Choosing the right fund, selecting the correct tax rate and adjusting your contribution rate are a couple quick changes that could have a long term impact on your KiwiSaver investment.

If you have been enrolled into KiwiSaver by the Inland Revenue and you haven’t chosen a fund, you are likely in the default fund. Being in a default fund means three settings have likely been automatically applied to your account:

Your money is invested in a low risk, low return fund (Cash Enhanced Fund).

If you are employed, you are contributing the default rate of 3% of your income

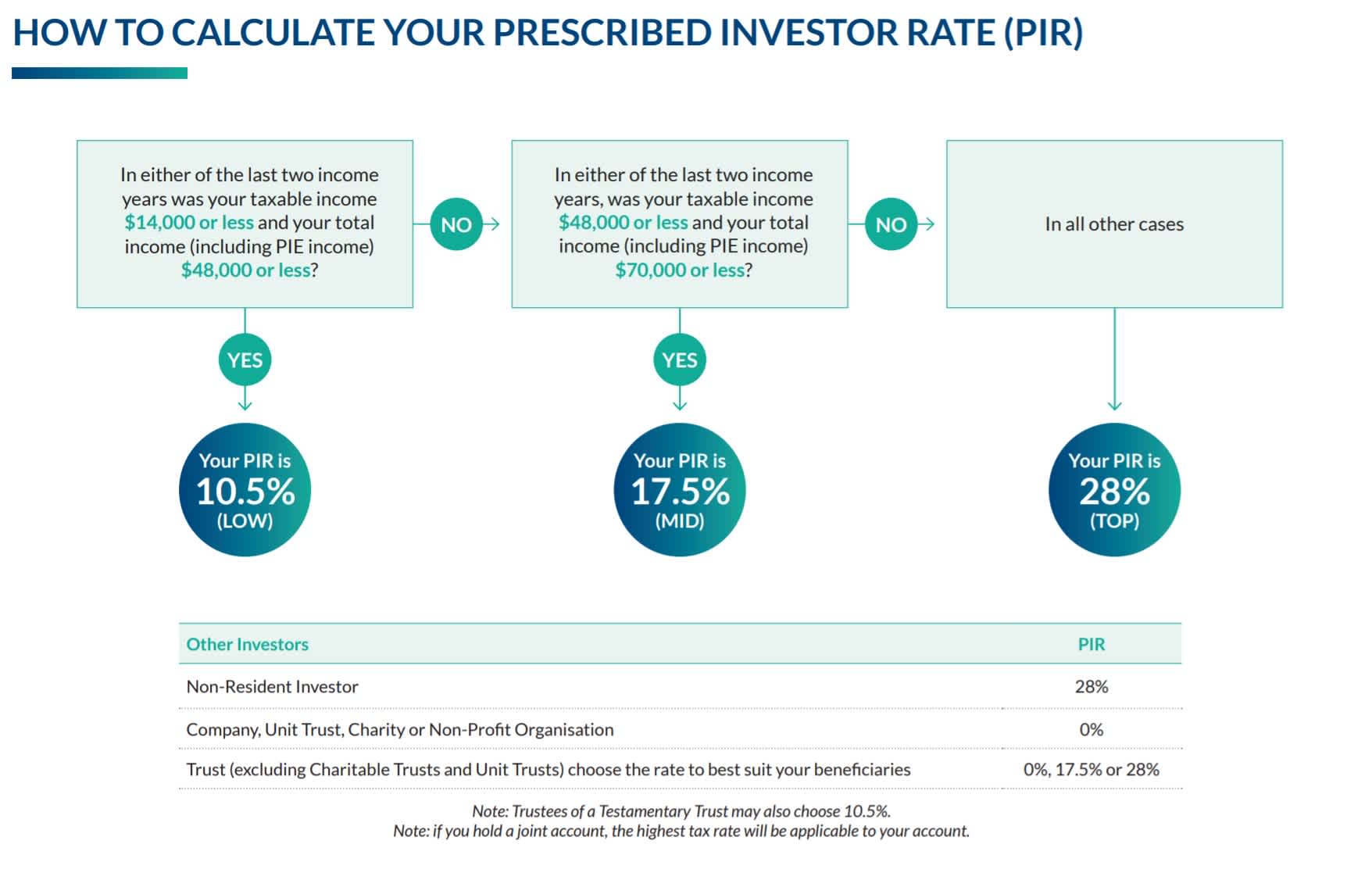

You have been placed on the highest tax rate (Prescribed Interest Rate) of 28%

Find out more about making active choices in your KiwiSaver investment below. If you need any help, feel free to contact us on 0508 347 437, or via email.

Choosing the right fund for you

There are three key things to think about when you select your KiwiSaver fund; your age, the length of time you are investing, and how comfortable you are with risk. Senior KiwiSaver Specialist, Carly Bartlett explains in the video below

Fisher Funds TWO KiwiSaver Scheme has six funds to choose from. To make it easy we have three high level approaches available, with conservative, balanced and growth strategies. We also offer GlidePath, which is a lifestages option. To put it simply, with Glidepath we'll automatically adjust the way your money is invested depending on your age.

Picking the right strategy for you is easier than it sounds, the first step is to complete our online Investor Profile Questionnaire, you can then update your strategy via Fisher Funds online. Alternatively get in touch with the team on 0508 347 437 or via email, we can discuss your investment goals and timeframe to help you make a decision that suits you.

Our Strategies

Conservative Strategy

Aims to provide stable returns over the long term by investing in mainly income assets with a modest allocation to growth assets.

Who is the fund suitable for?

A short term or naturally cautious investor:

Nearing retirement

Looking to make a withdrawal within the short term

Values lower volatility of returns over achieving potential higher returns

While this fund is designed to be conservative in nature, in times of heightened market volatility the value of your investment may go up or down.

Balanced Strategy

