and this analysis does not hold. Since 2014, Apple has been the largest company by market capitalisation every year, except for 2018 when Microsoft took the crown. Your $100 invested in the largest company in each year from 2014 would have generated a 214% excess return over the S&P 500 index.

What makes this period of increasing concentration even more unique is how narrow it has been. The weight of the ten largest stocks in the S&P 500 has increased from a mid-teen percentage in 2015 to over 30% today. In contrast, the weight of the 11th-50th largest companies has decreased during the same period.

Why a change in market leadership?

Concentration alone is not a reason for leadership change. In fact, concentration may be justified if market capitalisations mirror value creation prospects. This has been the case with the Mag 7. Share prices reflect a company’s potential earnings, and in the past 10 years, Mag 7 companies have mostly grown earnings ahead of market expectations.

However, size can present a problem for future share price appreciation for the largest companies in the index. As your denominator (market capitalisation) becomes larger, it becomes harder to generate numerator growth (earnings) above market expectations.

Mag 7 earnings growth is expected to decelerate this year, while the rest of the 493 companies in the S&P 500 Index are poised to accelerate. Last year, the Mag 7 achieved 26% growth in earnings, compared to 6% earnings growth for the other 493. This year, the market expects a convergence, with Mag 7 earnings growth forecast to slow to 17%, while the growth rate for the other 493 is expected to rise to 13%. This shift could indicate a potential broadening of market leadership away from the giant large caps and toward “the rest.”

The changing nature of Mag 7 companies

The Mag 7 companies possess considerable competitive advantages and have created formidable barriers to entry for would-be competitors. But the nature of competitive markets, particularly within newer, evolving industries, is to adapt and change over time.

Prior capital-light, advertising-driven models are giving way to higher capital intensity AI-driven models. In the last year alone, capex as a percentage of sales for Amazon, Microsoft, Alphabet, and Meta has increased to an average of 21%, up from 13%.

Meta’s Chief Technology Officer Andrew Bosworth, told staff in a leaked memo that this year is the "most critical" to prove whether the metaverse is a visionary feat or a "legendary misadventure."

Michael Cembalest of JP Morgan recently used Corning and their fiber optic business as an example of what can go wrong in capital-intensive industries that flip to being oversupplied. He notes that Corning earned around US$4 billion in the year 2000 in its fiber optic segment, but after the dot-com collapse, the business did not surpass this level again until 2018 in nominal terms. Similarly, the number of undersea fiber optic cables deployed globally each year did not surpass year 2000 levels until 2020.

This is not meant to be a prediction about AI. My point is that the earnings path of the Mag 7 is less clear than it has been in the past, given the shift to a high capital intensity model with an uncertain return profile.

What this means for investors

In periods of rising concentration, the winner tends to be passive investing. The Mag 7 has collectively returned 161% vs the S&P 500 ex Mag 7 which has returned 34.5% over the last two years. At 31% of the index, if this trend was to continue, an active manager would need to have around half of their portfolio in this small group of companies to gain a somewhat decent ‘active’ position.

In the 1970s and 2000s, concentration declined in the S&P 500, and this is correlated with the periods when the greatest percentage of active managers outperformed the index.

A similar dynamic played out in January of this year. The S&P 500 delivered a 2.8% return, yet the Mag 7 detracted 0.11% from this. Along with the broadening out of market, 66% of US active asset managers outperformed the benchmark.

Change is hard to predict

One thing is certain in the equity markets, and that is change. Previous winners give way to tomorrow’s giants. Just like the Mag 7 today, 50 years ago companies like IBM and Xerox seemed to have all the advantages for any coming computer revolution. But it was a bunch of kids like Steve Jobs and Bill Gates working in their Silicon Valley garages who built the future.

This is probably the most striking difference with the Magnificent Seven movie – it was predictable that Steve McQueen and Yul Brynner, being the stars, would be amongst the survivors riding off into the sunset. The future for companies in the Mag 7 is likely to be less certain.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.

This article was originally published in the NBR on 4 March 2025 (paywalled), prior to much of the recent March volatility.