After a strong rebound in 2023, global share markets continued their surge in the first quarter of 2024. This offshore strength resulted in solid returns for investors across most of our strategies, despite a weaker domestic economy and share market.

Strong quarter for fund performance

Global equity markets have followed on from the strong run in 2023, with a buoyant first quarter. The MSCI World Index gained 8.5% for the quarter, while the US S&P 500 and European Stoxx 600 Index gained 10.2% and 7.0% respectively. The US market has been supported by an improving economic outlook and supportive Federal Reserve, which is signalling that interest rates cuts may be on the way shortly.

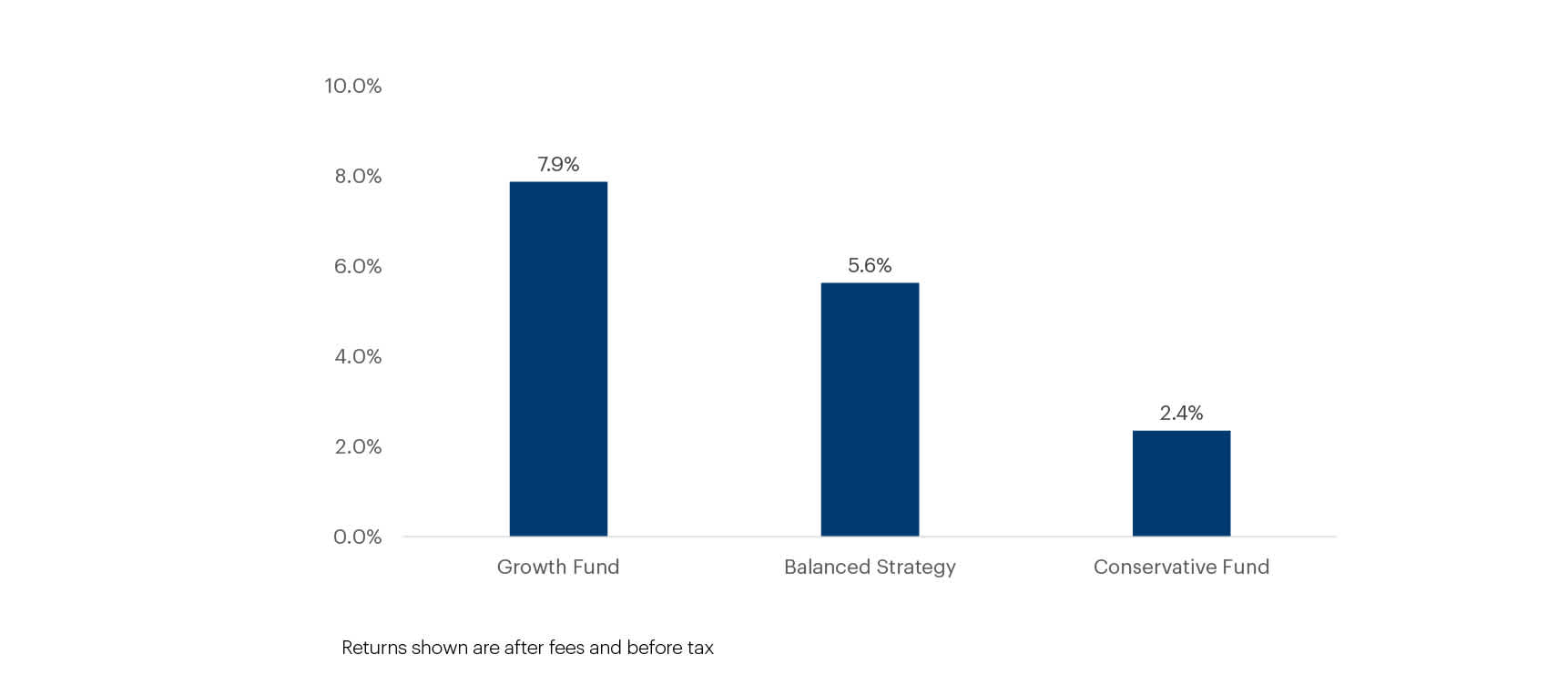

Our managed funds have had a strong quarter against this backdrop, with notably strong gains from our International Growth Fund, which gained 15.6% in the quarter. Our Australian Growth Fund gained 7.2% for the quarter, while our New Zealand Growth Fund gained 6.2%. As shown below, our Fisher Funds KiwiSaver Scheme funds have also shown solid gains in the first quarter, on top of a strong 2023.

