The last year was one of sudden, dramatic market upsets. But market volatility – sudden upswings and downswings – is more common than we may think, and a fact of life for investors. The key to surviving volatility is sticking to your investment plan and seeking advice when needed.

We have just passed the one-year anniversary of the 2020 COVID-induced share-market rout. The New Zealand market fell 30% from its February peak to March trough. The US S&P 500 fell 34% in just over a month, the fastest sell-off in US market history.

The scale of the market falls, and the stimulus-fuelled rebound, have been equally dramatic. A year later, parts of the global economy are booming. New Zealand’s NZX 50 Index is up 47% and the S&P 500 is up over 80%.

One year on, it is time to take stock.

Volatility is a fact of market life

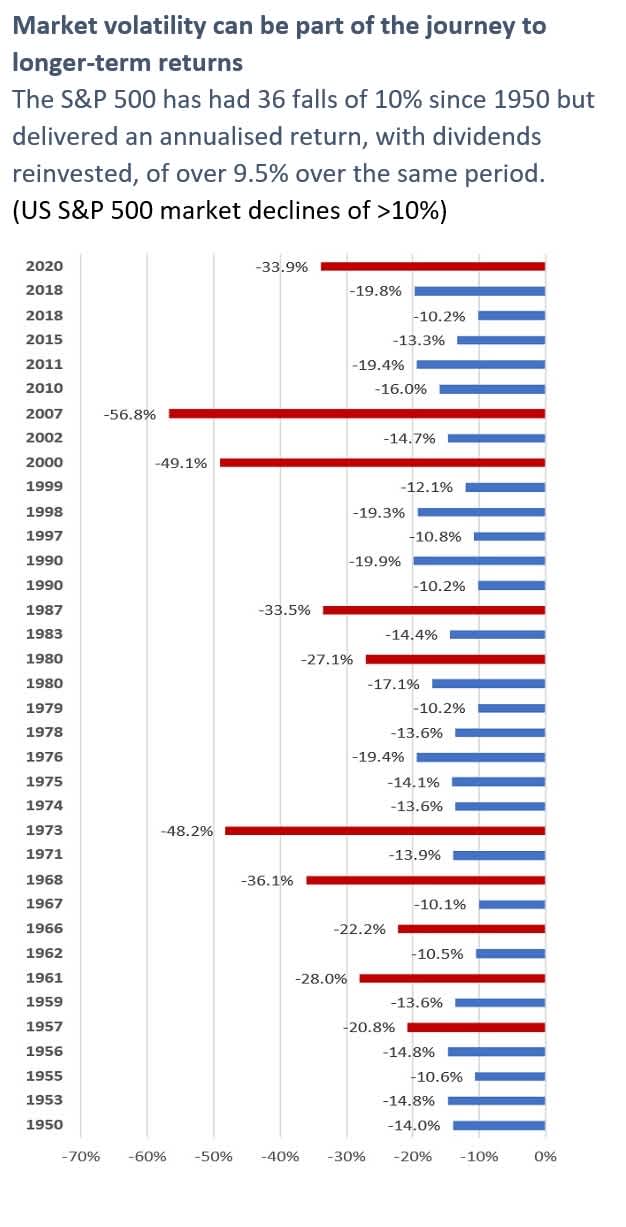

Market volatility can be part of the journey to longer-term returns. The S&P 500 has had 36 falls of greater than 10% since 1950 but delivered an annualised return, with dividends reinvested, of over 9.5% over the same period.

Markets are, by their nature, beset by boom and bust. Wars, oil-price hikes, credit crises, terror attacks and pandemics create shocks more regularly than you might think. This means that volatility is part and parcel of investing, and investors must accept some volatility to earn higher long-term returns.

Fortunately, COVID-level volatility is relatively infrequent and driven by the uniqueness of the situation. We had never seen the sudden, global closure of stores, businesses, schools and borders. Not even during wartime. Fear, job losses and sensationalist media coverage all pushed markets lower, and created further panic.

Attractive long-term returns despite bear markets

While 30% market slumps aren’t common, they do happen. The US S&P 500 has had six since 1950, along with 36 market corrections of 10% or more. Plus 10 bear-market falls of 20% or more — one every seven years

Despite these events, the share market has still delivered attractive long-term outcomes for investors. For example, since 1950, the US S&P 500 delivered an average annual return of over 9.5%. Enough to turn $1,000 into over $500,000 over 70 years.

Most people will experience several bear markets during their investing and working lives. But while volatility is part and parcel of investing in share markets, investors can limit the damage volatility does to their returns.

Investor behaviour can do more damage than market volatility

What hurts investors are knee-jerk reactions based on fear, not market volatility. Markets typically recover from corrections, and investors who stick in there for the long-term have been well rewarded.

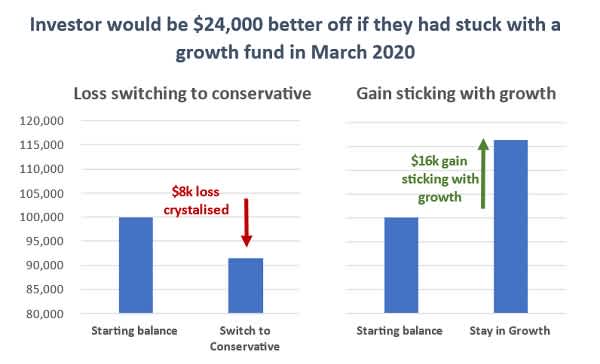

Over the last year, we have all read stories about investors who panicked and sold their investments in March 2020. Or who switched from a KiwiSaver growth fund to a conservative fund – locking in losses and missing the rebound in markets.

Let’s look at a KiwiSaver example. An investor with $100,000 in a KiwiSaver growth fund in January 2020 would be $24,000 worse off at the end of March 2021 if they had switched to a conservative fund on 23 March 2020, as markets reeled. If they had stuck with the growth fund, they’d current have a balance of over $116,000, compared with just $92,000 if they switched.

Thankfully, there are also many stories of investors who did the opposite, and stepped in as the market fell. An investment of $10,000 in the NZX50 on 23 March, 2020 would now be worth over $14,500. And a $10,000 investment in the US S&P500 would now stand at over $18,000.

But we are all human, and knee-jerk reactions to losses are common. Wise investors will take steps to avoid making these mistakes in future bear markets.

Have a plan, pick a fund that suits you, and think long-term

The volatility of the last year has reminded investors how important it is to have a financial plan. In many cases, market upheavals prompted clients to get back in touch with their KiwiSaver providers. We hope providers reinforced the message that investors should stick to their long-term plans.

Investors should have a plan in place for their retirement, save regularly – and accept that volatility is part of their wealth-building journey. Accepting volatility helps investors take a long-term view when the inevitable market shocks arrive. And investors who really internalise these lessons can use market volatility to their advantage — as we saw some of our clients do last year.

Investors also need to make sure they are in the right fund. Their fund should match their stage in life, and their risk appetite. For most investors, saving for retirement that is many years away, this means a growth fund. But investors who are more risk-averse, or nearer retirement, may sleep better at night if they are in a more conservative fund.

As always, we are keen to chat to make sure you are in the right fund. Wherever you are on your journey, we have an investment plan that suits you and your investment goals.