With the US stock market up around 17% from June lows, we question if markets have bottomed out and what this means for long-term investors. Is now the right time to be investing?

If you’re looking for a definitive answer to the question of when to start investing, you might be disappointed when I say that for long-term investors, any time is a good time to invest. You shouldn’t try to time the market but instead let the power of compounding do the hard work for you. As stock markets generally increase over time, the cost of sitting out the market can be high.

Nobel Prize winner William Sharpe found that a market timer must be right around 75% of the time to match a buy and hold return*. This is a success rate that even the best investors in the world could only aspire to. History shows us that most investors are not good at timing the market. Vanguard estimate that investors have lost 1-2% per annum from getting in and out of the market at the wrong times**. As famed baseball coach Yogi Berra said, “it's tough to make predictions, especially about the future”.

Pessimists sound smart. Optimists make money

To be clear, some caution is good in investing. Unbridled enthusiasm is what gave us the crypto bubble.

But too much pessimism can be a bad thing.

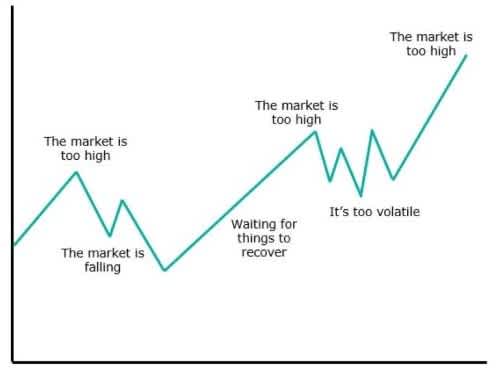

When markets are down it can be hard to invest. In fact, to the overly cautious, it can never seem like a good time to buy.

This seems counterintuitive to other purchases we make. If the price of our favourite chocolate was 20%, 30% or even 50% lower, we’d probably grab a bar or two. But when the stock market was off 20% earlier this year, investors hesitated.

This is human nature. Studies show that the pain of losing is psychologically twice as powerful as the pleasure of gaining.

When the news headlines are full of negative stories it can seem too risky to put money into the stock markets. But we would argue when everyone is pessimistic, investment risk is actually lower, as this pessimism is already in the price.

Just look at the recent months. If you had to guess how the stock market would perform in a ten-week period where inflation reached the highest level in decades, the Federal Reserve increased rates by 1.5% and the US entered a technical recession – most people would have assumed that they would have gone down. In fact, markets are up 4% since the start of June.

That is not to say things couldn’t get worse. But history is in your favour. As we said last month, in previous periods when the stock market has fallen by 20% (as it did back in May), around 85% of those times the market was up in the following twelve-months, and in every case market returns were positive after five-years, with a median return of 81%.

Time in the markets is far more important than timing the markets

There is a reason why optimism is generally the best approach to investing. Stock markets tend to go up in the long run. The US stock market has returned nearly 10% annually over the past 100 years and is up roughly 3 out of every 4 years, with almost 60% of all years gaining over 10%. Economic growth and innovation help drive higher corporate earnings, and over the long-run earnings drive stock market returns. Long-term you want to be invested in the markets. And this shouldn’t change when markets fall. In fact, the best performing days in the market typically follow the largest drops, and panic selling can both crystalise the loss and lead to missed opportunities on the upside.

Focus on what you can control

So don’t focus on the short-term or try to predict the unpredictable. Instead, control what you can. Which is understanding your long-term investing goals, putting a plan in place to meet these goals, and understanding how much risk you are willing to take.

Because it is these things that will ultimately drive your long-term investment performance, not trying to pick the next market move.

All investments involve some degree of risk. Markets and economies go up and down, and there will always be negative headlines in the news. There is no single way to invest that will guarantee to remove these risks while still generating the returns you need to meet your investment goals. But there is one way to guarantee poor results – and that is not investing at all.

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.

*William Sharpe, “Likely Gains from Market Timing”, Financial Analysts Journal, Vol. 31, No. 2, March-April, 1975, pp. 60 - 69

**Putting a value on your value: Quantifying Vanguard Advisor’s Alpha