After a roaring start to the year for global share markets, investors could be forgiven for overlooking fixed income markets that have largely been treading water. But there are parallels between 2023 and previous periods following central bank hiking cycles to suggest that fixed income could be ready for a resurgence.

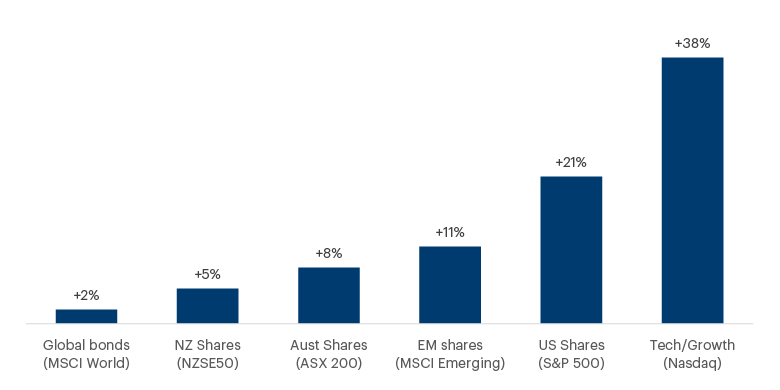

After the widespread market pessimism in 2022, the strong start to 2023 in share markets has taken many investors by surprise – in a good way. US stocks (+21% year-to-date) have recorded their longest monthly winning streak in two years, as optimism about falling inflation and resilient growth drives increasingly broad market gains. Technology stocks which dragged the market lower last year, have had their best start to the year in about 40 years. And after a slower start to the year, emerging markets took off in July (+6%), bringing the year-to-date return to 11%.

Don’t forget about fixed income

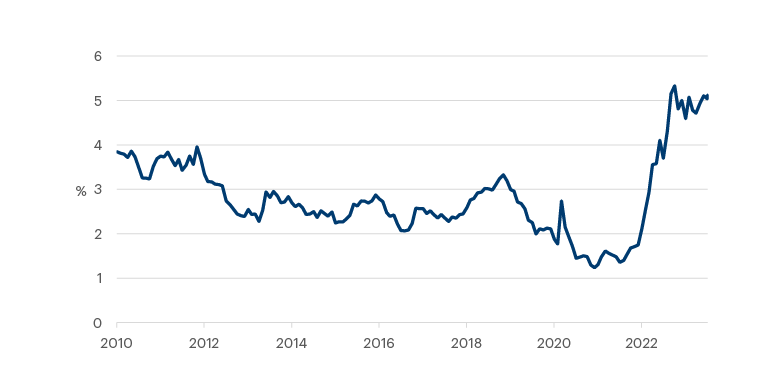

Despite bond yields at the start of the year that were the most attractive in a decade, fixed income has only delivered moderate returns this year. Global bonds have gained 2% in 2023, after declining 16% last year.

This may in part be explained by the fact that investors have started to chase equity market returns and sell their fixed income investments to jump on the band wagon of rising stocks. As always however, it is important to remember that blindly chasing recent winners in markets can be dangerous. This is particularly true in fixed income markets – where the best predictor of future returns is the current yield on bonds. Over the medium term, bond returns don’t deviate far from their yields at the start of the period.

Buy bonds, wear diamonds

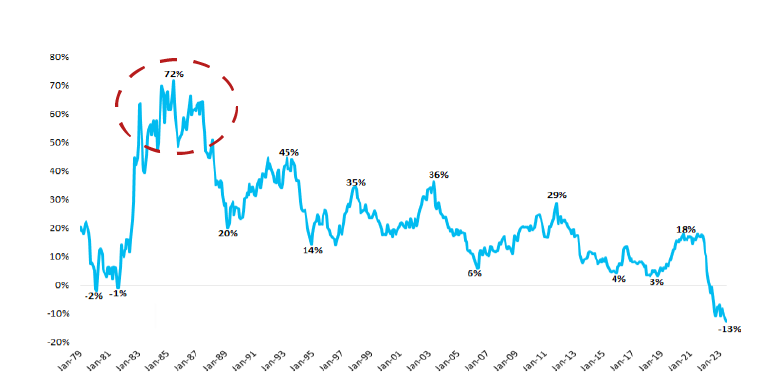

On top of the starting yield being the most attractive in a decade, there is also plenty of evidence to suggest that periods of lousy returns in the bond market are typically followed by far more attractive returns. This can be seen in the chart below, with three-year periods of low returns in fixed income typically being followed by much higher returns in the next three years.

The chart also shows the extremely strong performance of US bonds in the mid to late 1980s. Interestingly this was after the Fed had hiked interest rates to 20% to rein in inflation that had spiralled to over 14% in the early 1980s. Inflation started to subside materially in 1981 and 1982, but interest rates remained high as the Fed wasn’t willing to let up on interest rate hikes. This set the backdrop for strong bond returns in the following years.

From the mid-1980s to the mid-1990s fixed income returns not only benefited from starting yields that far outstripped inflation, but they also delivered capital gains as interest rates eventually fell and bond prices rallied. In the three years to the end of 1986, US bonds returned investors 17% per annum. In the 10 years to the end of 1993, US bonds returned 180%, or 11% per annum.

This spurred a new market saying in the late 1980s and early 1990s – “buy bonds, wear diamonds”.

Drawing parallels to 2023

Over most of the past decade I haven’t been a fan of the bond market. Low yields (prospective returns) simply didn’t seem to compensate for the risks (interest rate risk, inflation risk etc) and offer sufficient returns for investors. But when the fundamentals change it is important to revisit your views.

While yields are still nowhere near the levels seen in the 1980s, similar dynamics are at play. Yields are at decade highs, just as inflation is starting to subside. Should inflation continue to fall and central banks eventually cut interest rates, bonds could be in for a strong multi-year run. Even if central banks don’t cut rates, far better returns are likely to be in store for fixed income investors given current yields.

The running yield on the Fisher Funds Income Fund is currently c.7.4% (vs 3.0% in 2020), which compares with the 4.2% currently available on a three-month term deposit.

Both equities and bonds play an important role in balanced portfolios, and we believe both asset classes will deliver good long-term returns for investors. While bonds should never make up all of an investors’ portfolio (you need some growth assets), there are arguments that investors in retirement could now get away with a higher allocation to fixed income. This could potentially reduce the volatility of investor’s portfolios, without materially reducing returns.

Talk to us

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.