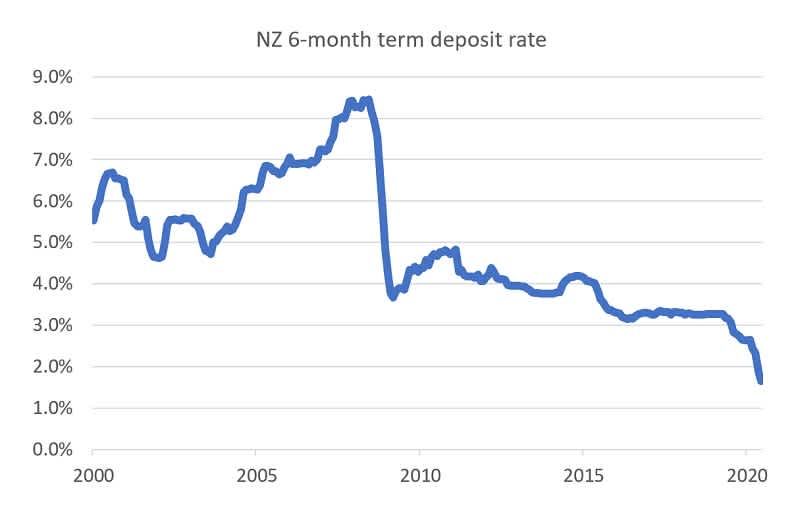

Low interest rates have upended retirement planning for many New Zealanders. With term deposit rates well below 2% they will no longer provide a sufficient retirement income stream for many investors. This has significant implications for those in retirement, but also for those preparing for it.

Central banks vow to keep interest rates low

July was another strong month in global share markets with the MSCI World Index up 4.7%. Markets were buoyed by data showing a strong rebound in consumer spending and an improving economy as COVID lockdown restrictions have eased. Employees have been returning to work, businesses have reopened, and consumer spending is almost back to pre-pandemic levels.

Despite this early economic optimism, interest rates have stayed stubbornly low as central banks around the world vow to hold interest rates lower for longer. This time around they have stated a desire to see a strong economy and significant inflation before they increase interest rates. This could see interest rates stay at depressed levels for many years. Based on this more relaxed approach to inflation targeting, the inflation-adjusted return on term deposits is likely to be very mediocre even if interest rates do eventually increase.

This lower-for-longer environment creates significant challenges for retirement planning.

Investors not savers

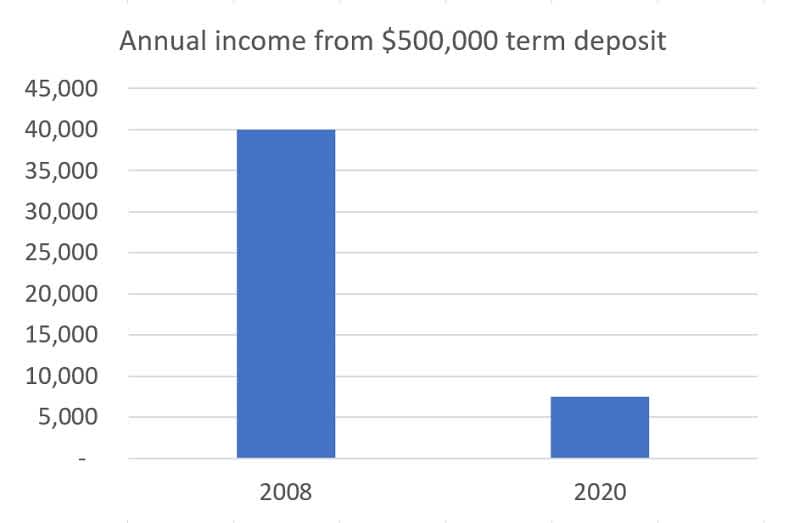

Prior to the global financial crisis New Zealanders could simply squirrel away money in term deposits and earn a reasonable income in retirement. Back in 2007 when term deposit rates in New Zealand were over 8% a $500,000 term deposit would create $40,000 in annual retirement income. With a six-month term deposit rate of 1.5% today this same deposit would generate just $7,500 a year in income – or less than $150 a week before tax.

Another challenge (although a great one to have!) is that we are all now living longer. This means we need to stretch our retirement savings further. On top of this, significant costs for retirees like property rates and healthcare are continually growing faster than inflation.

The reduced income provided by term deposits, combined with the need for a larger retirement nest egg, means that simply relying on term deposits is no longer a viable retirement option for many people. Squirrelling away money in term deposits will no longer work. People now need to think like investors, not savers. Thinking like an investor requires a different mindset and willingness to accept a little bit of short-term volatility to achieve higher returns and greater income over the long term.

Portfolios need to adapt

Investors around the world have already changed their investment strategies in response to this challenging investment landscape. Low rates in these markets have resulted in changes to many long-held investment policies. US pension funds have increased their share market and private equity exposure in recent years and reduced their exposure to low-yielding government bonds. These same funds have also increased their exposure to asset classes like infrastructure and real estate.

Many US financial advisers have also changed their age-old recommendation to clients on the optimal mix between shares and fixed income investments. The old 60/40 portfolio (60% shares / 40% bonds) advisers recommended in the past has been changed by some to include a 65-70% allocation to shares instead – to help clients’ retirement savings last longer.

How should New Zealanders react?

The solution for many New Zealand investors is relatively straightforward. A number of New Zealanders that we talk to (particularly those in retirement) have a significant portion of their liquid wealth in bank deposits. Most don’t have the 60% of their portfolio in shares that financial advisers have traditionally recommended. Until recently this wasn’t a major issue for savers. In fact, it was a viable strategy given the high returns that were available through term deposits for limited risk. But in the current environment investors should reconsider their dependence on term deposits - and consider a more balanced portfolio that includes both fixed income and share market investments.