Equity markets surged to successive all-time highs in September, powered by unrelenting enthusiasm for artificial intelligence and reinforced by central banks pivoting toward easier policy. Yet behind the euphoria, questions remain: are the dizzying gains of AI-linked companies and the promise of policy support enough to justify the pace of the rally, or are investors at risk of inflating another bubble like the one seen in the dot-com era?

Markets continue to set new all-time highs

Global equities powered higher in September (+3.2%) and since the April lows global stocks have climbed 33%. September provided the standout moment: all four major US indices - the S&P 500, Nasdaq 100, Dow Jones and Russell 2000 - closed at record highs on the same day. It was the first time this had happened since 2021, and only the 25th occurrence this century. The strength wasn’t limited to the US (+3.7%), with European markets up 1.5% and NZ stocks climbing 2.8% in September.

Although leadership remained anchored in AI-linked companies, the rally showed some signs of broadening. US small-cap stocks (+2.9%) advanced alongside the mega-cap Magnificent 7 (+9.0%), supported by resilient economic data and the Federal Reserve’s first rate cut since December - a move that also signalled more easing could follow.

Fundamentals hanging in better than expected

Economic fundamentals have held up better than many anticipated. US GDP is growing at a healthy annualised pace of 3.8%, while key inflation measures have remained stable, giving the Fed some breathing room. Corporate earnings growth in the US has comfortably exceeded expectations, with large-cap technology once again leading the way. Alphabet surged 14% in September, Oracle gained 29%, and Nvidia rose 8% - underscoring how central the sector remains to market momentum.

The main wrinkle came from employment, with the US labour market showing signs of slowing. Paradoxically, investors took this as good news: softer jobs data became the catalyst for the Fed’s policy pivot – with the central bank cutting rates for the first time this year in September.

The picture in NZ was starkly different. GDP contracted by 0.9%, well below expectations and far weaker than the growth seen across major economies. The RBNZ has now resumed OCR cuts and markets are now pricing in the prospect of further easing. As in the US, the promise of looser policy outweighed weak fundamentals and helped lift NZ equities during the month.

AI bubble brewing?

We are spending considerable time assessing how much of the recent strength in AI beneficiaries - such as semiconductor stocks (eg. Nvidia and Broadcom), software plays like Palantir, datacentre players like Oracle, and independent power producers (which have rallied due to rising electricity demand) - is fundamentally justified, and how much may reflect overexuberance and a growing bubble.

There is no question that generative AI is a game changer for some businesses, and that it is likely to become more engrained in our everyday lives. However, much like the expansion of fibreoptic networks in the late 1990s, there are valid concerns. These include whether the scale of datacentre and AI infrastructure being built is necessary, whether the capital invested will yield sufficient returns, and whether the high growth assumptions embedded in many of the ‘AI beneficiary’ companies are sustainable.

As the dot-com era demonstrated, the promise of a transformative technology does not automatically translate into strong investment outcomes. Not every AI-related company will prove to be a winner.

Refreshing portfolios

Against a backdrop of exuberant markets, our equity portfolios underperformed in September. Our cautious stance on AI valuations limited participation in the sharp rally, particularly in chipmakers - an area that has historically proven highly cyclical and volatile. Our focus on high quality companies, instead of chasing those with the strongest share price momentum, can result in underperformance during periods of animal spirits in markets, as we have seen recently.

Our overweight to Healthcare, a sector that has long been a good hunting ground for us, has been another headwind recently. Healthcare has been the weakest performing sector this year, pressured partly by policy uncertainty in the US, but also due to investors exiting more defensive stocks to chase hotter parts of the market.

