AI-fuelled exuberance has lifted technology’s share of the market beyond the dot-com peak and left benchmarks increasingly driven by a handful of mega-cap stocks trading on rich valuations. Caution is warranted.

Caution warranted amid market euphoria

There's no denying that markets are roaring. AI stocks have been surging, unprofitable tech firms are back in vogue, and speculative pockets have re-emerged with an energy not seen in years. From quantum-computing start-ups to loss-making software firms, investors seem happy to pay any price for the promise of exponential growth. Retail favourites like Palantir and Tesla now trade at valuations exceeding 200 times earnings – levels rarely seen outside the dotcom bubble. Cryptocurrencies and meme-stocks have also been attracting a wave of speculative flows. Have investors forgotten the lessons from 2021 and 2022?

Debt markets, too, are exuberant, and we’ve seen record-high corporate bond issuance. ChatGPT owner OpenAI has said it has over US$1 trillion of financial obligations to help build 30 gigawatts of data-centre infrastructure over the next few years. That’s a big commitment given the company only generates around $15 billion in annual revenue currently. That kind of ratio says much about the current mood – optimism bordering on exuberance. It may signal confidence in the future of AI, but it also shows investors’ willingness to suspend disbelief, at least for now.

Significant long-term potential, but does the math work for today’s investors?

This isn’t to say we are sceptical about AI’s potential. We see it as a game changer for business and personal productivity – much like the internet was. It will transform society and the economy in ways we can’t yet imagine but that doesn’t guarantee easy rewards for investors. As we saw in the early 2000s, many of the early dotcom names didn’t survive, and many of the big internet winners weren’t even listed on the share market in the late 1990s (e.g., Alphabet, Netflix, Meta, Uber).

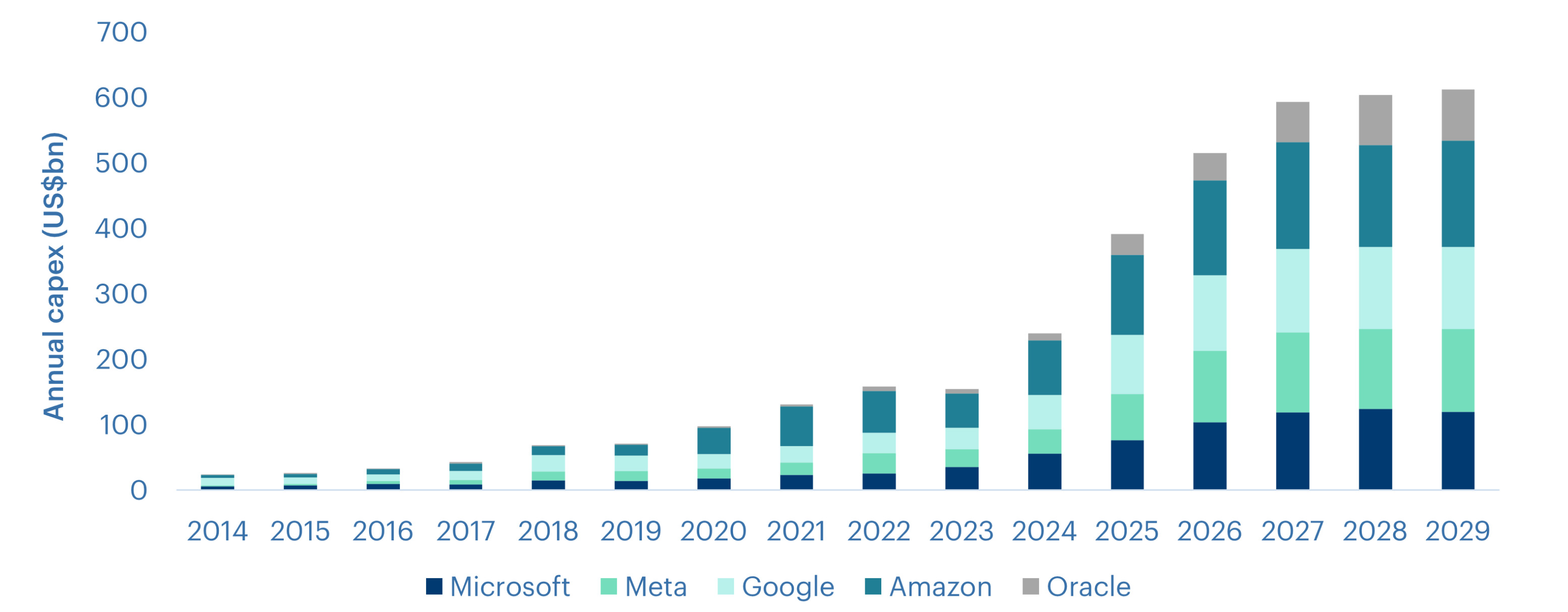

Market analysts forecast around US$3-4 trillion will be spent on building out AI infrastructure over the next five years. If this doesn’t happen, or if it happens more slowly than expected, the valuations of semiconductor, data-centre and other AI-beneficiary stocks could be sharply recalibrated downward.

Even if all this infrastructure is eventually developed, it is still far from certain that it will deliver an acceptable return on investment. Estimates suggest that over US$2 trillion in new industry revenue would be required to justify this investment by 2030 – more than the current revenue of Alphabet, Amazon, Meta and Microsoft combined. We’re not saying it’s impossible – but a lot must go right for investors to be adequately rewarded.

