I have always found politics interesting, having combined my economics degree with politics at Otago University.

I expect this year there will be a lot of focus on politics both in locally and globally. The New Zealand election is fast approaching, and in the US, Joe Biden has confirmed that he will seek re-election as President in 2024. There will invariably be a lot of discussion about how any politician or party will impact the share market.

It is important to follow the politics of the countries you invest in. Over the long-term having a stable democratic system, clear property rights and a bureaucracy that still lets business succeed is critical. Poor governance and wild west markets tend to lead to poor long-term investing outcomes.

But too much focus on politics can also be detrimental. A company’s share price will be driven by its earnings growth over time, and a change in politicians, policies or heightened geopolitical tensions usually does not interrupt that.

Predictions and expectations

What makes political events hard for investors is they can be unpredictable and volatile, and even if the event was correctly predicted by investors, share markets might not react as the investor expected.

An example of this was Donald Trump’s election win in 2016. The polls didn’t expect Trump to beat Hillary Clinton to the White House. Even if you accurately predicted the Trump election result would you have bought or sold in the share market? Most thought a Donald Trump victory would be negative for the markets. A quick google search from October 2016, just before the election, shows headlines like, 'Economists: A Trump win would tank the markets' from Politico and 'The stock market doesn’t like the idea of a Trump Presidency' from PBS.

Instead of the market dropping like many predicted, the S&P 500 increased in value by 5% to the end of the year. The narrative changed from Trump’s election tanking the stock market to his policies of lower taxes, deregulation and fiscal stimulus being supportive for equity prices.

This example highlights that even if you predicted the event correctly, understanding the market’s expectation of that event is very difficult.

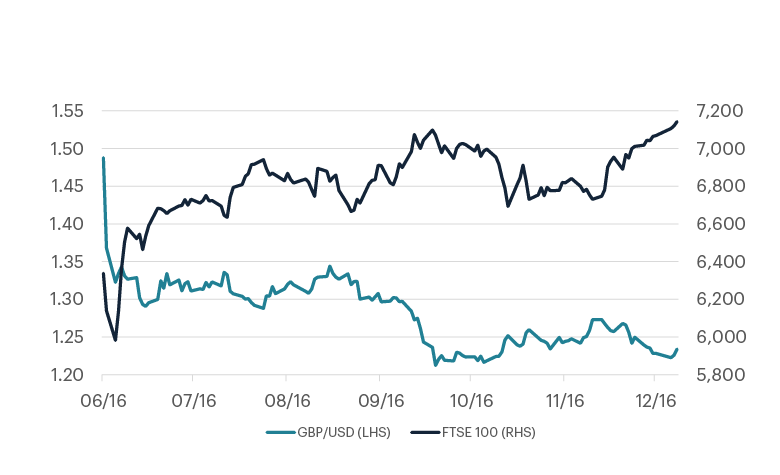

Earlier in 2016 a similar dynamic played out with Brexit when the UK population voted narrowly to leave the European Union. In the immediate aftermath of the referendum in June 2016, the FTSE 100 index dropped sharply, losing around 8% at its lowest point. This was due to the uncertainty surrounding the UK's future relationship with the European Union and the potential impact of Brexit on the UK economy.

However, the index soon rebounded as the British pound fell against the Euro, US dollar and other currencies, which benefitted the FTSE 100 index as its constituents earn around 65% of revenues outside the UK. By year end the FTSE 100 had risen 15%.

We can use the same analysis for major wars that have taken place since World War II. During the Korean War, Vietnam War and the Gulf War the S&P 500 average annual return was 15%, 7% and 12% respectively. If investors had taken a risk-off approach and moved their holdings to cash, they would be worse off having forgone significant returns.

Understanding what you own and why you own it still matters

There are times a political or geopolitical event will have a tangible effect on a specific company or industry.

For example, we own shares in Dollar Tree, a North American retailer whose profitability was hampered by Trump’s trade war with China.

The company’s stores are unique. For 35 years, the discount retail chain selling general merchandise and holiday inspired items, had held its fixed price point steady, pricing all its merchandise at $1.00. The company did this by constantly changing the items it sold and sourcing around 50% of its inventory from China.

In 2019 when Trump’s tariffs on Chinese goods had increased to 25%, Dollar Tree’s profitability was pressured as the trade war had a material effect on the company’s business. As a result, our investment thesis needed to change.

We retained our ownership of the company, believing that while the trade war was negative in the short term, it might provide the catalyst for Dollar Tree breaking the buck. The company eventually lifted its fixed price point to $1.25 and the share price responded favourably.

There are times however, when political changes do fundamentally change an investment thesis and necessitate an exit of an investment. For example, there have been times when changes in government funding in US healthcare has fundamentally changed the profitability for selected listed companies. If the facts change for a specific company you may need to change your mind.

Looking at political change through a corporate lens

These events all reinforce the fact that as an investor you shouldn’t make sweeping generalisations about the impact of political outcomes, which can be detrimental to your long-term portfolio performance. Instead, it’s more valuable for investors to look at political events through a corporate lens. How would this outcome impact the profit of this company, and what probability should I put on that outcome? Making sweeping changes to your investment based on political change is risky, and the odds of getting it right is no better than a coin toss – as we saw with Brexit.

Investors should instead focus their efforts on building a portfolio of high-quality companies with strong fundamentals and preferably a management team that have skin in the game thereby aligning their interests with shareholders over the long term. This is likely to be a more effective strategy for achieving good investment outcomes than investing based on your view on politics.

This article was originally published in the NBR on 2 May 2023.

Talk to us

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.