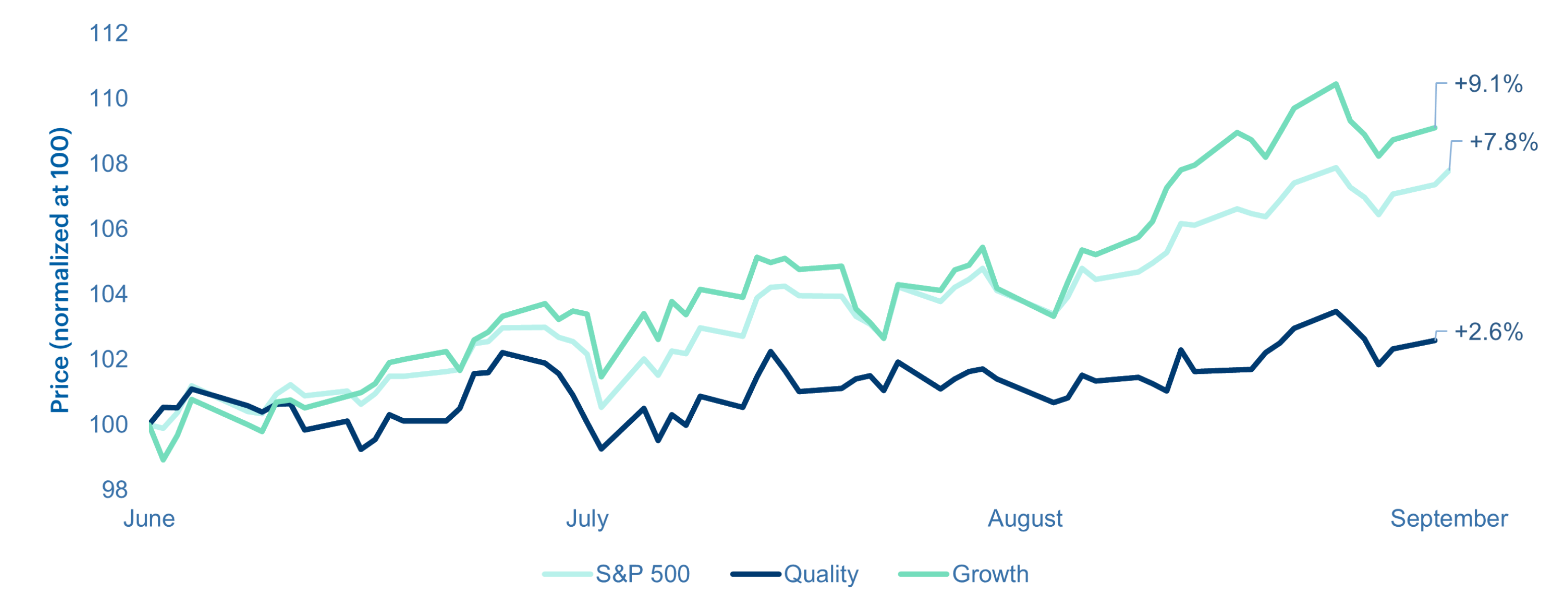

Quality oriented stocks, which are a hallmark of our investment style, have also lagged more speculative parts of the market in recent months. By “quality,” we mean companies with strong balance sheets, durable competitive positions, and reliable profits - as reflected in the S&P 500 Quality Index below. As the chart illustrates, quality has trailed growth materially in recent months, weighing on the relative performance of our portfolios.

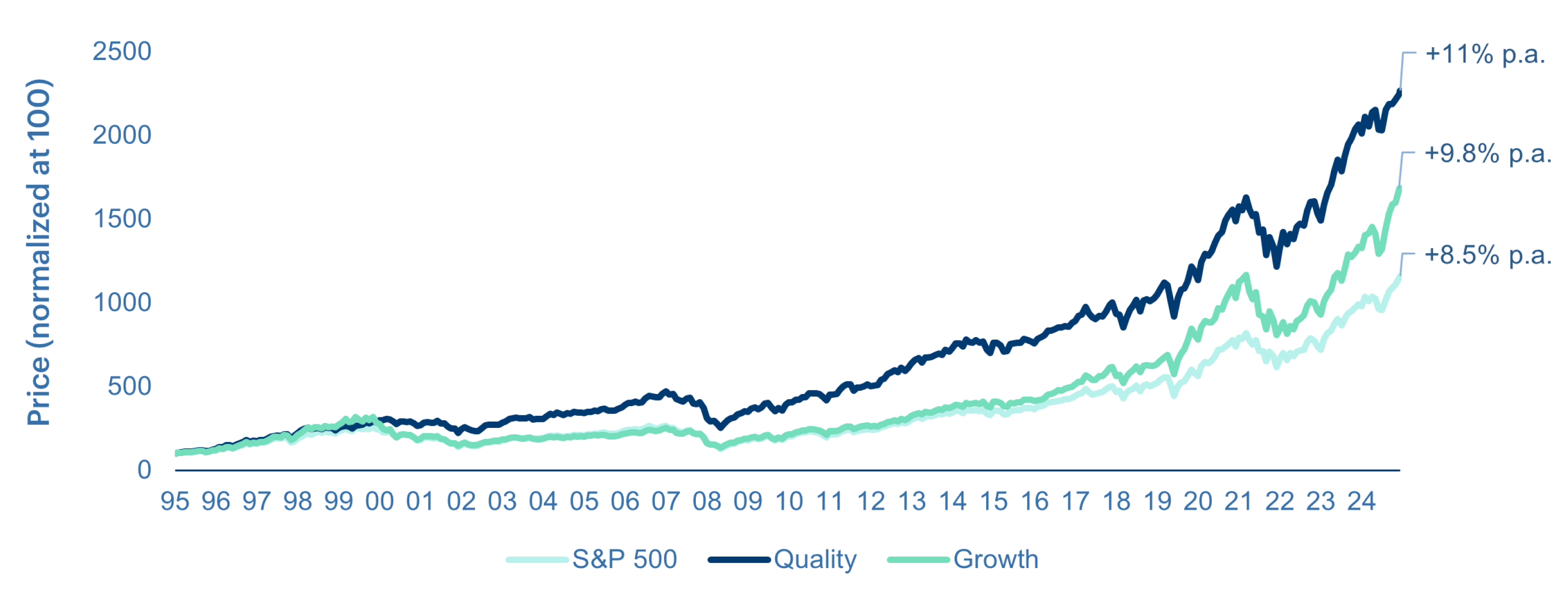

While quality may be out of favour in the current risk-seeking environment, history shows that it has won over the long run, ultimately delivering higher and less volatile returns (see chart below).

In today’s environment, selectivity is key. Investors need to be careful about which parts of the market they invest in – carefully distinguishing between quality companies with durable, monetizable advantages, and those whose share prices may be driven more by hype than by fundamentals.

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.