Quality lags

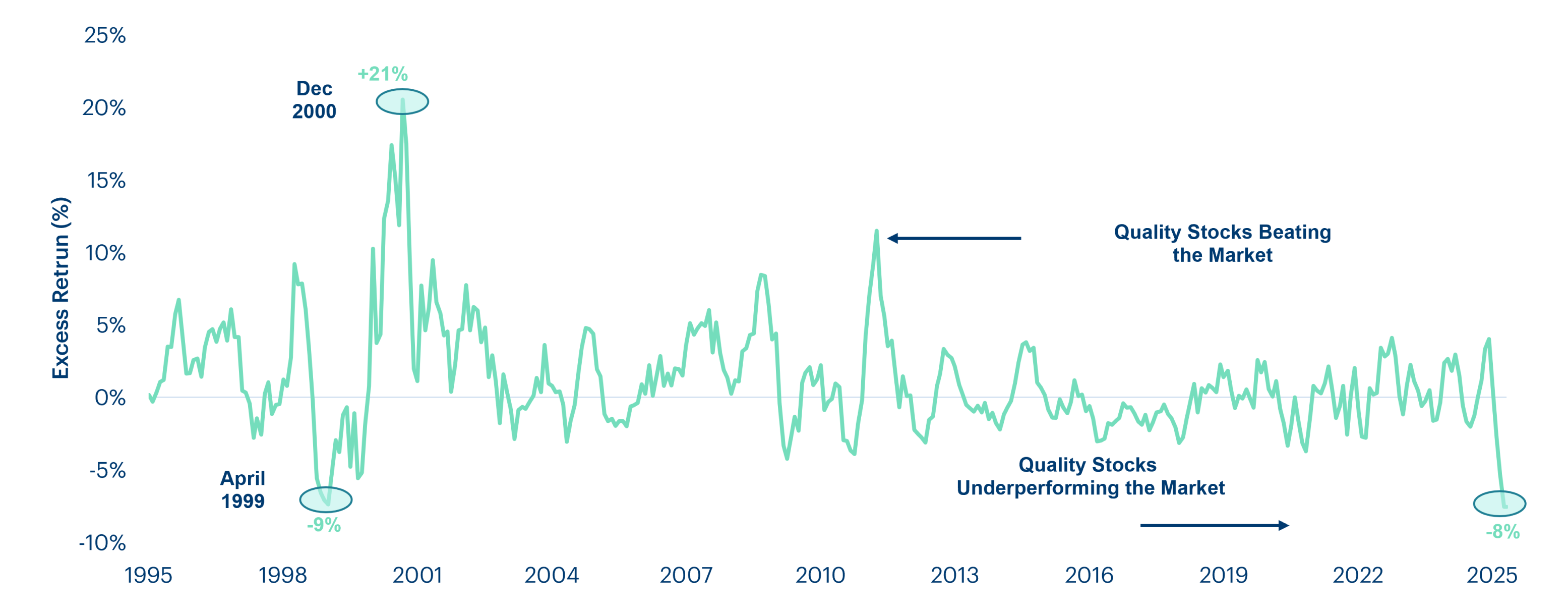

While excitement builds in the AI sphere, quality companies, those with strong balance sheets, durable earnings, and consistent returns on capital, have been left behind. By some measures, high-quality stocks like Visa, Costco and Coca-Cola, have lagged the market more than at any time in the last 25 years. The last time this happened was during the late-1990s tech bubble, when investors similarly crowded into a handful of growth names and ignored fundamentals. The pattern is familiar: valuation discipline erodes, story stocks dominate headlines, and prudent investing looks outdated – until it doesn’t.

Market concentration risk

A handful of firms have powered much of the market’s gains recently. In fact, since launch of ChatGPT in November 2022, about 75% of market gains have been driven by AI related stocks. While not necessarily a problem in isolation, concentration is higher than at any point in modern market history, and it is a risk factor to watch.

The top ten US companies(1), eight of which are mega-cap tech companies, now account for more than a third of the S&P 500’s total market capitalisation, and in many global benchmarks, the story is similar. This kind of dominance creates fragility. When market leadership narrows, breadth declines, and the fortunes of investors become increasingly tied to a small cluster of names.

The lesson: this isn’t the time to buy the index blindly. It’s a time to be selective, to understand not just what you own but why you own it.

What inning are we in?

As the American saying goes, no one knows exactly which inning we’re in. Bubbles rarely announce themselves, and exuberance can endure far longer than reason alone would suggest. As prior market cycles remind us, markets can stay irrationally strong well beyond traditional valuation limits.

The late 1990s dotcom mania carried on for years before bursting. In the last 6 months of the bubble alone, the Nasdaq Composite doubled in value.

Time for prudence

While this cycle could have further to run, particularly if AI continues to deliver tangible productivity gains, investors should resist the temptation to believe that momentum will protect them indefinitely. The higher valuations climb and the narrower leadership becomes, the greater the importance of investment discipline.

As stewards of client capital, our job isn’t to predict the precise top but to ensure portfolios can withstand the inevitable correction that follows periods of irrational exuberance. Choose carefully. Avoid speculative names, those trading at stratospheric valuations, and companies yet to turn a profit or prove their business model.

(1) Nvidia, Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, Broadcom, JP Morgan, Berkshire Hathaway

Talk to us

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.