So far in this 4-part newsletter series we have explained our unique investing style and the key pillars of our investment process. We have covered the sorts of companies we look for, the importance of these businesses having a durable competitive advantage as well as aligned and talented management teams. In our final article we discuss identifying businesses with materially underappreciated earnings potential. Businesses that can multiply in value many times over.

Price is what you pay, value is what you getThe best long-term investment outcomes have generally not come from businesses that looked cheap on traditional valuation metrics. They were often businesses that looked expensive but were materially undervalued relative to their long-term earnings potential. Well recognised international examples in this camp include companies like Amazon, Mastercard, Netflix, Google or Facebook. Examples closer to home are companies like Ryman Healthcare, A2 Milk, Xero or Mainfreight.

Common themes with these businesses were that (a) many investors avoided them because they appeared expensive, (b) they operated in large and growing markets and were taking market share, and (c) investors materially underappreciated their long-term earnings potential.

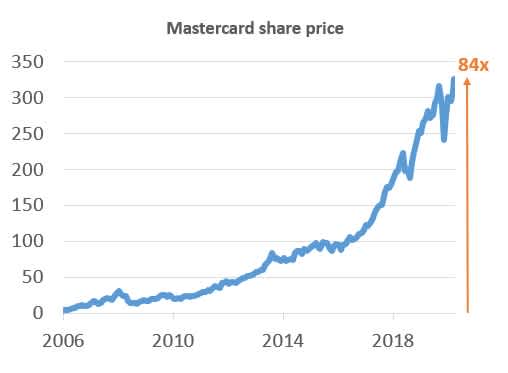

A great example of this is Mastercard, which listed on the share market in 2006. Shortly after it listed it traded on a price-to-earnings (PE) multiple of close to 30x - twice as expensive as the broader US market at the time. Although it appeared expensive on this short-term valuation metric, it was actually a bargain. Since IPO Mastercard’s share price has increased 84-times, from $3.90 to $326 per share! A $12,000 investment in 2006 would now be worth over $1 million dollars.

Despite being a household name and having a well-known growth story. Investors simply underestimated the structural growth drivers behind digital payments and the potential for Mastercard to expand its margins year after year.

Underappreciated earnings powerAs an investor it is easy to become short-sighted and focus on current news, corporate developments and fluctuations in near-term earnings. But because many other investors are focused on these same short-term developments there is limited opportunity to profit from them. Instead, focusing on what a company could earn in 5 to 10 years can provide an investment edge, while short-sightedness can result in investors missing great opportunities for two reasons.

Firstly, there are businesses that are intentionally underearning so they can invest in new products and maximise future earnings. We see this with Amazon, who chooses to earn low margins by offering free and fast delivery to win more customers and reap the rewards later. Secondly, there are businesses that simply have multi-decade growth runways. Investors often undervalue these businesses and may only give them credit for a few more years of strong growth. MasterCard is a great example of this.

Occasionally you find a business that meets both criteria. Their current earnings power in obscured in some way, and they have a very long and underappreciated growth runway.

Alphabet’s future earnings power is materially undervalued

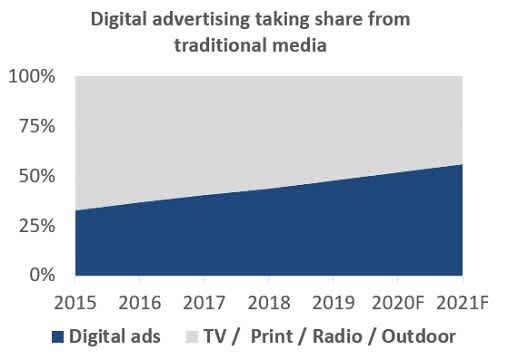

We are becoming addicted to our mobile phones, turning to them dozens of times a day for information and entertainment rather than reading the newspaper or watching TV. Despite this shift in consumer behaviour, less than half of advertising dollars are spent on digital platforms like Google and Facebook - with the majority still being spent on inefficient tradition media channels like TV and radio. Advertisers are behind the curve and need to adapt.

This adaption is happening gradually and as a result the digital ad market is growing at almost 20% per annum. As the dominant online player in search advertising and the owner of YouTube, Alphabet will almost inevitably grow for many years as this advertising shift continues.

While the exact pace of this shift is hard to gauge, a slower shift wouldn't be the end of the world for Alphabet. Our analysis suggests that other investors are assuming that digital advertising grows to 55-60% of the total advertising market and then growth slows drastically to c.3% per annum. We think this is conservative for a number of reasons. Firstly, the total advertising market has grown at c.5% per annum historically (in-line with nominal GDP growth) and digital is likely to continue growing materially faster than the broader market. Secondly, in an online world where you can only reach customers by paying for their attention via Google, Facebook or ecommerce marketplaces like Amazon, we are likely to see more and more competitive tension for advertising slots as advertisers fight for customers. All considered we believe the market is underestimating Google’s long-term growth runway.

The second part of the investment thesis for Alphabet is that the earnings and profit margin potential of its core business is underappreciated. Alphabet is currently spending money on a number of its ‘other bets’, which are yet to make a profit and are dragging on group earnings. Alphabet’s loss-making Other Bets segment includes projects like driverless cars (Waymo) and connected homes (Nest). They are also still investing in building a cloud services business to compete with Amazon and Microsoft, which is dragging on current profitability.

Adjusting for some of these investments we suspect Alphabet’s underlying earnings would be 10-15% higher. Alphabet also has over $100 billion of cash on its balance sheet and other business that could conservatively be worth $50 billion. Adjusting for these items, we believe that Alphabet is significantly undervalued and its core Google and YouTube businesses trade on an implied PE ratio of 17-18x. This is cheaper than the broader US share market, which trades on a PE ratio of 20x, despite Alphabet growing its revenues three times as fast as the average US company (c.15% pa vs 5% pa). We believe the business is significantly undervalued.

Google and YouTube are materially undervalued (c.17-18x earnings)

when adjusting for the investments they are making in new growth areas

Advertising businesses

Loss-making growth

investments

Our three pillars: Moats, management and underappreciated growth

Making long-term forecasts and trying to identify businesses with under-appreciated growth potential is fraught with difficulty. It should always be done with humility and a healthy dose of scepticism. The difficulty we all have seeing too far into the future reinforces the importance of the first two pillars of our investment approach we discussed in Part 2 and Part 3 of this newsletter series. That is, the importance of a business having a wide economic moat (to keep competition at bay) and a talented and aligned management team. The first two pillars help reduce risk, while underappreciated growth is what drives long term share price outperformance.