Complacency can be a dangerous thing. For sports teams, in business, but also for investors. When returns have been good and markets seem to only go one-way, it can be a good time to check in on your portfolio, and your expectations.

Nothing gets people thinking about their portfolio more than a major share market crash! In a crisis many investors check their portfolios and call their advisers more regularly. Share market trading also spikes materially. Behaviourally this makes sense, given investor anxiety spikes in turbulent times. But the opposite is also true, and investors can become complacent in periods of low market volatility. Market corrections are not an ‘if’, but a ‘when’. Will it be caused by Federal Reserve tapering later this year? Or interest rate hikes? Or problems in the Chinese property sector? Nobody knows the answer to these questions, but that doesn’t mean you can’t be prepared.

One-way traffic

We have had an unusually subdued period in markets for 18 months now. The US share market has doubled since its lows during the Covid-driven sell-off in March last year, and it hasn’t fallen by more than about 4% from its peak at any stage this year. Ignoring the short-lived sell-off in March last year, we are over 12 years into one of the biggest bull markets in history. One-way traffic like this can breed complacency.

We are now seeing signs of this complacency in parts of the market. Some investors are starting to think that share prices only go up. Driven by a fear of missing out, investors can start to jump from one bright and shiny object to the next - focusing far more on the potential for gains than on the potential risks. Electric vehicle stocks, biotech and genomics plays, cryptocurrencies, NFTs, meme stocks – the list goes on. But even outside of these pockets of exuberance, investors are flocking to the market in record volumes.

When times are good, it can pay to check your expectations, and ensure you are comfortable with your portfolio should volatility resurface.

Checking your expectations. The road may be bumpy

Over the long term the share market has delivered great outcomes for investors. The New Zealand share market has delivered a return of 10% per annum since the NZX 50 Gross Index was created in early 2001. Over the last 100 years, the US S&P 500 Index has delivered a return of 9.7% per annum including dividends. Over the long term, we would still expect the share market to deliver good returns – particularly relative to those on offer at the bank.

But markets don’t go up in a straight line and there are often hiccups along the way. Investors need to make sure they aren’t positioned so aggressively that they panic when one of these inevitable setbacks occurs.

The table below shows just how regularly the market suffers setbacks. You should expect a 5% fall in markets roughly every 9 months, a 10-19% correction every 24 months, and a 20% plus decline (a bear market) about once every seven years. Note, we have used the US share market here because there is better long-term data available.

How regularly does the share market plunge?

Event | Average frequency |

|---|---|

5% market decline | 9 months |

10% market correction | 2 years |

20%+ bear market | 7 years |

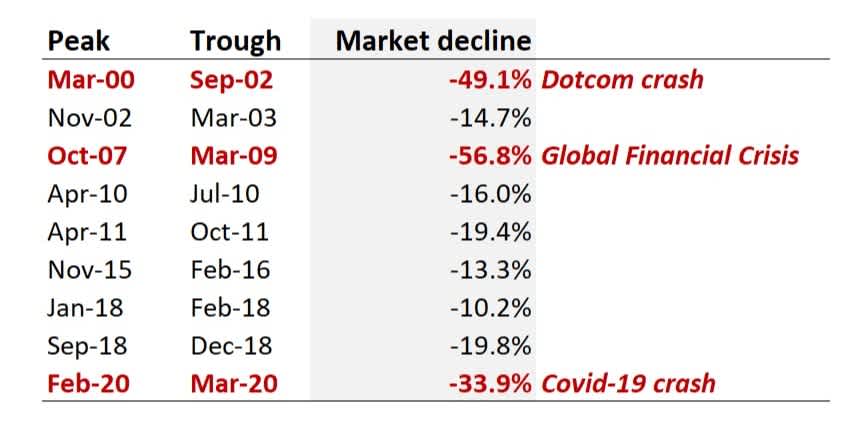

Looking at share market corrections since the turn of the century is also helpful. The table below shows all 10% or greater market corrections over this period. There were three declines of 33% or more and six other market corrections of more than 10%. Not included in the table are the other 19 times markets fell by more than 5% from their highs.

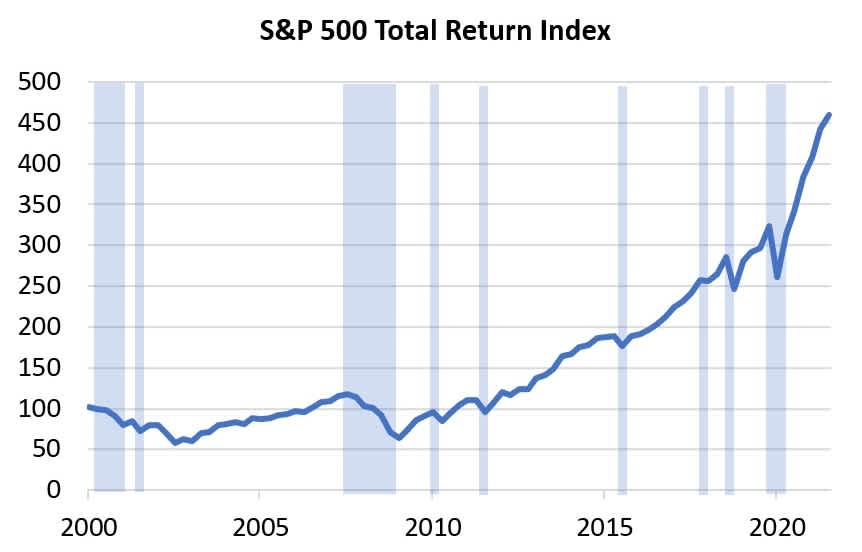

The chart above simply shows these events graphically. While there has been lots of market volatility over the last two decades, an investor that could stomach this volatility has done very well indeed. Despite a terrible starting point (just before the dotcom crash), $10,000 invested in the US market at the turn of the century would now be worth over $45,000. The maths work out even better for the New Zealand market.

Making sure you get to the long term

Investors shouldn’t be concerned by these market volatility statistics, just aware of them. Growth assets like shares and property can deliver materially better outcomes for investors over the long term. Awareness that market volatility comes part and parcel with wealth creation can help investors hang in there during inevitable setbacks.

So ask yourself, would you be able to hold tight during a 10% market correction? How about a 20% decline? While markets are going well, it is a good time to check in and make sure you have the right portfolio for you - one that suits your risk tolerance and investment timeframe.