If you thought they would be out of your pockets for good after leaving home, think again! High house prices and rising interest rates mean our children will probably still need help.

We all want the best for our children and grandchildren. Helping them into their first home, paying for their education, or buying their first car, are great ways to give them a leg up in life. But how do you help them out without having to put a big dent in your own savings?

First home deposits are getting harder to save

The average 20% deposit that is required for a first home is now sitting around $150k nationwide, and for a fresh faced 20 something, or even a slightly less fresh 30 something, that is a huge amount of cash to come up with! With the cost of living steadily increasing, paying off student loans, saving for their OE, and anything else they might want in life, trying to save that much is going to be a tough ask for our kids.

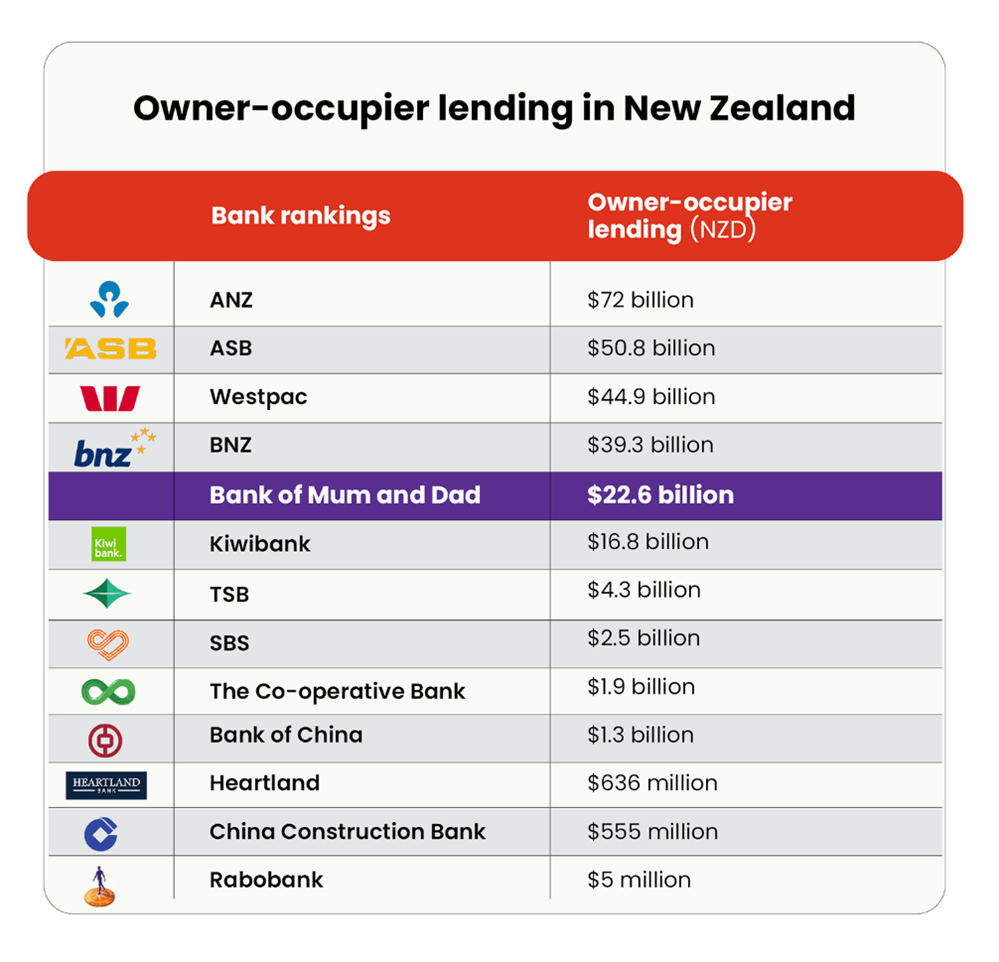

This is where the fifth largest lender in New Zealand has been stepping in, “the Bank of Mum and Dad.” A recent report from Consumer highlighted that parents have handed out $22.6 billion in loans to their children to help get their feet on the property ladder. That makes parents the fifth biggest owner-occupier lender in New Zealand, ahead of Kiwibank and TSB!

Source: Consumer NZ – The Bank of Mum and Dad

Help your kids without jeopardising your own financial future

Early planning is the key. If your kids or grandkids are still young, you have time on your side. You could put your money to work by either investing an existing lump sum or by investing smaller amounts on a regular basis.

If you do have a lump sum available to invest now for the longer term, then a managed fund is a great way to grow the value of this money over time. Alternatively, you can invest into our range of managed funds regularly for as little as $100 per month. Either of these options is likely to be more appealing than having to dip into your personal retirement savings or home equity which could impact your own financial future.

These approaches mean you will be able to enjoy the benefits of compounding returns over time. It is amazing how investing over a long period of time can produce a considerable sum – especially when the amount our kids will need for a deposit is likely to keep on increasing!

A great educational opportunity

Planning early also allows you to define the end goal and form a strategy to get there over time. You can involve your children in the planning and encourage them to contribute as well, instilling them with a lifelong ‘investor mindset’ and savings habit. Financial literacy is such an important part of life and teaching our children early will help to set them up well for the future.

Good options for setting your children up

Managed funds are a very simple and flexible investment option. They can be held in your own name, jointly with your children, or even in your children’s names only (it’s worth noting with the latter option, this makes it their investment and when they get old enough, they can do whatever they like with it!). With our range of funds, you can invest in a mixture of growth assets (such as shares and property) and income assets (such as cash and bonds), depending on your timeframe, goals and risk profile. For example, if you’re investing for a longer period (5 years or more) then having a higher allocation to the more growth-oriented assets may be appropriate to benefit from higher expected returns.

You can also set up your children with their own KiwiSaver account. Some of the benefits of KiwiSaver, such as Government contributions, don’t kick in until they’re over 18, but there won’t be any temptation to spend the funds on other things as KiwiSaver is generally only accessible for their first home purchase or retirement.

Get in touch and start planning now

If you’re considering ways to help your kids without impacting your own retirement plans, get in touch with one of our Advisers today, we’re always happy to help.

Want to find out more about managed funds? There's lots of information on our website here.