Throughout much of this year, the Reserve Bank of New Zealand (RBNZ) and the US Federal Reserve have stood out from other central banks as particularly single-minded in their focus on combating inflation. The European Central Bank and the Bank of Canada began cutting rates in June, and the Bank of England joined them this past week. Meanwhile, the RBNZ and the Fed have remained devoted to maintaining rates at two-decade highs.

This stubborn stance shifted dramatically in July when both banks signalled their readiness to cut rates at their upcoming meetings. They finally recognised the need to respond to what had become obvious to everyone else: inflation had been addressed, and they had engineered the slowdown they set out for.

The New Zealand stock market, which had been lagging global peers for months, rallied on the change. The NZX50 rose by 5.9% last month as the entire country breathed a sigh of relief, realising that the RBNZ had finally acknowledged the state of the economy. Performance was strong across the board for New Zealand-listed companies, with 43 of the NZX50 companies delivering positive returns. Previously embattled companies saw a sharp reversal of fortunes with the first hints of a looser monetary policy from the RBNZ.

Similar trends were observed in the US, where investors shifted funds towards interest rate-sensitive small-cap companies. This, coupled with increased scepticism about the potential for future returns from AI investments led to a decline in the large-cap tech giants that have dominated the market. Heavily influenced by tech, the S&P 500 experienced subdued performance, lagging the New Zealand market and gaining only 1.1%.

The question is whether it's too little, too late

While the Fed has successfully lowered inflation, recent economic data suggests their policies may be cooling the economy too much. Similarly, economic data in New Zealand has been sluggish, with well-documented accounts of businesses and households struggling.

Investors are concerned that the RBNZ and the Fed are running late. With increasing fears of a policy mistake, the narrative of a soft landing is shifting towards worries about a hard landing. Whether the latest data indicates a temporary economic soft patch, or a deeper downturn will likely depend on their responses in the coming months.

It’s important to remember that markets are forward looking

The recent rally in New Zealand is not necessarily a sign that the economy is out of the woods. The share market, which is forward looking, often reflects the fears and bad news we observe around us, even if the RBNZ seems to ignore them. The market rebound we witnessed last month was due to the market's prior expectation of a very bad economic environment. The change in RBNZ's stance has potentially reduced the chance of a worst-case scenario playing out.

However, the jury is still out. A strong economy is still needed for share markets to perform well over the medium term. In the past 18 months, markets have rallied significantly, front-footing most of the central banks' moves, so current levels already partially reflect economic optimism.

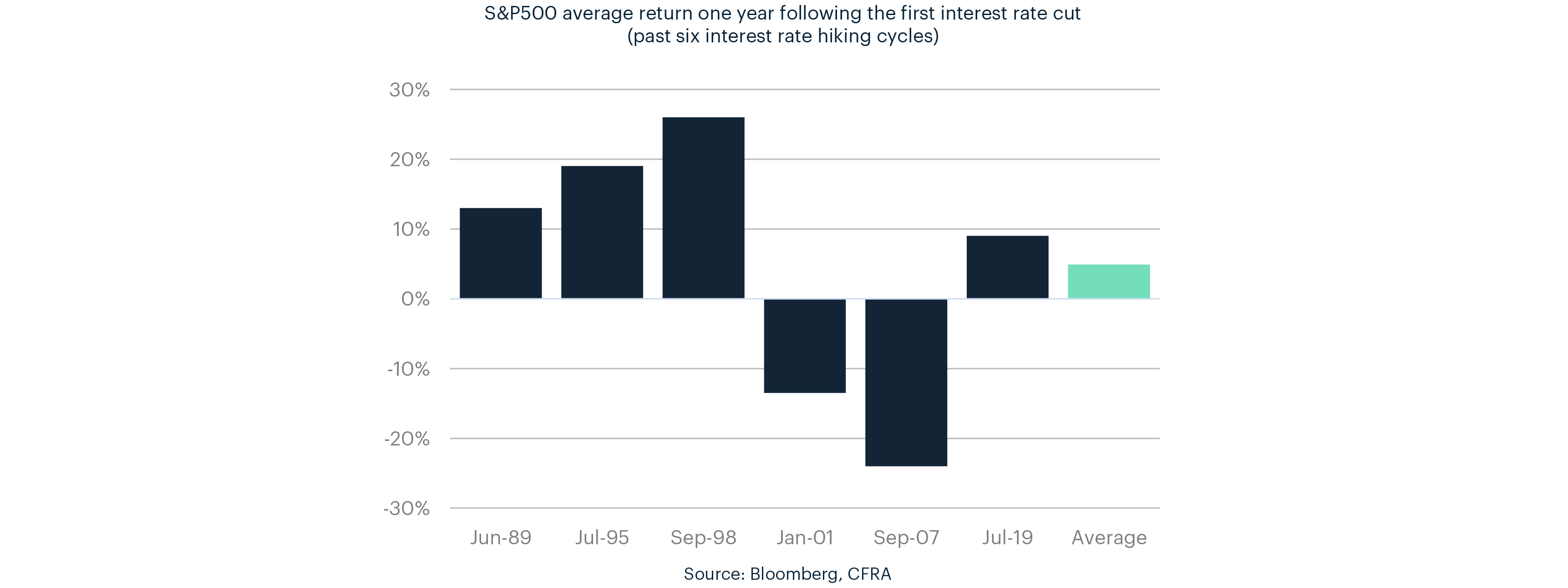

In the six previous interest rate hiking cycles, the US market has risen an average of 5% one year after the first rate cut. However, the caveat is that this performance hinges on the cut not being in reaction to a recession. What happened in 2001 and 2007 demonstrates the adverse outcomes when cuts occur in response to economic pain, and the central banks are playing catch up. Excluding those years, the average return jumps to +16.8%.

Fixed income is looking increasingly attractive – at a time when the best may be behind for term deposits

The medium-term outlook for equities appears balanced, and an element of optimism is already baked in. If you aren’t convinced in the outlook for share markets, or have a lower risk tolerance, fixed income is an increasingly compelling option.

Although term deposits offer a great place to hide, their rate of return may have peaked, and investors in term deposits will soon have to start getting used to lower rates again. Bonds, with yields still near decade-highs, potentially offer investors the chance to lock in attractive yields for longer. Just two years removed from the worst year for bonds on record, the combination of high yields, falling inflation, and the possibility of a flight to safety out of equities offers investors an infrequent opportunity.

Our Income Fund delivered a 9.2% return over the last 12 months and still offers a running yield of 6.3%. If the economic environment worsens and interest rates fall further as central banks play catch-up, bonds could deliver even better returns – and potentially even outpace share markets.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.