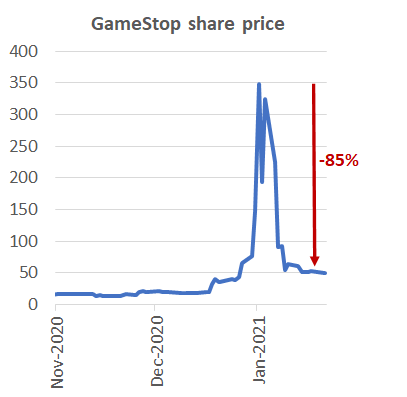

A friend of mine called a few days ago, sounding a bit sheepish and wanting to talk about a US listed company called GameStop. Uh-oh I thought. The GameStop that has just seen its share price fall 85%? He assured me it was just a bit of fun speculation and he was using money he could afford to lose. Phew I thought... But then he asked me how he could now get the money back - should he hold on until the share price recovers, or perhaps even buy some more shares at this lower price?

Countless other investors have also been caught out following other people’s online recommendations and blindly investing in GameStop. As a result, it is an opportune time to dig into the lessons we can learn from all of this, and what investors can do if they ever find themselves in this situation.

The GameStop saga

There has recently been renewed enthusiasm for the share market by first-time retail investors, with record trading app downloads and booming retail share trading volumes. It is great to see more people taking an active interest in their financial wellbeing and investing for the future. While the vast majority of investors will invest prudently, the combination of low-cost trading apps and social media are causing some investors to speculate and gamble.

In the case of GameStop (a struggling US video game retailer) the story started with a kernel of truth. The company announced a plan to focus on digital sales and appointed three new board members with ecommerce expertise. As the share price rallied in response to this news, retail investors spurred each other on to try to push the price higher. With the stock surging higher; Reddit forums encouraging investors to join the trade to squeeze short-sellers; and the fear of missing out kicking in - we soon had a frenzy in GameStop trading. This had the desired effect for a short period, with early investors seeing the share price rocket over 1500% in just a few short weeks. Unfortunately, the share price move was not justified by the company’s fundamentals, and its stock price has since fallen back to earth. Investors that bought near the top have now lost over 85% of their investment.

This behaviour isn’t just isolated to GameStop. We’ve seen it with cryptocurrencies, countless electric vehicle stocks (like Nikola and Tesla), Hertz, and the record amount of capital raised through ‘blank cheque’ special purpose acquisition corporations which are the latest craze. In many cases investors aren’t doing any research on these investments, they are simply following the crowd, and embracing the greater fool theory. The theory that they will be able to sell to someone else at an even higher price in the future. However, in the case of GameStop, the party is already over and those who were late to the game have been left holding the bag.

What to do if you got caught up in the euphoria

Making mistakes comes part and parcel with investing. What separates good investors from the rest is how they learn from their mistakes and improve. So, what do you do in a situation like GameStop? And what can you do to avoid similar mistakes in the future?

If you didn’t do your research on an investment and simply followed the lead of others, then the right decision will usually be to cut your losses and get out. However, the human brain doesn’t make a decision like this easy and selling a losing investment may not feel like the right thing to do.

According to behavioural research, the pain of losing is psychologically about twice as powerful as the pleasure of gaining. In investing this can mean that investors are unwilling to crystalise their losses and sell a losing investment, even when logic suggests they should. The research goes even further and suggests that this loss aversion can cause investors to gamble and take extra risk to try to ‘get back to even’. This sort of emotional decision-making can be very harmful for investors, just like it is at the casino. This is what my friend was thinking of doing – by holding GameStop (or buying more) until he hopefully recovered his losses. The risk is that he ends up waiting forever, or losing the rest.

If you realise you have been invested in something you probably shouldn’t have and were caught up in the hype then just get out. It can be hard to take a loss on an investment, but in many instances it is the right thing to do.

Staying on the straight and narrow

Investing is a discipline where you never stop learning. There are lots of potential lessons from GameStop, but here would be my five lessons for a new investor.

1. Don’t follow the crowd

In GameStop, many investors saw others making big gains and wanted to get in on the action. The fear of missing out was clouding their judgement and resulted in bad decisions. Some investors choose to avoid crowded stocks and market darlings altogether to reduce this risk.

2. Do your own research

Do your own research on the company you are investing in. You need to understand what it does, how it makes its money, and what a fair valuation is. Doing this research on GameStop would have stopped most people from investing. It is a shrinking business in an industry that no longer needs to exist.

3. Don’t use leverage

Unfortunately a lot of investors in GameStop were buying shares with margin loans (or buying options). Using leverage can magnify gains, but it also magnifies losses. It can result in investors being forced to sell and losing more than their initial investment.

4. Diversify

Some investors had GameStop as a very large position in their portfolios. Being overly concentrated can do a lot of damage to your wealth. If you feel the need to have some more speculative investments, you want to keep them as very small positions.

5. Invest for the long term, not a quick buck

It is difficult to build your wealth in the share market quickly, but surprisingly easy to do it over long periods of time. Chasing short-term trading profits by investing speculatively is unlikely to work. The good news is that even moderate gains generated by investing in quality growing businesses can compound significantly over the long term. Buying and holding shares in a highly successful, but traditional, business like Mainfreight in New Zealand would have seen you make over 100-times your money if you invested 20 years ago (turning $10,000 into over $1,000,000). That’s a much better return than you are likely to make from any of today’s market darlings, and with a lot less sleepless nights.