Equity markets reflect differing economic and monetary policy paths

As is reflected in the returns above, global share markets have materially outperformed the New Zealand share market (up just 2.8%) in the first quarter. Over the last twelve months, the divergence between the US and New Zealand markets has been even more pronounced, with the S&P 500 up 27.9% against the NZX 50 which is up 1.9%.

Some of the divergence can be explained by differing economic outcomes – but an increasingly divergent monetary policy stance by the Reserve Bank of New Zealand (RBNZ) is also a factor.

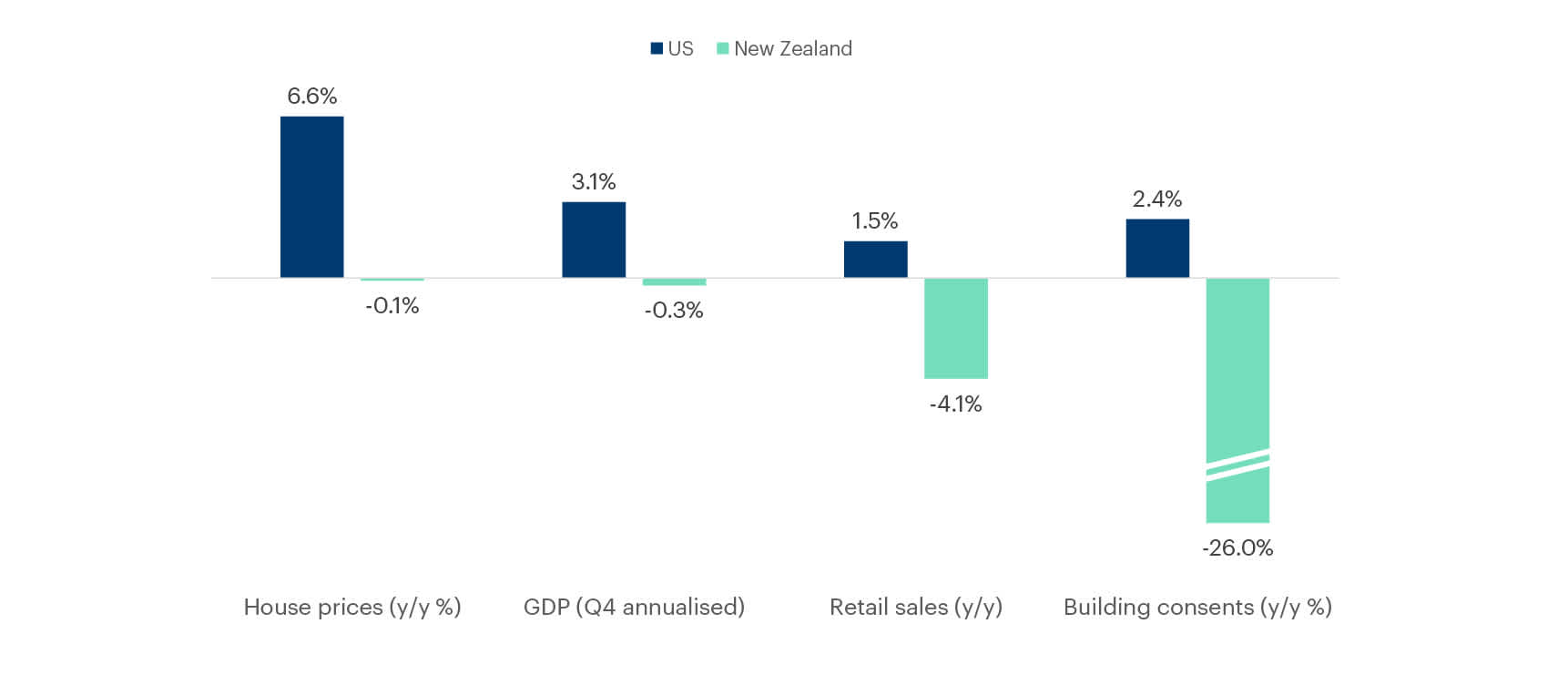

The US continues to report solid economic data and stable inflation, and in its most recent corporate earnings season has also shown surprising resilience and growth in its corporate sector. US GDP grew at an annualised rate of 3.1% in the fourth quarter of 2023, unemployment remains near all-time lows at 3.9%, and house prices are still pushing higher (up 7% y/y). All considered, the data out of the US is increasingly pointing to a soft landing.

Meanwhile in New Zealand, the latest earnings season and economic data has not been as pleasant. Announced recently, New Zealand’s GDP shrunk 0.1% for the December quarter compared with the September quarter, which also shrunk 0.3%. Some economists define this as a recession. Regardless of definition, the data is clearly showing that the economy isn’t in the same good shape as the US – despite New Zealand being bailed out by record net migration. On a per capita basis the picture is even more concerning, with GDP per capita now 4% below mid-2022 levels. At a household level the situation is very stretched for many.

RBNZ’s divergent approach to monetary policy

In both New Zealand and the US, inflation has come down significantly over the last 18 months. The underlying drivers of inflationary pressure – like supply chain stress and energy prices – have also eased in both markets.

At the 28 February Official Cash Rate (OCR) announcement, the key interest rate was held at 5.5%, and the RBNZ was firm that the OCR needed to stay at a “restrictive level for a sustained period of time”. Contrast this with the US Federal Reserve who recently held interest rates for the 5th consecutive meeting but indicated that they expect to cut interest rates a number of times this year. The forecasts in the RBNZ’s most recent Monetary Policy Statement showed no expectation of interest rate cuts until mid-2025, in contrast to the Fed’s 'dot plot’ projections which shows 2-3 expected cuts this year.

