Global share markets have proved buoyant in 2023, despite the list of issues still facing the global economy – from elevated inflation to the recent US debt ceiling overhang, as well as mortgage rates and cost of living concerns driving recessionary fears. Despite low investor expectations going into the year, global share markets are up c.+14% and tech-heavy indices like the Nasdaq Composite have gained over +30%.

As we discussed at our roadshows earlier this year, the elevated market volatility and dispersion in the market provided richer pickings for our team in late 2022 and the first half of 2023. This allowed our Portfolio Managers to reposition portfolios and add new companies at more attractive valuations. The team’s efforts here are starting to pay off and we remain optimistic about the outlook for our portfolios.

This backdrop has been supportive for many of our funds, which have delivered strong performance this year:

New Zealand Growth Fund: up +12.0% YTD (+7.7% ahead of the market benchmark)

Australian Growth Fund: up +13.6% YTD (+8.2% ahead)

International Growth Fund: up +21.7% YTD (+5.6% ahead)

A different set of investments leading the pack in 2023

In stark contrast to last year, the best performing asset class of 2023 has been global shares, with the US (+16%) performing particularly strongly. While cash or term deposits provided ballast in last year’s falling market, this year they have acted like an anchor, with returns on cash failing to outstrip the rate of inflation.

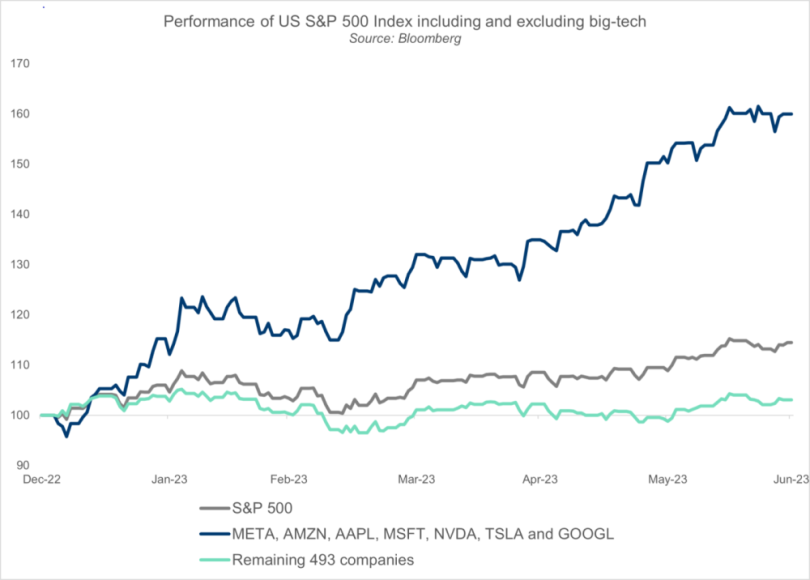

Last year’s outperforming sectors – Energy (due to surging oil prices) and Utilities (due to their defensive characteristics) – are lagging in 2023, with these sectors both down -7% year-to-date. In contrast, last year’s laggard, Information Technology, has rallied strongly with the S&P 500 IT Index gaining +42% so far this year. As the chart below shows, almost all gains in the US share market this year have been driven by just a handful of technology companies.

This reversal of fate should serve as a healthy reminder to not go chasing last year’s winners. In fact, investors are often better off investing in assets that are temporarily out of favour.

Beware of predictions

2023 is another good reminder of how unpredictable markets are.

Late last year investors were pessimistic. In a Bloomberg survey of market strategists in December 2022, the average prediction was for a fall in the S&P 500 Index in 2023. This was the first time in over two decades that the usually optimistic group predicted a drop in the US market. Just six months in and the S&P 500 is up +16%. And the tech-heavy Nasdaq index has had its best start to the year in over 40 years. Market predictions really are fraught.

With rapidly rising interest rates, a weakening property market and an increasing risk of recession, many commentators were starting to draw parallels with prior recessions (like the global financial crisis) and highlighting how much further markets could fall.

As an investor it is important to learn from history, but it is also important not to draw incorrect parallels. Being too confident in predictions about the market direction can be very dangerous. While selling up and moving to cash in 2022 may have felt safe, sitting on the sidelines for prolonged periods of time often proves costly for investors.

There is always uncertainty in markets. Be it the risk of war, recession or even the risk posed by over-exuberance and elevated valuations. Right now, there is still a lot of global economic uncertainty, with a real risk of recession in many markets. At the same time, bond yields are more attractive than they have been in a decade and equity markets also look reasonably priced.

The best approach for most investors is to take a balanced approach. Holding both defensive assets that provide ballast should the hypothetical risks eventuate, and growth assets like shares should these risks prove unwarranted.

Talk to us

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.