Amazon is one of the rare companies that meets all three of our investment criteria. It has a wide economic moat, long-term focused management, and a very long runway for growth. We believe Amazon is in pole position in both e-commerce and cloud computing – two industries that are still in the early stages of growth.

History shows that over the long-term, a significant amount of equity market returns can be explained by a handful of companies. Our aim is to identify these value creating companies by executing our investment process.

As we have recently covered in a series of articles, there are three key attributes common to many value creating businesses. These are:

Wide economic moats. This refers to a business’s ability to keep competitors at bay and protect its profits over the long-term

Management teams that have significant ‘skin in the game’ and a history of making decisions that prioritise long-term value creation over short-term gains

Underappreciated earnings growth potential

We currently own shares in Amazon. The company’s share price has had a phenomenal year as Amazon’s two main businesses, e-commerce and cloud computing, have both benefitted from a significant pull forward of demand due to covid-19. This backdrop provides a good opportunity to revaluate our investment thesis and overlay the three pillars of our investment process.

A formidable moat that is getting wider

Amazon’s economic moat or competitive advantage is best explained by scale, and how that drives what the company terms as its flywheel.

Both the e-commerce business and cloud computing require significant up-front investment in fixed costs. But as these costs are spread across a growing number of users, the cost per users falls. Amazon’s scale allows it to provide a better service more cost effectively. For example, the recent introduction of one-day US shipping for e-commerce purchases by Amazon required significant upfront investment. But by improving the customer experience and driving increased usage they can reduce the cost per user to a level competitors can’t achieve.

This huge scale widens Amazon’s lead over competitors and its peers cannot compete with Amazon’s level of investment. Amazon Web Services (AWS), the company’s cloud computing segment, has similarly developed cost advantages thanks to scale. AWS has shared these lower costs with customers, reducing prices on average 7.5x per year. Lower prices mean more customers and increasing AWS usage, which again lowers infrastructure costs and allows for sharper prices – driving Amazon’s flywheel faster and faster.

A long-term focused management team

Amazon’s management team ticks all the right boxes. Not only does its founder Jeff Bezos have significant skin in the game, but all the senior management team have been with the company roughly 15-years and have considerable share ownership. The company has a track record of forgoing short-term profits in favour of long-term value creation. This is evident with Amazon’s investment into fulfilment and distribution, prime subscription, and cloud computing. Because they initially dragged significantly on profitability and took years to bear fruit, these are the sorts of investments most businesses avoid.

Underappreciated earnings potential

Amazon’s current market capitalisation is around US$1.7 trillion. We think by 2030 Amazon’s e-commerce and cloud computing businesses could be worth US$4 trillion. This would provide a 10% annual return, although its unlikely to be a straight line up and to the right. Some years Amazon will underperform the market and in others the company will significantly outperform.

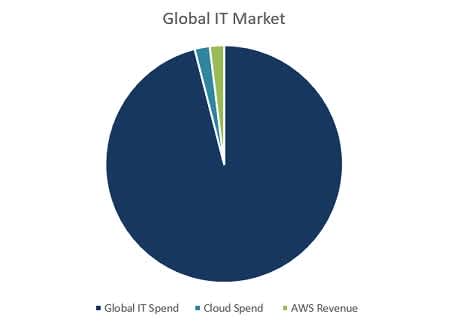

In both of Amazon’s core businesses the addressable markets are huge. Global retail is a US$24 trillion industry and global IT is a US$2 trillion industry. Both e-commerce and cloud computing are a growing slice of the pie and Amazon has the leading position in both. We believe the long-term economics of both industries are attractive.

In addition, Amazon also has numerous other businesses, including Whole Foods, Prime, Twitch and Amazon Marketing Services. The latter is growing revenue at 45% per annum and likely to become highly profitable.

Amazon is just one example of a company in the portfolio that meets all three of our investment criteria: moats, management, and underappreciated growth. By identifying companies with these attributes we believe investors give themselves the best opportunity to find the handful of companies that will deliver sizeable long term gains.