Aims to provide a balance between stability of returns and growing your investment over the long term by investing in a mix of income and growth assets.

Who is the fund suitable for?

A medium to long term investor:

Wants a balance between volatility of returns and achieving potential higher returns

Growth Strategy

Aims to grow your investment over the long term by investing in mainly growth assets.

Who is the fund suitable for?

A long term investor:

Ok with volatility of returns in the expectation of potential higher returns

Has time on their side

GlidePath

GlidePath is our smart service that takes the hassle out of investing. With GlidePath your savings are automatically invested in a mix of funds that change based on your age. It’s designed to reduce your investment risk as you get older. We will adjust what funds you are invested in each year automatically within three months of your birthday.

Who is GlidePath suitable for?

Really suits investors who want less fuss

Those comfortable with letting us change their investment in funds based on their age over time.

GlidePath may not be suitable for someone saving for a first home.

Make an active choice today, contact us via email or on 0508 347 437 to make quick updates to your account. Or access your account online with Fisher Funds Online.

Being on the right contribution rate

When you are placed in the defaut fund, your contribution rate is set to 3%. As a KiwiSaver member, you can choose to contribute more if you wish, contribution rates are 3%, 4%, 6%, 8%, and 10%. Increasing your contribution rate now could make a huge difference in your KiwiSaver investment when it comes to retiring or making your first home withdrawal.

If you are employed, you simply need to notify your employer that you wish to change your contribution rate when you wish to do so. If you are not contributing from your salary or wages, the Fisher Funds TWO KiwiSaver scheme has no minimum contribution rate, so you can set your own amount.

Ensuring your tax rate is correct

You don’t want to pay more tax than you need to. Check your prescribed investor rate (PIR) using the chart below. If your PIR is 10.5% or 17.5% then you need to get in touch with us to make the quick change, or you can login to Fisher Funds Online and update your PIR via your account. Register here.

To find out more about choosing a KiwiSaver fund or to answer any questions you have, feel free to contact us on 0508 347 437 or via email.