Over the past few years, there have been recommendations aplenty to buy European shares over US shares. The argument goes that Europe’s stock market will outperform the US stock market in coming years because shares in Europe are a lot cheaper than those in the United States.

This recommendation comes at a time when the United States S&P 500 has delivered a 158% return over the last 10-years through to 31 December 2023, versus the (rather minuscule in comparison) 43% return delivered by the MSCI Europe stock index.

Yes, European stock markets are cheap relative to the US, but investors should look past the valuation and understand the valid reasons why. And perhaps in understanding the differences between the US and Europe stock markets, there are also lessons for New Zealand.

Looking under the bonnet

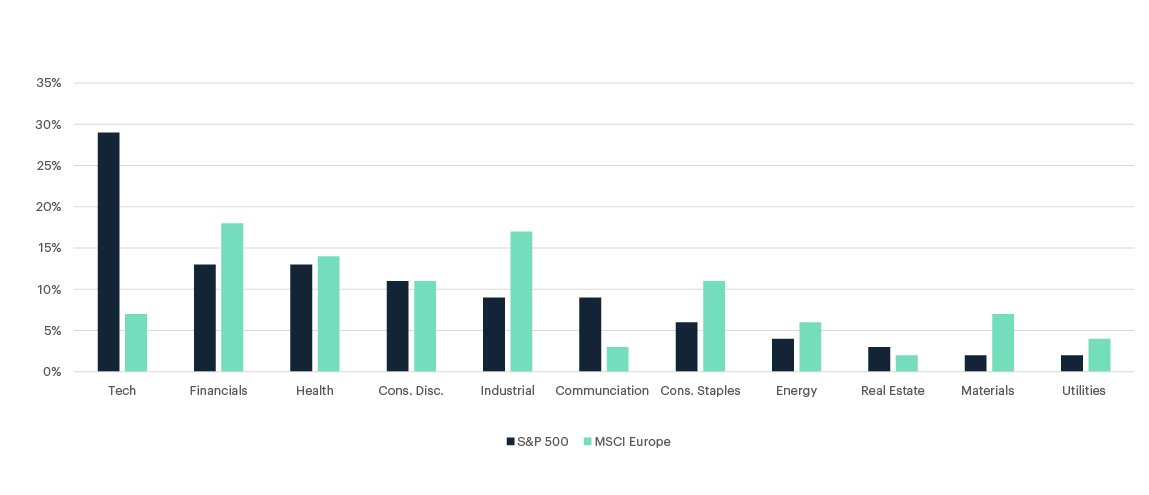

If you look beneath the hood of European equity markets, you will find an index more heavily weighted to ‘old economy’ companies, such as financials (banks and insurance companies), industrial firms and consumer staple companies which sell items in the middle aisles of a supermarket. By comparison, higher growth technology companies play a more substantial role in shaping the US market. All things being equal, technology companies generally grow profits faster. As earnings are what drive share prices, it makes sense investors will be willing to pay more for faster growing profits. Would you rather own Nestle and Shell, or Amazon and Alphabet? This goes part of the way to explaining why shares in US companies are more expensive than Europe.

Burdensome regulation can stifle growth

Increased regulatory burden has hampered Europe’s competitive position, hindered innovation and is particularly burdensome for small and medium sized companies. The root cause is hard to identify. There are, of course, cultural differences between Europe and the US, but Europe also has more complexity with regulation, from both individual countries and the single market. The formation and growth of Silicon Valley firms through the 2000s to the rapid growth we are seeing from AI firms today is evidence that the US has created an environment that fosters innovation. While countless hours are being spent by software engineers in the US trying to outcompete each other for the next AI breakthrough, European law makers are apparently burning the midnight oil to prepare the first AI Act!

Lack of economic diversification is hampering growth

The Ukraine war has and is having an impact. Europe (mainly Germany) is one of the largest exporters of manufactured goods globally. For years before the war, cheap Russian natural gas flowed to Europe and was its main energy resource driving the industrial complex. Arguably, parts of Europe became too reliant on Russian gas. Now that supply has been significantly reduced, European companies are looking to relocate abroad where they can lower production costs. This hampers European economic growth. It is also in stark contrast to the US, where companies are being offered subsidies and/or tax breaks through the Inflation Reduction Act to reshore their operations back to North America.

China is also having a two-pronged effect on Europe. China is one of Europe’s largest trading partners, but its economy is slowing down. However, China is expanding its influence in the global electric vehicle (EV) market – threatening an industry that’s been an economic force for Europe for decades. According to a report by the International Energy Agency, China was responsible for 35% of global EV exports in 2022. In fact, Chinese automaker, BYD, sold more electric vehicles than all European auto manufacturers combined in in H1 2023 – as did Tesla. Foreign competitors are beating Europe at its own game.

Comparing the relative success of the US and Europe helps illustrate the foundations that are required for innovation, economic growth and vibrant capital markets. For New Zealand, Europe highlights the importance of pushing towards a diversified economy, both in terms of industry exposure and trading partners. We also need to maintain policy settings that support innovation and create an environment for businesses to thrive.

A version of this article was published in the NZ Herald on 3 March 2024 (paywalled).

Talk to us

If you would like to make sure you have the right investment strategy to help you reach your goals, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.