As a keen enthusiast of Golden era detective fiction, I love unravelling all the loose ends of a problem, discarding the red herrings, attempting to beat the detective to the solution. A recent call from a client reminded me of an observation by Lord Peter Wimsey (a detective in Dorothy L. Sayer’s Clouds of Witness) of the world “as an entertaining labyrinth of side-issues”.

My client contacted me in a state of high anxiety when during a discussion with her friends, talk had turned to how much money was needed to retire. “$1.5million” she told me in shocked tones, “I am already 70, how will I ever manage that sum? When will I ever be able to stop working”?

My client is not alone, this is a recurring theme asked of Advisers and popular newspaper columnists. People’s concerns are being exacerbated by rising cost of living pressures, fears of draining finite resources and no definitive solution in sight.

Four potential solutions presented by the New Zealand Society for Actuaries

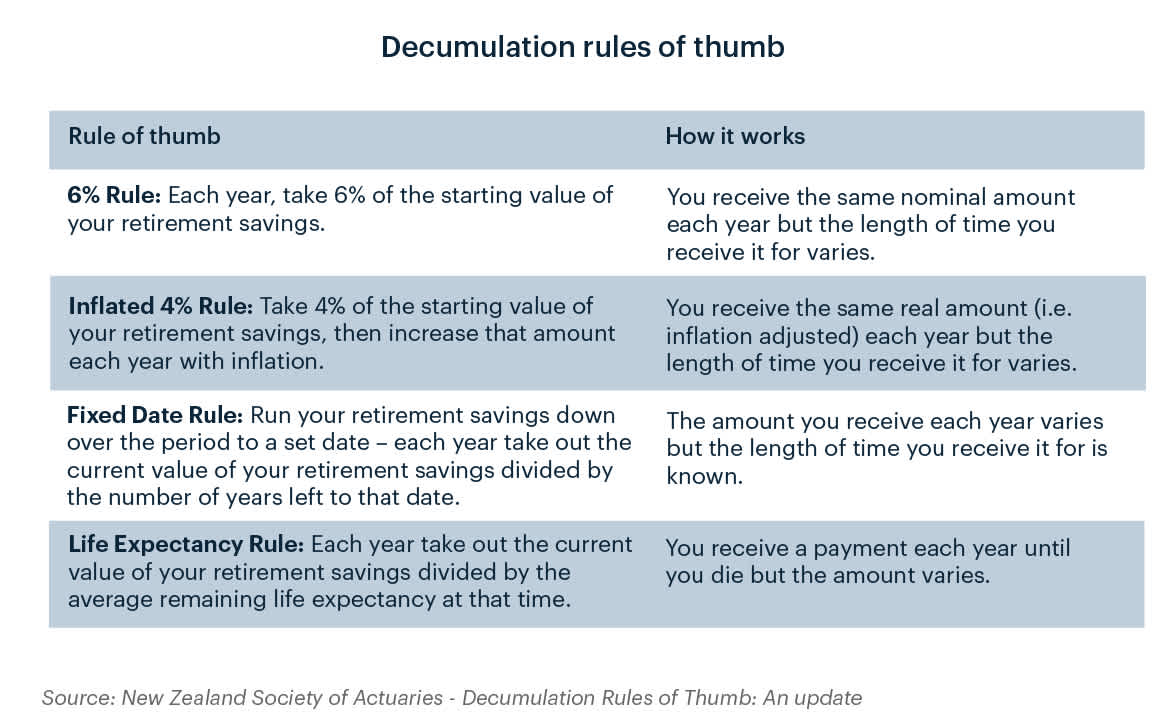

In an attempt to simplify the problem and provide guidelines that anyone can use, The New Zealand Society of Actuaries in their 2020 Paper Decumulation Rules of Thumb: An Update presented four solutions. The 6%, the modified for Inflation 4%, the Fixed Date and the Life Expectancy Rule.

Briefly: the ‘6%’ and ‘4%-modified for inflation’ guidelines require the user to run a ruler over their investments and withdraw 6% per annum, or 4% plus inflation per annum, of your starting balance. Whilst simple and elegant, providing an absolute regular income runs the risk that retirement savings run out within the retiree’s lifetime.

The ‘Fixed Date’ rule advises taking the starting retirement balance and dividing by the number of years they want the investment to last, to derive an amount they may draw down every year. Again, elegant but less simple, as the amount of income will vary every year and each year will require a new calculation.

The ‘Life Expectancy Rule’ also requires an annual calculation, as well as requiring investors to estimate how long they think they are going to live. Rather inelegantly, income will vary from year to year, decreasing as they age, but most of all, estimating life expectancy is a pretty difficult and morbid undertaking, particularly when you are only 65.

Simplifying the simple has led to the suggestion that for every $100,000 saved you can spend $100 per week, but that too leaves a shortfall when adjusted for inflation.

You should view your retirement savings as a long-term investment even after age 65

So what is the solution? How can retirement savings last and how much will you need? What is important and what are side issues here? Whilst attempts to simplify retirement equations can be helpful to some they could also lead to confusion for others. From an investment perspective they overlook some important details.

The first important point is that your retirement savings are a long-term investment. The NZ Society of Actuaries' paper on longevity suggests New Zealand retirees should in general be planning to live until age 90 to 95, so your investment timeframe at 65 could be 25 to 30 years. That’s a long time to make your money last.

The second point lies in the detail of the NZ Actuaries study, which assumes retirement savings of $100,000 are invested in a Conservative Fund, with an expected annual return of 2.3% per annum, which is lower than the FMA prescribed 2.5% per annum. In both cases the Prescribed Investor Rate used (the tax you pay on your investment) is 28%. Many retirees may have their investment taxed at a lower rate than this. As ever, the devil is in the detail.

The third point is that broad comparisons between conservative funds is not possible. Investment approaches and asset allocation differ widely between providers; returns hinge on those two factors and investors need to choose wisely.

Since retirement could have a 25-30 year timeframe, then it might not be the right choice to be invested in a conservative fund, which is more suited to a short term or cautious investor who is primarily concerned with maintaining the capital value of their investment. In order to sustain long term capital requirements, the higher proportion of growth assets found in a balanced or growth fund are needed to provide longevity and the ability to outpace inflation. This 25-30 year time frame is sufficiently long enough for the added risk of volatility from these growth assets to be smoothed out over time.

Working together to solve the retirement mystery

So, how did I arrive at a solution for my client, worried that she would never achieve the magic $1.5million (roughly $60,000 p.a. for 25 years) in retirement savings? We set about unravelling the mystery by looking at her current earnings and spending regime. We calculated a realistic budget for her expenses in the short, medium and long term. We acknowledged that her lifestyle will change as she gets older and overseas travel is likely to be something that she will no longer enjoy past a certain age.

By shining the light on the facts of her situation, it became clear that not only did she not need anything like an additional $60,000 each year above the NZ Super; being in the right strategy for her timeframes meant that she had more than enough saved to begin her retirement whenever she was ready.

The popularity of the Golden era detectives lies in their ability to bring order to chaos. Using your retirement savings in an orderly manner, with a degree of certainty requires investigation and clarity. Both can be achieved with tailored financial advice coupled with an understanding of your personal circumstances. By working together we can solve the retirement mystery.

Talk to us

If you’d like some help to make sure your investment strategy is right for you, or with planning how much you might need in your retirement, get in touch with one of our advice team today – we’re happy to help.