Last month I wrote about how bad 2022 has been compared to history (spoiler: it’s been bad!). I also wrote about the driver of this being rapidly rising interest rates – which act as gravity – pulling asset prices down everywhere (including shares, property and bonds). But what’s important to remember is how rare years like this one are, and what typically happens in the years after a major downturn. A study of history would suggest better times could be ahead.

Putting 2022 in context

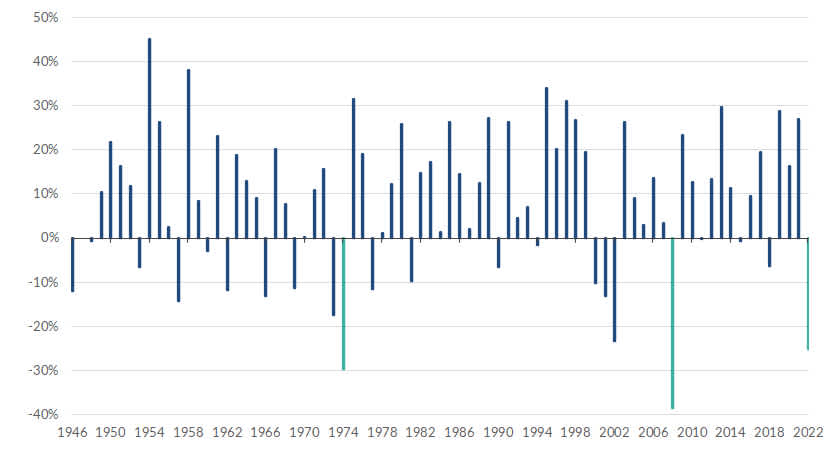

At one point in October this year the US S&P 500 Index was down 25% for the year. To put this in historical context, the S&P 500 has only fallen by 25% or more on seven other occasions since 1950 (so once roughly every 10 years).

Note: Chart excludes 33% Covid sell-off as we don’t have 10 years of subsequent trading data.

If we look at calendar year returns, 2022 stands out even more. If the S&P 500 Index ends up down by more than 25% by the end of 2022, that would mean that only two other years since World War II had larger declines:

the Global Financial Crisis in 2008 – one year which most of us in financial markets remember vividly; and

a tumultuous period in 1974 that included soaring inflation, the Arab oil embargo, President Nixon’s resignation and the Nifty Fifty crash.

Market declines of the size we have witnessed this year are uncommon, although should be expected from time-to-time. The uncertainty this causes, and the volatility of equity markets compared with bank deposits, is the exact reason that the share market tends to deliver better returns than other asset classes over the long term. Investors demand better returns to compensate for the extra risk we are currently witnessing.

Performance after a 25%+ decline in equity markets

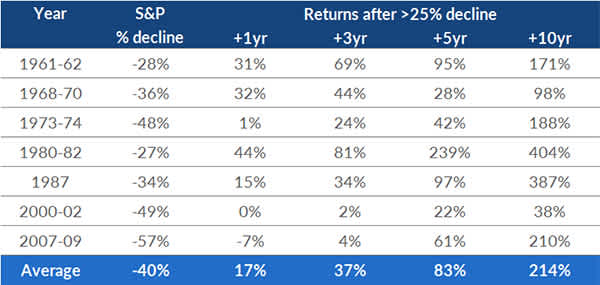

We’ve established that there have regularly been some pretty trying declines in the share market over the last 70 years. And we are in the middle of another one right now. But historically, what has been the typical experience after a 25% decline?

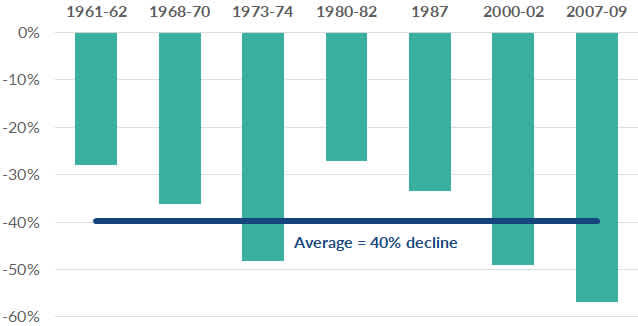

The good news is that after a significant drawdown in markets, investors typically then experience much better returns in the following years. As the chart below shows, one year on from a 25% decline in markets, investors have experienced an average gain of 17%. Three years later markets were on average 37% higher, and 10 years later equity markets were a whopping 214% higher on average.

Note: Chart excludes 33% Covid sell-off as we don’t have 10 years of subsequent trading data.

The 10-year performance figures above really highlight the benefit of investing during these market downturns. A 214% gain over 10 years equates to a return of around 12% per annum. This compares to the long run return for the US share market of around 9-10% per annum.

One of the reasons there tend to be higher returns after a bear market is because investors often overreact in a market downturn and push share prices to levels below what their fundamentals would suggest. Those who overreact and sell during a downturn are transferring wealth to those who are buying and stay the course.

Outlook from here

2022 has been a tough year for investors, but there is evidence that investors may be overreacting this time as well. Surveys show that investor sentiment is as low as it was during the Global Financial Crisis. Investors are also holding more cash than usual, and market valuations are below long-term averages. These are often the conditions present when markets are oversold and poised to rally.

While it is hard to pick where markets will go over the next 3-6 months, if history is any guide, then the next 12 months should be significantly better for investors. As we have seen countless times before, those who keep their composure and look through the noise should be rewarded.