The Federal Reserve’s approach is in stark contrast to the RBNZ’s, especially when considering the strength of the US economy. Given their economy is growing steadily, while ours is contracting, you would expect the roles to be reversed from the two central banks.

Central bank pivot needed

While both central banks look at similar data sets when making decisions (which are often out of date at the time of interest rate announcements), it appears that the Federal Reserve is being more forward looking than the RBNZ. They appear more willing to balance the underlying factors impacting supply, demand and prices – rather than anchoring solely on historical data.

Not taking a broader view of the underlying economic fundamentals and supply and demand drivers, creates risks of missing the forest for the trees and being overly restrictive. If taken too far, the potential issues of this are obvious. Risks include increasing unemployment, increasing defaults by borrowers, destabilising the financial system and increased financial support for citizens from the government as a result.

We are hopeful that the RBNZ will start to see the strengthening arguments for rate cuts before our economy sustains further damage.

Global investment outlook outweighs domestic headwinds

With all of this said, and somewhat counterintuitively, New Zealand investors don’t necessarily need to be concerned with the impact of the domestic economy on their investments.

Most of our diversified strategies have far more exposure to global equity investments than domestic equity investments. This is by design – to ensure New Zealanders have diversification away from the country in which they reside, earn a living, and own property. There are also simply more attractive investment opportunities offshore, in industries that aren’t easily accessible domestically. Finally, even in our New Zealand share portfolios, many of our investments (like Fisher & Paykel Healthcare) have the bulk of their revenue and growth opportunities offshore – meaning they aren’t as significantly impacted by the ups and downs of the New Zealand economy. In fact, many New Zealand companies benefit from a weaker NZ dollar in times of economic weakness.

We continue to monitor the domestic economy closely. The RBNZ will eventually dial back its restrictive interest rate policy, and we hope that after a short period of consolidation, growth and stability will return. However, as always, we are also positioning our portfolios in a way that we think will deliver good results for investors over the long term, irrespective of the state of the domestic economy.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.